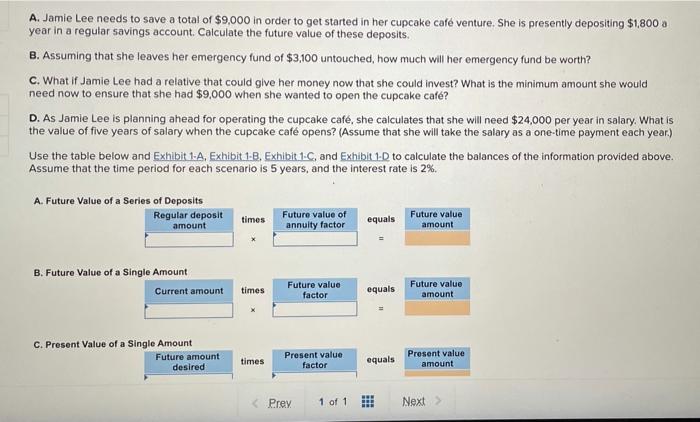

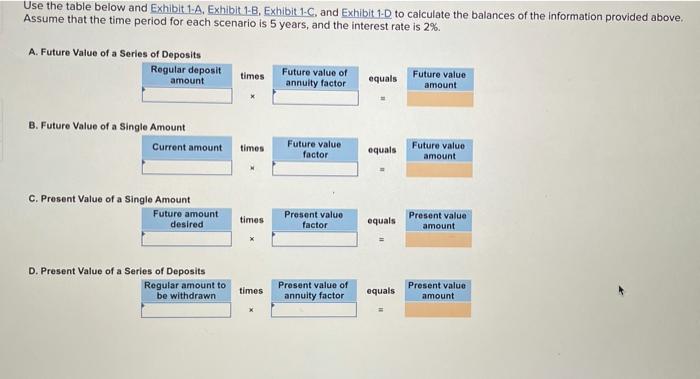

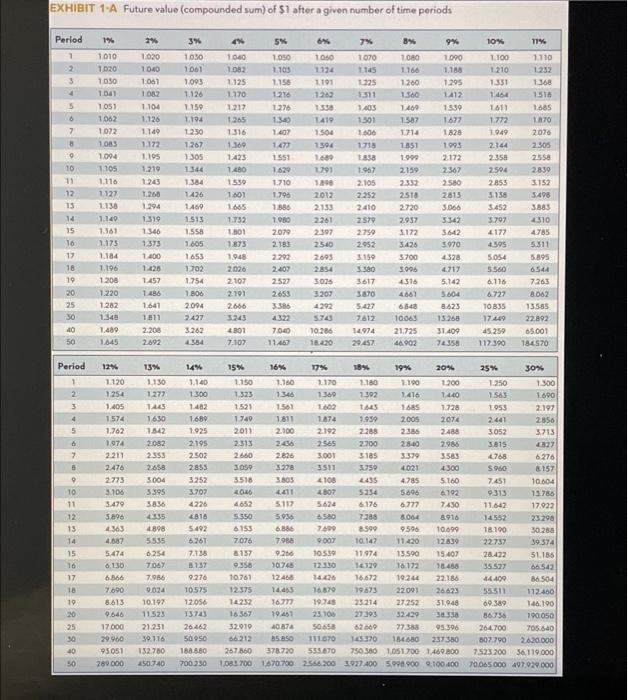

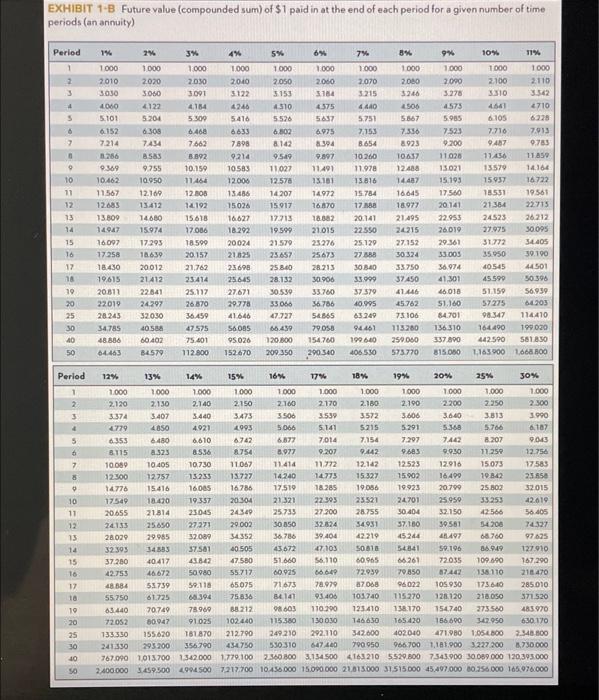

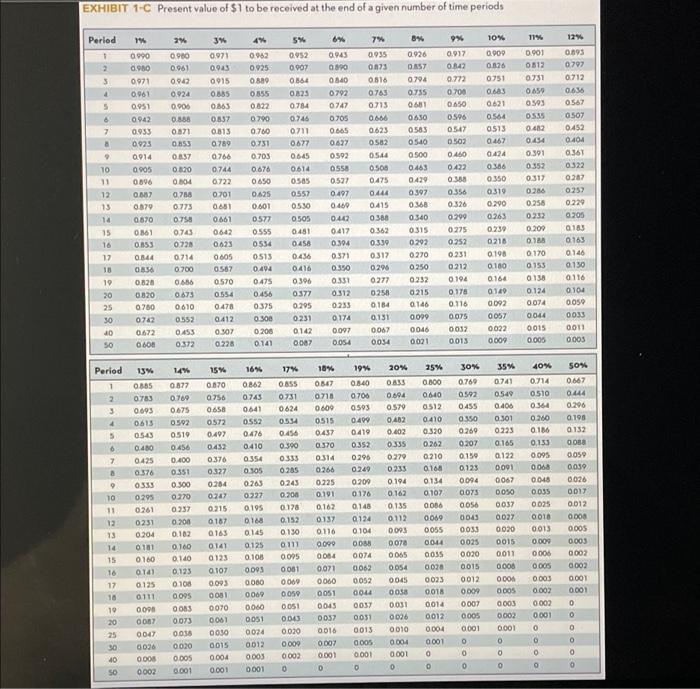

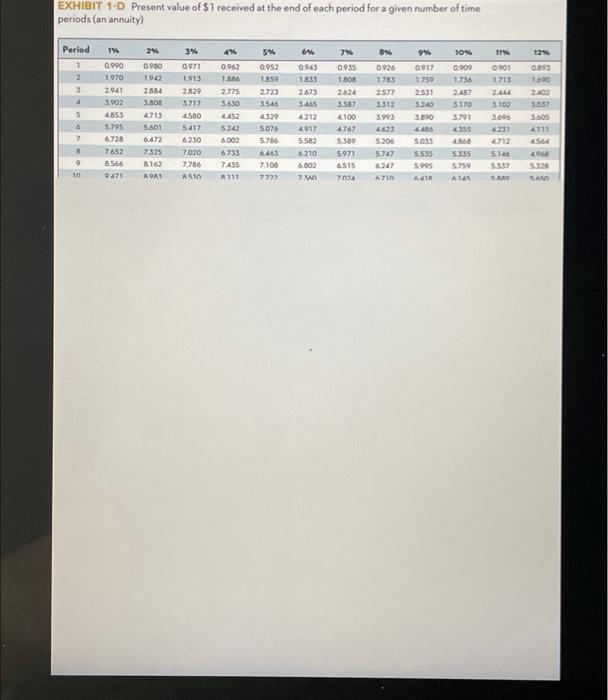

A. Jamie Lee needs to save a total of $9,000 in order to get started in her cupcake caf venture. She is presently depositing $1,800 a year in a regular savings account Calculate the future value of these deposits. B. Assuming that she leaves her emergency fund of $3,100 untouched, how much will her emergency fund be worth? C. What if Jamie Lee had a relative that could give her money now that she could invest? What is the minimum amount she would need now to ensure that she had $9,000 when she wanted to open the cupcake caf? D. As Jamie Lee is planning ahead for operating the cupcake caf, she calculates that she will need $24,000 per year in salary. What is the value of five years of salary when the cupcake caf opens? (Assume that she will take the salary as a one-time payment each year.) Use the table below and Exhibit 1-A, Exhibit 1-B. Exhibit 1-C, and Exhibit 1-D to calculate the balances of the information provided above. Assume that the time period for each scenario is 5 years, and the interest rate is 2%. A. Future Value of a Series of Deposits Regular deposit amount times Future value of annuity factor equals Future value amount B. Future Value of a Single Amount Current amount times Future value factor equals Future value amount C. Present Value of a Single Amount Future amount desired times Present value factor equals Prosent value amount Prey 1 of 1 !!! Next Use the table below and Exhibit 1-A. Exhibit 1-B, Exhibit 1-C. and Exhibit 1-D to calculate the balances of the information provided above. Assume that the time period for each scenario is 5 years, and the interest rate is 2%. A. Future Value of a Series of Deposits Regular deposit amount times Future value of annuity factor equals Future value amount B. Future Value of a Single Amount Current amount times Future value factor equals Future value amount C. Present Value of a Single Amount Future amount desired times Present value factor equals Present value amount D. Present Value of a Series of Deposits Regular amount to be withdrawn times Present value of annuity factor equals Present value amount EXHIBIT 1-A Future value (compounded sum) of $1 after a given number of time periods Period 1% 3% 4 5% 8% 9% 10% 11% 1050 1 2 3 4 5 1040 1.082 1.125 1170 1.217 1265 1316 1.100 1 210 1.331 1050 1103 1156 1216 1.276 1340 1.402 6% 1060 1124 1101 1.263 1.56 1.477 1419 1504 1394 16 1.791 1010 1020 1050 1041 1051 1.062 1072 1083 1094 1.105 1.116 1127 1138 1.140 1.161 1.173 1184 1.196 1.200 1.220 1.282 1.34 1.489 1.445 11 2% 1.020 1040 1067 1 02 1.104 1.126 1.149 1.172 1.195 1.219 1.245 1.266 1.294 1319 1346 1.373 1.400 1.420 1457 1.486 1.641 1811 2.200 2.892 7 8 9 10 11 12 13 1 35 16 17 18 19 20 25 30 40 50 1551 1.629 1.710 1.795 1386 1061 1093 1.126 1159 1104 1 230 1267 1.305 1344 1384 1426 1460 1513 1.558 7605 1653 1702 1754 1806 2004 2427 3.262 4384 1080 1166 1.260 1360 1.469 1587 1714 1851 1999 2.159 2332 2.510 2720 2057 3.172 3.426 3700 1423 1.480 1530 1.601 1665 1.733 1.501 1.875 1948 2026 2107 2191 2666 3.245 7% 1070 1145 1225 13511 1.405 1501 1606 1718 188 1967 2.105 2.252 2410 2.579 2750 2.952 3.159 3580 3617 3870 5.427 7612 14974 29457 1980 1000 1.188 1.295 1412 1539 1677 1828 1995 2.172 2.367 2.580 2815 3.066 5.343 5642 3970 2328 4.717 5.142 5.604 8.623 15.268 31.409 74358 2012 2133 2261 2.397 2.500 2003 2854 3035 3.203 4292 5745 10.286 18.420 1110 1232 1368 1516 1685 1870 2070 2.305 2558 2.830 3152 3498 3883 1510 4785 5.311 5.895 6.544 7.265 8.062 13565 22892 65.001 184570 1611 1772 1949 2.744 2.358 2.594 2.853 3.158 5452 5797 4177 4595 5054 5.560 4.116 6.722 10835 17.419 45.250 117.300 2079 2.183 2.292 2.407 2527 2653 3.386 2322 7040 11467 3006 88888 4316 4661 6340 10065 21725 44902 401 7.107 Period 12% 1416 1 2 3 4 5 1.561 1874 2192 13% 1.150 1277 1445 1630 1342 2082 2353 2.650 3004 3.395 3836 4335 14% 1.140 1.300 1.482 1689 7.925 2.195 2502 2355 3252 3.707 4226 2816 5.492 2.513 7 3001 3.759 6276 8157 7451 315 1.120 1.254 1.405 1574 1.762 1974 2.211 2476 2773 3.106 3.479 3.896 4363 4.687 5.474 6.1.30 6.566 7690 8.613 9.646 17.000 29.960 93051 280.000 10 11 12 13 14 15 15% 16% 17% 18% 19% 20% 25% 30% 2.150 1.160 2170 1180 2.190 1.200 1.250 1.300 1.323 1346 1.360 2.392 1440 1563 1.600 151 1600 1685 1728 1955 2.197 1.740 1811 1.959 2005 2074 2.441 2856 2011 2.100 2288 2385 2488 3052 3713 236 2565 2700 2840 2985 3.815 2660 2.26 3185 3379 3583 4765 3050 3.276 3511 4021 4300 5960 3516 3.805 4108 1435 4785 5160 10.104 4046 4411 2807 5254 5496 4192 13786 4652 5117 5.624 6176 6.777 7430 11.642 17.922 5550 5.936 45.00 7.38 8.064 8916 14552 23298 6.153 6.886 7.400 8.599 9598 10.699 18.100 30.286 7076 7.955 9.007 10:147 11.420 127839 22737 39374 8137 9.266 10.559 11.974 13.590 15.407 28.422 51.186 9.358 10.765 72.330 14129 18172 18.488 35527 66542 10.761 124 1406 16,672 19244 22.186 44400 36504 12375 14:43 16.870 19673 22001 20.625 55511 112460 14232 16.777 19745 23214 27252 31.946 69.389 T46:190 16.367 19.451 25.108 27393 32429 58338 86756 190050 32.010 40-874 50658 62.669 77.388 95 396 264.700 705.640 66212 25 25 111.670 143370 154.680 237380 307.790 2.620.000 267.860 378.720 555.670 790.580 1.051.700 149.00 7.523 200 36.119.000 1083.700 1670.700 2.66.2001027400 5.990 900 9.100.400 70.065.000 497.929.000 4.898 16 17 18 19 20 25 30 5535 0.254 7.06 7.036 9024 10.197 11.523 21251 30.116 152.780 450740 7.136 3.137 9.276 10.575 12056 13743 26462 50950 188880 700230 8.8 % 8 % 50 EXHIBIT 1-3 Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annuity) 9 Period 1 2 3 4 5 6 2 14 1000 2010 3030 1060 5.101 6.152 7.214 1.286 9369 10.462 11567 12.685 13.800 14947 16.097 17258 18.430 19,615 20.811 22019 28.243 34.785 48.836 64463 9 10 11 12 13 14 15 16 17 18 19 20 25 24 1.000 2020 3060 4122 5.204 6308 7434 585 9.755 10.950 12.160 13.412 14680 15.974 17295 18.639 20012 21412 22841 24.297 32050 10.5 60.402 34579 3* 1.000 2030 3091 4.164 5300 6.468 7662 3.892 10.159 11464 12.00 12192 15618 17.086 18.599 20.157 21.762 23.414 25.117 26870 36.450 47575 75.401 112.800 4% 1.000 2040 3122 4246 5.416 6633 7898 9214 10.583 12.006 13.486 15026 16627 18.292 20024 5% 1 000 2050 5.153 4510 5526 6.802 8142 9589 11027 12.578 14207 15 917 17213 19.599 21.579 25.657 258.00 28.132 30.530 35066 47.727 439 120.000 209 350 6% 1.000 2.000 3184 4 375 5637 6975 8.394 9.897 11.491 13.181 14.972 16.870 18.382 21.015 25276 25673 28.213 30.906 33.780 36.786 54.365 79058 154.760 290.340 7% 1.000 2.070 3.215 440 5.751 7.153 8.654 10260 11.978 13.816 15.784 17.88 20.141 22550 25.129 27.80 30 340 33.999 37 379 40.995 63349 94.461 199640 406 530 8% 1000 2060 3246 2506 5867 7356 8.923 10437 12400 14487 16645 18.977 21.495 24215 27.152 30 324 33.750 37450 41446 45.762 78106 113280 250 DO 573770 1.000 2090 3.278 4575 5.985 7533 9.200 11028 15021 15.195 17.560 20141 22.953 26.019 29.361 33003 36.974 41.301 46018 51.100 84.701 136.310 337.890 815.050 10% 11% 1000 1000 2.100 2110 3310 3.542 4661 4710 6105 7.710 7.913 9.487 9.783 11450 1125 13570 14.164 15937 16722 18531 19561 21.364 22715 24523 26 212 27.975 30095 31772 34405 35.950 39.190 40545 44501 45.599 50398 51.150 56.939 57275 40203 98.347 114410 164.490 199.00 442.590 581.850 1.163900 106800 8 $6088 25698 25645 27.671 29.778 41.646 S6085 95026 152670 30 40 50 Period 1 9 207 19056 88888888EUREGON 10 11 12 13 12% 13% 14% 15% 16% 17 18% 19% 20% 25% 30% 1.000 1000 7.000 1000 1000 1.000 1000 1000 1000 1.000 1.000 2.120 2.150 2.140 2.150 2.100 2170 2.180 2.190 2200 2.250 2.500 3.374 3.407 3.440 3.473 3506 3539 3572 3.606 3.6.40 3813 3.990 0779 4850 4921 4093 5066 5.141 5715 5291 5.368 5.766 8.107 6.353 6480 6.610 6742 6.877 7,014 7.154 7.297 7447 8.207 9.043 8115 a323 8536 8.754 6.977 9.442 9.683 9.9.30 11.250 12.756 10089 10.405 10.730 11067 11.414 11.772 12.142 12.525 12016 15.073 17583 32300 12757 13.233 13.727 14.240 14775 15.327 15.902 16499 10242 25850 14776 15.416 16085 16786 17.519 18.285 19.923 20.799 25.802 32015 17549 18.410 19.357 20:304 21321 22.305 25521 24701 25.950 33253 12.619 20655 21814 23045 24349 25.735 27.200 28.755 30.404 32.150 42566 56 405 24.153 25.650 27371 29.002 30 ASO 32824 54931 37.100 39 581 54.200 74327 28.029 29.985 32089 34352 36.786 39.404 42219 15244 41497 68760 97625 32393 34333 37581 40.505 43672 47103 50618 54841 59.196 36.949 127.910 37.250 40.412 43.843 47500 51.660 56.110 60965 66261 72035 109.500 167,290 42.753 46.672 50 980 55.717 60.925 66.649 72.939 70.850 87.442 158.110 216 470 48.68.4 55.759 59.110 65075 71673 78.979 870.8 96022 105.930 1736-0 285.010 55.750 61.725 68.394 75.836 8414 93.400 103740 115.270 128. 120 218.050 371.520 63.440 70.749 78960 88212 98 603 110.990 123.410 138170 154740 273560 485970 72052 50.947 91025 102440 115.580 130030 146650 165.420 156 600 102.950 630.170 133330 155.620 181870 212.700 249 250 292.110 342.600 402040 471.080 105-L300 2.348 800 241.330 29.5.200 356790 434750 530310 647 400 700 950 966.700 1.181.900 3.227.200 8.730.000 767090 1018.700 1342.000 1.770.100 2360.800 3,1345004163210 5529.000 7.543.900 30.089.000 120,393.000 2.400.000 $459.500 4994500 7.217.700 10.456.000 15.000.000 21813000 31.515.000 45.497.000 80.356.000 165.076.000 14 15 17 10 25 30 40 EXHIBIT 1-C Present value of $1 to be received at the end of a given number of time periods 1% 5% 6% HOL 11% 12% Perlod 1 2 3 0660 3% 0.971 0.943 0915 0.000 0.826 0751 0.43 P 5990 0.943 OS 0840 0792 0747 0.705 0.665 0.900 0.971 0.961 0.951 0942 0.933 0923 2014 0.005 0896 0621 5 . 7 . 0.901 0812 0731 0650 0503 0535 0.482 7 0.935 0873 0816 0763 0713 0.666 0.623 0582 0544 0.500 0.475 0.444 0.415 LEVO 24 0.900 0.961 0.94 0.924 0.005 0.868 0871 0.853 0837 0.820 0.004 0.750 0.773 0.750 0.743 0720 0714 0.700 0656 0.673 9% 0.917 0.142 0.772 0700 0.650 0.596 0547 0503 0.460 0.422 0.30 0.356 0.326 . 8 0.926 0557 0794 0755 0001 0630 0585 0540 0.500 0.463 0.429 0307 0.368 0.340 0.315 0.292 0962 0925 0.800 0555 0.822 0790 0.760 0.731 0.703 0.676 0650 0.625 0.001 0577 0.555 0534 0513 0.494 0.475 0.456 0.375 0.300 0 200 0.141 0.952 0907 0864 0823 0.784 0.746 0711 0677 0645 0.614 0505 0557 0.530 0505 0.451 0456 0436 0416 0.396 0.377 0.295 0231 0.142 0087 ZONO 0.391 0.352 0317 0286 0.256 0.232 10 11 12 13 14 15 16 17 18 19 20 25 30 0.363 0.837 0.813 0789 0.766 0744 0.722 0.701 0651 0661 0642 0.623 0605 0.567 0570 0554 0.478 0.412 0.307 0.228 0950 0.200 0.895 0.797 0712 0.656 0567 0507 0.452 0404 0.367 0.322 0.362 0257 0.220 0205 0183 0163 0146 0.130 0116 0104 0.050 0033 0011 0.005 0.200 0592 0550 0527 0.497 0460 0442 0417 0.394 0.371 0.350 0.331 0.312 0.233 0174 0.097 0.054 0.379 0870 0.361 0.853 0344 0356 0.820 0820 0.780 0742 0.672 0.564 0513 0.467 0.424 0386 0.350 0319 0.290 0263 0.239 0218 0.198 0.180 0164 0.140 0092 0057 0022 009 016 0.170 0270 0.362 0.339 0.317 0.296 0277 0258 0.184 OSCO SSID 0275 0252 0.231 0212 0194 0.178 0.116 0.075 0032 0.013 0.252 0215 0146 0610 0130 0124 0.074 0044 0015 0.005 0.131 6600 OP 0.553 0453 0372 2900 0046 0.021 50 1090 0034 18% 19% 50% Period 1 13 0.885 0785 25% 0.000 2190 0718 OP9D 35% 0.741 0549 0.406 0.301 UN 6090 16% 0.862 0.745 0641 0.552 0.476 0410 0.354 0.305 3 4 5 6 7 8 0693 0613 0543 0.480 0.425 0.376 0.165 0122 0.091 0.840 0706 0.593 0.400 0410 0.352 0296 0.249 0.200 0176 0.148 0124 0104 008 6.512 0.410 0.320 0.262 0210 0.160 0.134 0.107 0056 0515 0437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0116 30% 0.760 0592 0.455 0.350 0.269 0.207 0.150 0.123 0094 0075 0056 0043 0033 0025 SISO 6 2900 0.667 0.444 0.296 0198 0132 0.08 0059 0039 0026 0017 0012 14% 0877 0.709 0.675 0.502 0.510 0456 0.400 0.351 0.300 0.370 0.237 0.200 0.102 0.100 0.140 0.123 0.100 0005 0033 0.073 0.036 0.020 O.DOS 0.001 17% 0855 0731 0624 0.534 0.456 0.390 0.333 0285 0.245 0.200 0.178 0.152 0.150 0111 0.095 0.001 0060 0.050 0051 0043 0.243 0227 15% 0.870 0756 0650 0572 0.402 0432 0.376 0.327 0284 0.247 0.215 0.187 0163 014 0123 0.107 0.093 0081 0070 0061 0030 0015 0.004 20% 0.833 0.694 0579 0.482 0.402 0.335 0.279 0.233 0.194 0.163 0.135 0.112 0.09 0.070 OS 0.054 0045 0058 0.031 10 11 12 40% 0714 0510 0364 0.260 0.186 0.133 0.005 0.06 0046 0.035 0025 0010 0013 0.000 0006 ODOS 0003 0.002 0002 0001 0295 0.261 0231 0.204 0181 0100 0 141 6900 0000 0195 0.168 0.145 0.125 0.108 009 0.000 6600 0074 14 15 16 17 18 0.050 0057 0027 0020 0015 0.011 0.000 0.00 0005 0.003 0002 0.005 0.003 0002 0002 0.001 0.001 0015 0012 0.125 0055 0044 0035 0.020 0023 0018 0014 0012 0004 0001 6900 0004 0071 0060 0051 0045 0037 0016 0.007 0.001 0062 0052 001 0037 0031 0015 0111 0098 000 0047 0036 6000 2000 9000 20 25 0005 0.001 0060 0051 0024 0012 0.003 0001 0001 0000 0010 0004 o o o o o o O SOOD 1000 ooo 06 0002 000 0.001 OP OG O 0 0 0 SO 0 0002 0.001 EXHIBIT 1-D Present value of $1 received at the end of each period for a given number of time periods (an annuity) Period 1 0.943 0.900 2 ex 0926 1.785 2.57 3.312 19 0.000 1.070 2.041 3902 4855 5795 6720 7652 a566 0471 3 4 5 6 7 24 0.080 1942 2884 JOS 4713 5601 4.472 7.325 8162 KORT 3% 0.971 1.913 2.829 3717 4580 5417 6250 7020 7.786 RE 0.062 1.686 2.775 3430 4452 52423 6002 6733 7435 5% 0.952 1859 2.723 3545 4329 5076 5786 4.463 7.100 104 0.900 1756 247 3.170 3.791 7% 0.955 1108 2624 3587 4.100 2767 5.500 5971 SIS 7034 0893 1600 2200 3657 360 2673 3465 4212 4017 5582 6210 6.802 7 2444 3.100 5.00 2231 0.917 1.750 2.531 3310 3890 2486 SOS 5.535 5995 ALIA 4623 5206 5747 2564 5.335 5759 ALS 5.14 5552 SAND in 111 5328 SAR A710