Answered step by step

Verified Expert Solution

Question

1 Approved Answer

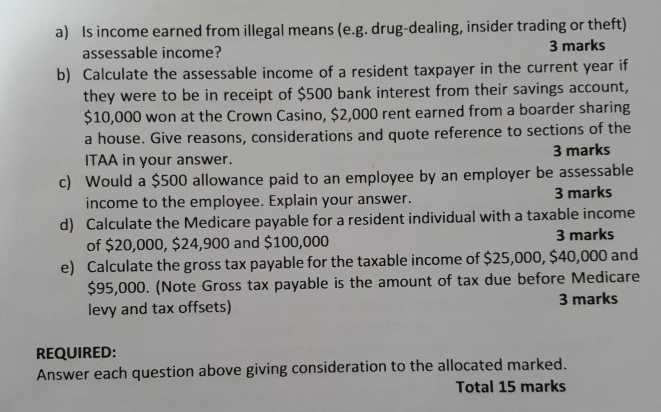

a) is income earned from illegal means (e.g. drug-dealing, insider trading or theft) assessable income? 3 marks b) Calculate the assessable income of a resident

a) is income earned from illegal means (e.g. drug-dealing, insider trading or theft) assessable income? 3 marks b) Calculate the assessable income of a resident taxpayer in the current year if they were to be in receipt of $500 bank interest from their savings account, $10,000 won at the Crown Casino, $2,000 rent earned from a boarder sharing a house. Give reasons, considerations and quote reference to sections of the ITAA in your answer. 3 marks c) Would a $500 allowance paid to an employee by an employer be assessable income to the employee. Explain your answer. 3 marks d) Calculate the Medicare payable for a resident individual with a taxable income of $20,000, $24,900 and $100,000 3 marks e) Calculate the gross tax payable for the taxable income of $25,000, $40,000 and $95,000. (Note Gross tax payable is the amount of tax due before Medicare levy and tax offsets) 3 marks REQUIRED: Answer each question above giving consideration to the allocated marked. Total 15 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started