Answered step by step

Verified Expert Solution

Question

1 Approved Answer

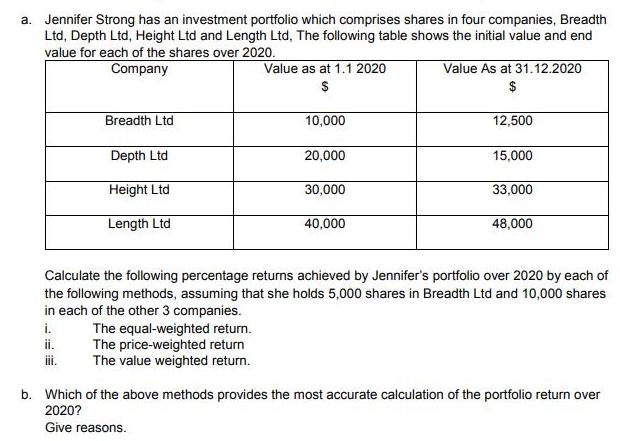

a. Jennifer Strong has an investment portfolio which comprises shares in four companies, Breadth Ltd, Depth Ltd, Height Ltd and Length Ltd. The following

a. Jennifer Strong has an investment portfolio which comprises shares in four companies, Breadth Ltd, Depth Ltd, Height Ltd and Length Ltd. The following table shows the initial value and end value for each of the shares over 2020. Company Breadth Ltd Depth Ltd Height Ltd Length Ltd Value as at 1.1 2020 $ 10,000 The equal-weighted return. The price-weighted return The value weighted return. 20,000 30,000 40,000 Value As at 31.12.2020 $ 12,500 15,000 33,000 48,000 Calculate the following percentage returns achieved by Jennifer's portfolio over 2020 by each of the following methods, assuming that she holds 5,000 shares in Breadth Ltd and 10,000 shares in each of the other 3 companies. i. b. Which of the above methods provides the most accurate calculation of the portfolio return over 2020? Give reasons.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Jennifers Portfolio Return 2020 a Portfolio Return Calculation i EqualWeighted Return This method as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started