Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A is the expected present value of a payment of $1 payable at the end of the year of death (for an insured who

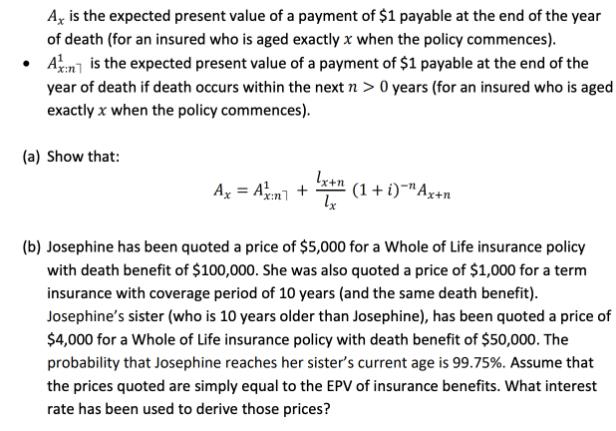

A is the expected present value of a payment of $1 payable at the end of the year of death (for an insured who is aged exactly x when the policy commences). A:n is the expected present value of a payment of $1 payable at the end of the year of death if death occurs within the next n > 0 years (for an insured who is aged exactly x when the policy commences). (a) Show that: Ax = Am7 + lx+n lx (1 + i)", -"Ax+n (b) Josephine has been quoted a price of $5,000 for a Whole of Life insurance policy with death benefit of $100,000. She was also quoted a price of $1,000 for a term insurance with coverage period of 10 years (and the same death benefit). Josephine's sister (who is 10 years older than Josephine), has been quoted a price of $4,000 for a Whole of Life insurance policy with death benefit of $50,000. The probability that Josephine reaches her sister's current age is 99.75%. Assume that the prices quoted are simply equal to the EPV of insurance benefits. What interest rate has been used to derive those prices?

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

solution a This can be written as Axn Axn1lxn1 1iAxn1 Where Axn1 represents the expected present value of a payment of 1 payable at the end of the yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started