Question

(a) It is generally believed that as the Covid-19 crisis gets more serious, it stirred much panic in the U.S. financial market after the start

(a) It is generally believed that as the Covid-19 crisis gets more serious, it stirred much panic in the U.S. financial market after the start of May in the year 2020. The 9th May 2020 U.S. government yield curve revealed a parallel shift downwards from that of April 2020. List two (2) interpretations from this observation, from the supply and demand, bond price and interest rate perspectives. (4 marks)

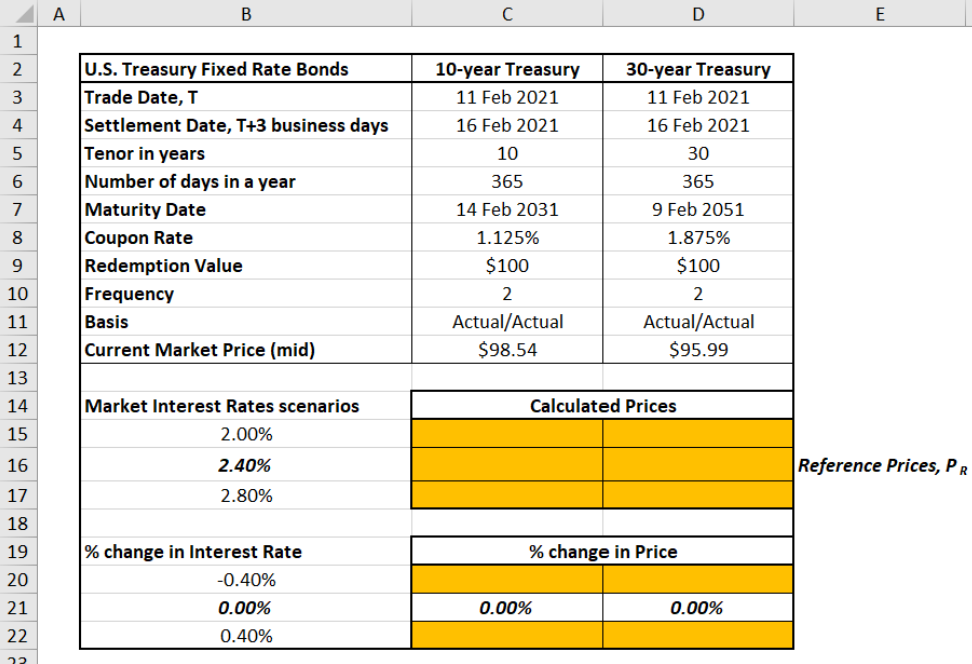

(b) An investor is evaluating two U.S. Treasury Fixed Rate Bonds: 10-year and 30- year. He would like to understand their prices and the % change in their prices subjected to impacts from market interest rates that may vary 0.40% below and 0.40% above a reference interest rate, vR, of 2.40%. The bonds key parameters are presented in Figure 1b below:

Solve for the prices of the 10- and 30-year Treasury Bonds and the corresponding % change in their prices.

Specifically, show your answers and formulas for: Cells C15:D17 Cells C20:D20, and Cells C22:D22

Note:

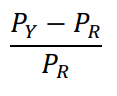

Lets denote the reference interest rate as yR and, therefore, vR = 2.40%. At this interest rate, the price of a bond is known as its reference price, PR. When the interest rate is vY, a bonds calculated price is PY. Therefore, if the change in interest rate is (vY - yR), then the % change in price for a bond can be calculated as:

(12 marks)

(c) Examine the result of your calculations in Question 1(b) from the perspective of bond maturity and fixed-rate bond price volatility when there is a change in market interest rates. (4 marks)

(d) A firm that currently pays no dividends is expected to pay the first dividend of $0.82 at the end of Year 4. If in the subsequent years the firm will continue to pay dividends indefinitely with a constant growth rate of 5%, what is the estimated current value of the stock assuming a required rate of return of 10%? Draw the timeline indicating the dividend payments up to end of year 6. (5 marks)

Reference Prices, PR PRPYPRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started