Answered step by step

Verified Expert Solution

Question

1 Approved Answer

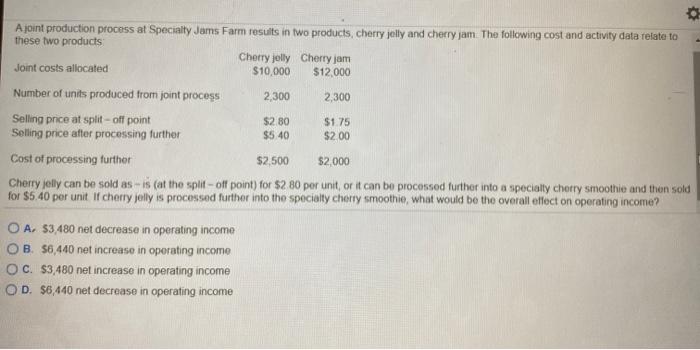

* A joint production process at Specialty Jams Farm results in two products, cherry jelly and cherry jam. The following cost and activity data

* A joint production process at Specialty Jams Farm results in two products, cherry jelly and cherry jam. The following cost and activity data relate to these two products Joint costs allocated Number of units produced from joint process Selling price at split-off point Selling price after processing further Cherry jelly Cherry jam $10,000 $12,000 2,300 $1.75 $2.00 O A $3,480 net decrease in operating income OB. $6,440 net increase in operating income OC. $3,480 net increase in operating income OD. $6,440 net decrease in operating income 2,300 $2.80 $5.40 Cost of processing further $2,500 $2,000 Cherry jelly can be sold as-is (at the split-off point) for $2.80 per unit, or it can be processed further into a specially cherry smoothie and then sold for $5.40 per unit. If cherry jelly is processed further into the specialty cherry smoothie, what would be the overall effect on operating income?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Option C is correct Situation 1 Operating loss Situation 2 Operati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started