Answered step by step

Verified Expert Solution

Question

1 Approved Answer

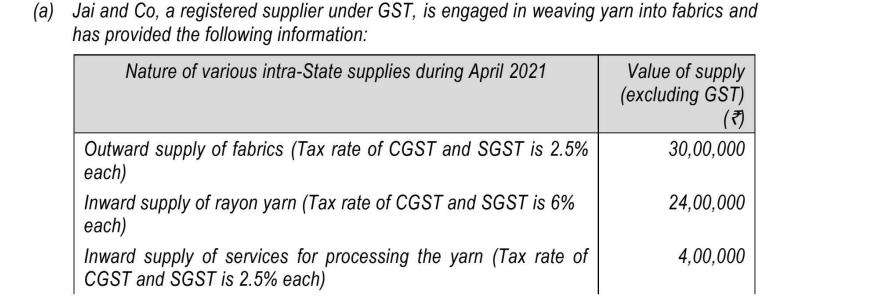

(a) Jai and Co, a registered supplier under GST, is engaged in weaving yarn into fabrics and has provided the following information: Nature of

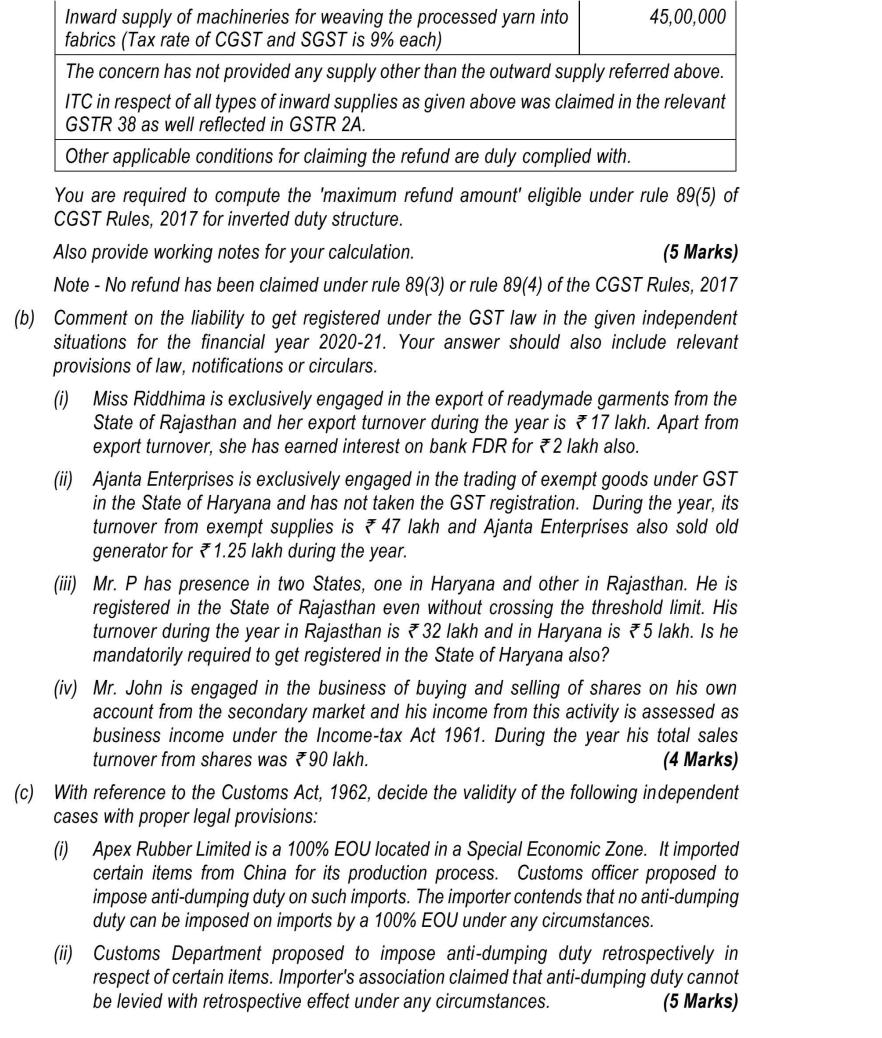

(a) Jai and Co, a registered supplier under GST, is engaged in weaving yarn into fabrics and has provided the following information: Nature of various intra-State supplies during April 2021 Outward supply of fabrics (Tax rate of CGST and SGST is 2.5% each) Inward supply of rayon yarn (Tax rate of CGST and SGST is 6% each) Inward supply of services for processing the yarn (Tax rate of CGST and SGST is 2.5% each) Value of supply (excluding GST) 30,00,000 24,00,000 4,00,000 Inward supply of machineries for weaving the processed yarn into fabrics (Tax rate of CGST and SGST is 9% each) 45,00,000 The concern has not provided any supply other than the outward supply referred above. ITC in respect of all types of inward supplies as given above was claimed in the relevant GSTR 38 as well reflected in GSTR 2A. Other applicable conditions for claiming the refund are duly complied with. You are required to compute the 'maximum refund amount' eligible under rule 89(5) of CGST Rules, 2017 for inverted duty structure. Also provide working notes for your calculation. (5 Marks) Note-No refund has been claimed under rule 89(3) or rule 89(4) of the CGST Rules, 2017 (b) Comment on the liability to get registered under the GST law in the given independent situations for the financial year 2020-21. Your answer should also include relevant provisions of law, notifications or circulars. (i) Miss Riddhima is exclusively engaged in the export of readymade garments from the State of Rajasthan and her export turnover during the year is 17 lakh. Apart from export turnover, she has earned interest on bank FDR for 2 lakh also. (ii) Ajanta Enterprises is exclusively engaged in the trading of exempt goods under GST in the State of Haryana and has not taken the GST registration. During the year, its turnover from exempt supplies is 47 lakh and Ajanta Enterprises also sold old generator for 1.25 lakh during the year. (iii) Mr. P has presence in two States, one in Haryana and other in Rajasthan. He is registered in the State of Rajasthan even without crossing the threshold limit. His turnover during the year in Rajasthan is 32 lakh and in Haryana is 5 lakh. Is he mandatorily required to get registered in the State of Haryana also? (iv) Mr. John is engaged in the business of buying and selling of shares on his own account from the secondary market and his income from this activity is assessed as business income under the Income-tax Act 1961. During the year his total sales turnover from shares was 90 lakh. (4 Marks) (c) With reference to the Customs Act, 1962, decide the validity of the following independent cases with proper legal provisions: (i) Apex Rubber Limited is a 100% EOU located in a Special Economic Zone. It imported certain items from China for its production process. Customs officer posed to impose anti-dumping duty on such imports. The importer contends that no anti-dumping duty can be imposed on imports by a 100% EOU under any circumstances. (ii) Customs Department proposed to impose anti-dumping duty retrospectively in respect of certain items. Importer's association claimed that anti-dumping duty cannot be levied with retrospective effect under any circumstances. (5 Marks)

Step by Step Solution

★★★★★

3.28 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started