Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A2X Services Limited, registered under GST, is engaged in providing various services to various educational institutions. The company provides the following information in

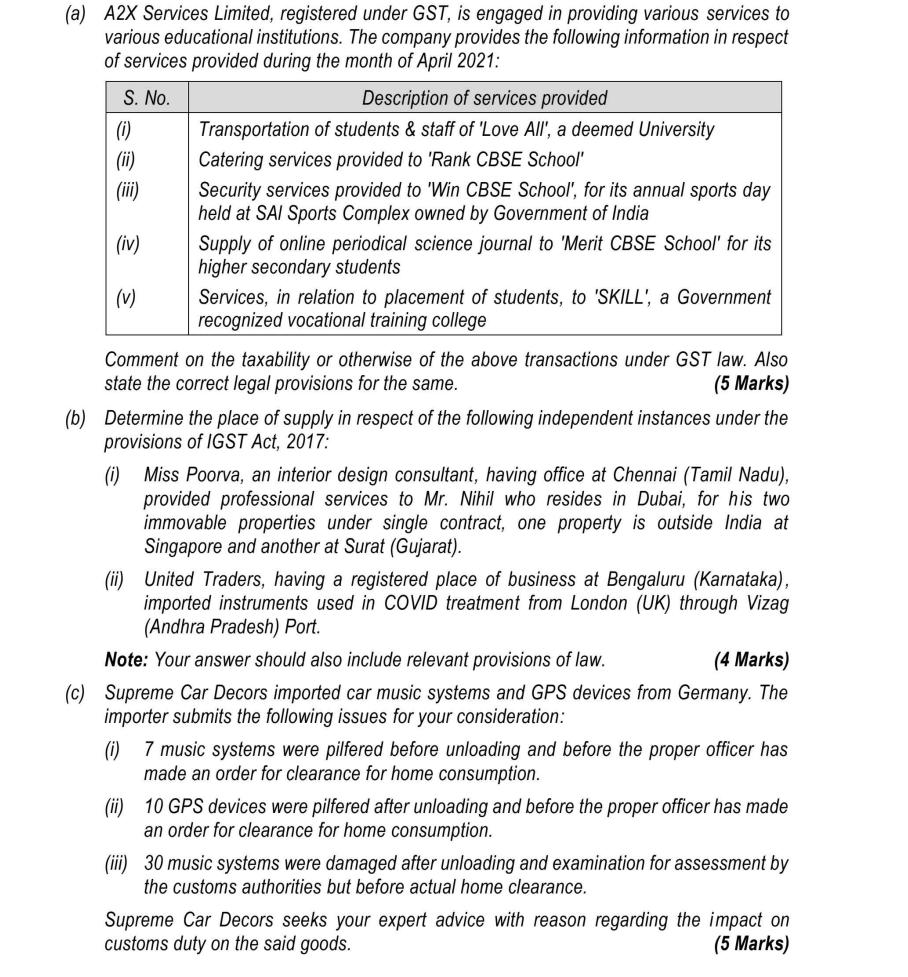

(a) A2X Services Limited, registered under GST, is engaged in providing various services to various educational institutions. The company provides the following information in respect of services provided during the month of April 2021: S. No. (i) (ii) (iii) (iv) (v) Description of services provided Transportation of students & staff of 'Love All', a deemed University Catering services provided to 'Rank CBSE School' Security services provided to 'Win CBSE School', for its annual sports day held at SAI Sports Complex owned by Government of India Supply of online periodical science journal to 'Merit CBSE School' for its higher secondary students Services, in relation to placement of students, to 'SKILL', a Government recognized vocational training college Comment on the taxability or otherwise of the above transactions under GST law. Also state the correct legal provisions for the same. (5 Marks) (b) Determine the place of supply in respect of the following independent instances under the provisions of IGST Act, 2017: (i) Miss Poorva, an interior design consultant, having office at Chennai (Tamil Nadu), provided professional services to Mr. Nihil who resides in Dubai, for his two immovable properties under single contract, one property is outside India at Singapore and another at Surat (Gujarat). (ii) United Traders, having a registered place of business at Bengaluru (Karnataka), imported instruments used in COVID treatment from London (UK) through Vizag (Andhra Pradesh) Port. Note: Your answer should also include relevant provisions of law. (4 Marks) (c) Supreme Car Decors imported car music systems and GPS devices from Germany. The importer submits the following issues for your consideration: (i) 7 music systems were pilfered before unloading and before the proper officer has made an order for clearance for home consumption. (ii) 10 GPS devices were pilfered after unloading and before the proper officer has made an order for clearance for home consumption. (iii) 30 music systems were damaged after unloading and examination for assessment by the customs authorities but before actual home clearance. Supreme Car Decors seeks your expert advice with reason regarding the impact on customs duty on the said goods. (5 Marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started