Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A is correct the rest are all wrong for some reason. Thank you for your help. Compute ROE and RNOA with Disaggregation Selected balance sheet

A is correct the rest are all wrong for some reason. Thank you for your help.

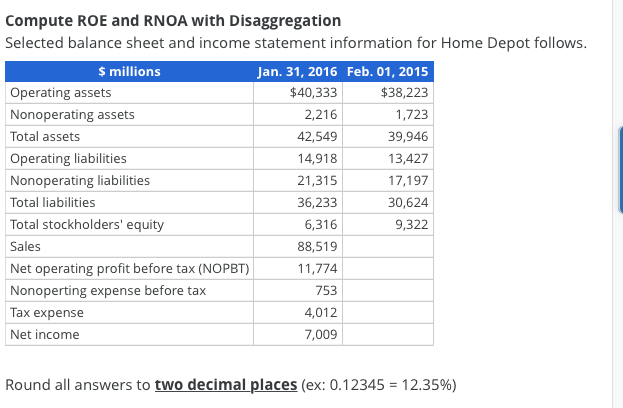

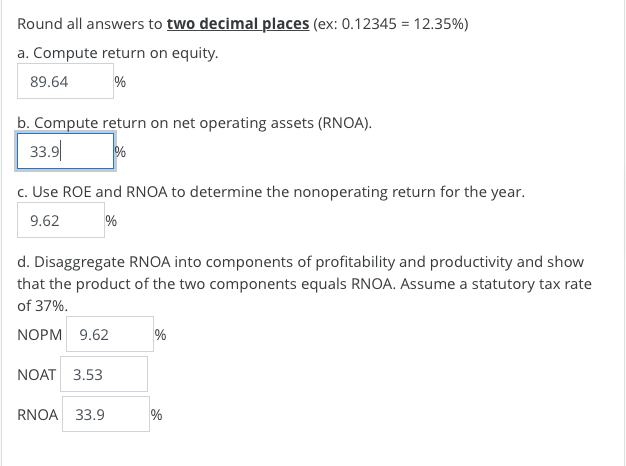

Compute ROE and RNOA with Disaggregation Selected balance sheet and income statement information for Home Depot follows. $ millions Jan. 31, 2016 Feb. 01, 2015 Operating assets $40,333 $38,223 Nonoperating assets 2,216 1,723 Total assets 42,549 39,946 Operating liabilities 14,918 13,427 Nonoperating liabilities 21,315 17,197 Total liabilities 36,233 30,624 Total stockholders' equity 6,316 9,322 Sales 88,519 Net operating profit before tax (NOPBT) 11,774 Nonoperting expense before tax 753 Tax expense 4,012 Net income 7,009 Round all answers to two decimal places (ex: 0.12345 = 12.35%) Round all answers to two decimal places (ex: 0.12345 = 12.35%) a. Compute return on equity. 89.64 % b. Compute return on net operating assets (RNOA). 33.9 % c. Use ROE and RNOA to determine the nonoperating return for the year. 9.62 % d. Disaggregate RNOA into components of profitability and productivity and show that the product of the two components equals RNOA. Assume a statutory tax rate of 37%. NOPM 9.62 NOAT 3.53 RNOA 33.9 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started