Question

a . January 1 Purchased and cancelled 3,700 common shares for $35.00/share . b . January 1 - Issue 1,000 preferred shares at $ 105

a . January 1 Purchased and cancelled 3,700 common shares for \$35.00/share . b . January 1 - Issue 1,000 preferred shares at $ 105 per share . c . March 31 Declared a 10 % stock dividend on the common shares . The trading price of the stock on that date was $ 45 per share . d . April 30 - I * s * s * L the stock dividend . e . December 31 Declared a total dividend ( combined for common and preferred shares ) of $ 70,860 for the year . f . December 31 - Options were granted to the CEO for 25,000 common shares at an exercise price of $ 48 , the current market value . The vesting period is four years from the date of grant . An option pricing model ( e.g. Black - Scholes ) has determined that the fair value of the options is an aggregate of $ 72,000 . These options were granted as a replacement for an annual bonus plan based on a percentage of net income . Required 1. Prepare journal entries to record the transactions that took place during 2021 . 75, 000 2. Prepare the shareholders ' equity section of the Statement of Financial Position at December 31 , 2021. Assume 2021 net income was $ 450,000 and comprehensive income was $ . 3. On January 2 , 2026 the CEO exercised the stock options . Prepare the journal entry on the exercise date .

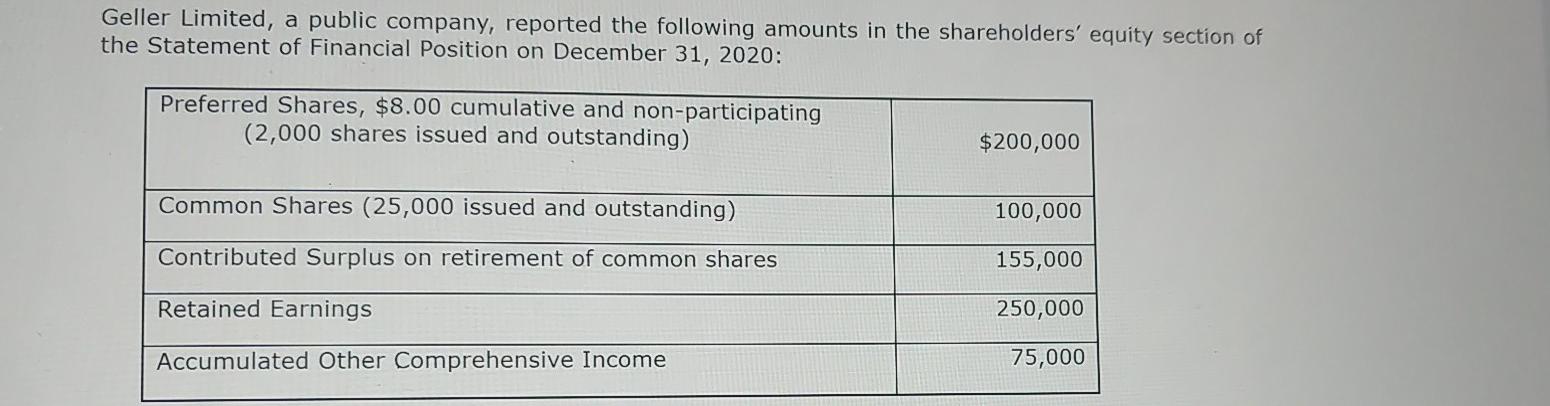

Geller Limited, a public company, reported the following amounts in the shareholders' equity section of the Statement of Financial Position on December 31, 2020: Preferred Shares, $8.00 cumulative and non-participating (2,000 shares issued and outstanding) $200,000 Common Shares (25,000 issued and outstanding) 100,000 Contributed Surplus on retirement of common shares 155,000 Retained Earnings 250,000 Accumulated Other Comprehensive Income 75,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started