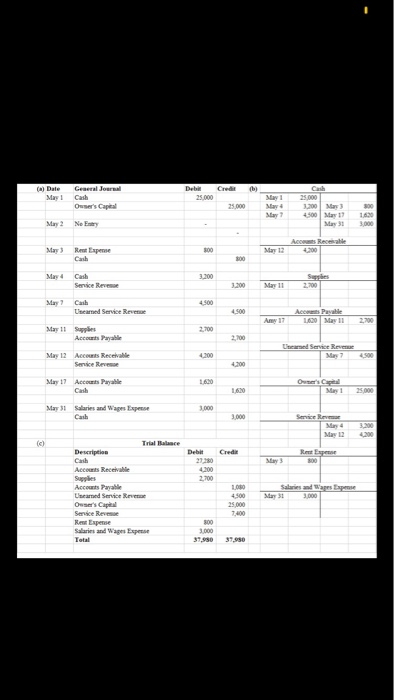

a journalize the transactions

b post to the ledger accounts

c prepare a trial balance

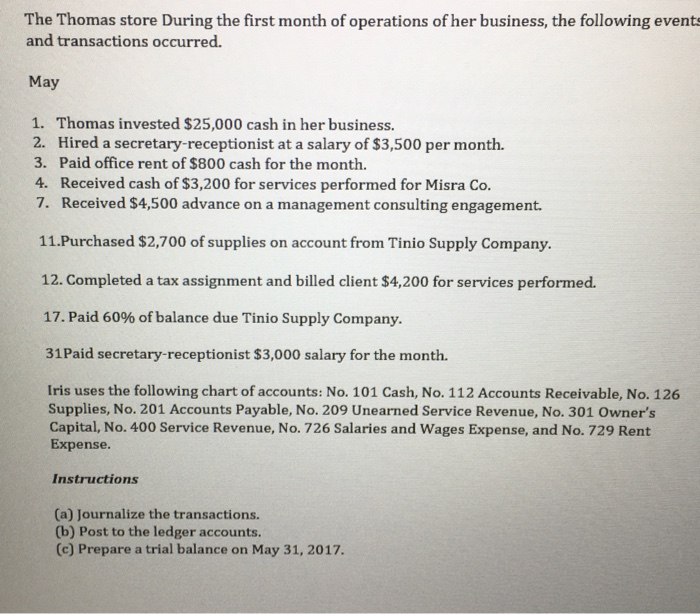

Examen 2 sin Protected ViewSaved e search at References Mailings Review View Help an contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Editing Account Titles and Explanation Ref. Debit Credit Date May 31 (b) Cash Date No. 101 Explanation Debit Credit Ref. J1 J1 J1 J1 J1 J1 Accounts Receivable Date Explanation No. 112 Balance Ret Debit Credit Supplies Date No. 126 Balance Explanation Ref. Debit Credit Accounts Payable Date Explanation No. 201 Balance Debit Credit Ref. J1 J1 Unearned Service Revenue Date Explanation No. 209 Balance Debit Credit Ret J1 BP + C 00 PROBLEM 2-2B (Continued) Owner's Capital Date Explanation No. 301 Balance Ref. Debit Credit I Service Revenue Explanation No. 400 Balance Date Debit Credit Ref. J1 J1 Salaries and Wages Expense Date Explanation No. 726 Balance Ref. Debit Credit Rent Expense Date Explanation No. 729 Balance Debit Credit Ref. J1 (c) IRIS BECK, CPA Trial Balance May 31, 2017 Debit Credit a 5 > C 8 6 7 00 5 9 O T U (a) Date General Journal De Cred Cache 25.000 Owser's Capital 25 000 Stay 1 Way Bay ch 25.000 1.200 May 45001 May 31 160 3.000 May 2 Noty Ac Recessable 4200 May Rest Espense Cash 300 May 12 800 Mary 3.200 Cash Service Reve Sessies 2700 1.200 May 11 May Call Uneared Service Revenge 4.500 Accs Pavalle 1,620 May 11 2.700 2.700 2.700 May 11 Supplies Accounts Payable May 12 Accws Receivable Service Reve Led Service Revenue 4200 4200 May 17 Accounts Payabile 1.6.0 25.000 1.000 May 31 Salaries and prese Cash 3.000 Trial Blace Description Det Credit 800 4300 2.700 Accounts Receivable Acces Paya Uneared Service Review Own's Capital Sense Revue Rest Expense Salaries and Wages Expert Total 1,080 4.500 25.000 700 Salaries and asse May 31 3.000 3.000 37.950 The Thomas store During the first month of operations of her business, the following events and transactions occurred. May 1. Thomas invested $25,000 cash in her business. 2. Hired a secretary-receptionist at a salary of $3,500 per month. 3. Paid office rent of $800 cash for the month. 4. Received cash of $3,200 for services performed for Misra Co. 7. Received $4,500 advance on a management consulting engagement. 11.Purchased $2,700 of supplies on account from Tinio Supply Company. 12. Completed a tax assignment and billed client $4,200 for services performed. 17. Paid 60% of balance due Tinio Supply Company. 31Paid secretary-receptionist $3,000 salary for the month. Iris uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 301 Owner's Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Instructions (a) Journalize the transactions. (b) Post to the ledger accounts. (c) Prepare a trial balance on May 31, 2017