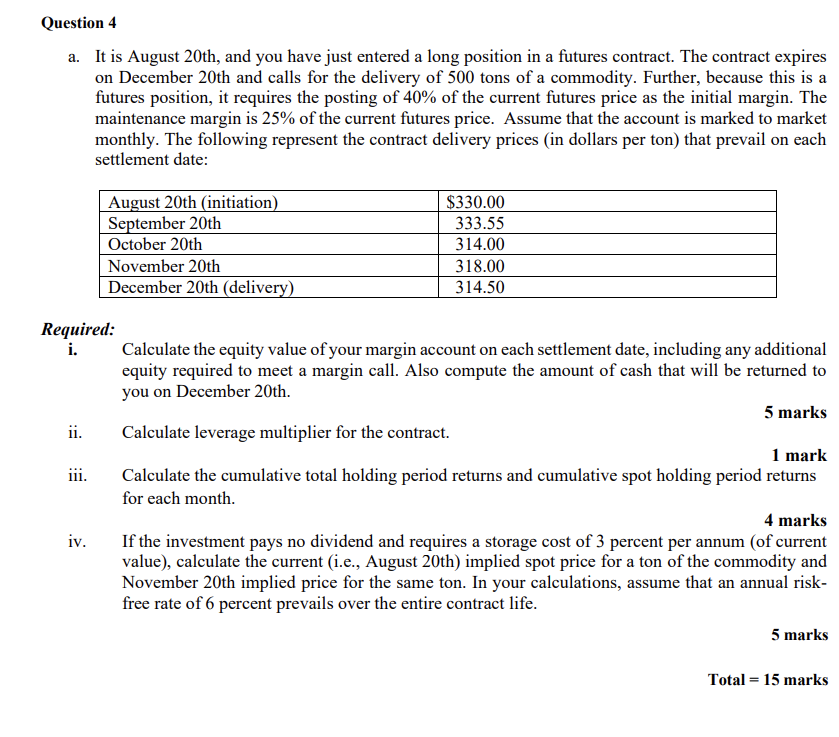

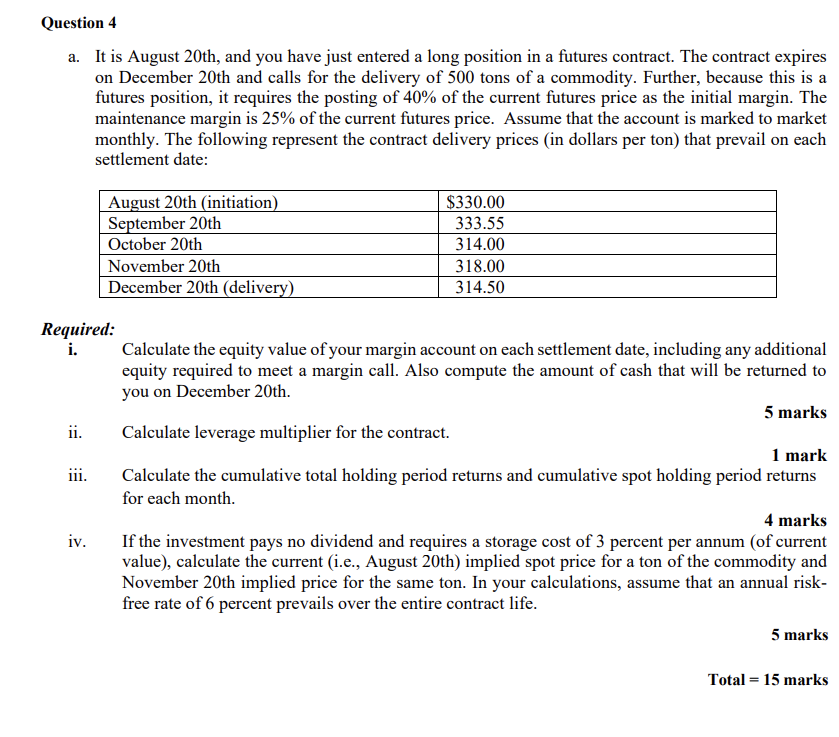

a. It is August 20th, and you have just entered a long position in a futures contract. The contract expires on December 20th and calls for the delivery of 500 tons of a commodity. Further, because this is a futures position, it requires the posting of 40% of the current futures price as the initial margin. The maintenance margin is 25% of the current futures price. Assume that the account is marked to market monthly. The following represent the contract delivery prices (in dollars per ton) that prevail on each settlement date: Required: i. Calculate the equity value of your margin account on each settlement date, including any additional equity required to meet a margin call. Also compute the amount of cash that will be returned to you on December 20th. ii. Calculate leverage multiplier for the contract. 5 marks iii. Calculate the cumulative total holding period returns and cumulative spot holding period returns for each month. iv. If the investment pays no dividend and requires a storage cost of 3 percent per annum (of current value), calculate the current (i.e., August 20th) implied spot price for a ton of the commodity and November 20th implied price for the same ton. In your calculations, assume that an annual riskfree rate of 6 percent prevails over the entire contract life. a. It is August 20th, and you have just entered a long position in a futures contract. The contract expires on December 20th and calls for the delivery of 500 tons of a commodity. Further, because this is a futures position, it requires the posting of 40% of the current futures price as the initial margin. The maintenance margin is 25% of the current futures price. Assume that the account is marked to market monthly. The following represent the contract delivery prices (in dollars per ton) that prevail on each settlement date: Required: i. Calculate the equity value of your margin account on each settlement date, including any additional equity required to meet a margin call. Also compute the amount of cash that will be returned to you on December 20th. ii. Calculate leverage multiplier for the contract. 5 marks iii. Calculate the cumulative total holding period returns and cumulative spot holding period returns for each month. iv. If the investment pays no dividend and requires a storage cost of 3 percent per annum (of current value), calculate the current (i.e., August 20th) implied spot price for a ton of the commodity and November 20th implied price for the same ton. In your calculations, assume that an annual riskfree rate of 6 percent prevails over the entire contract life