Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Justin is a single man and wants to save up enough money to put as a down payment on a new house in 5

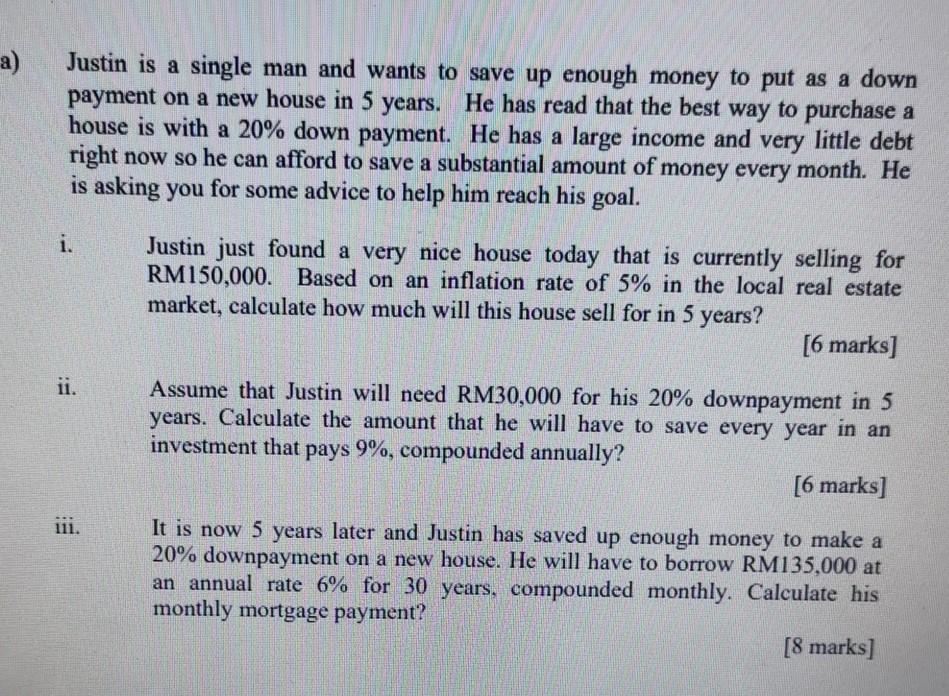

a) Justin is a single man and wants to save up enough money to put as a down payment on a new house in 5 years. He has read that the best way to purchase a house is with a 20% down payment. He has a large income and very little debt right now so he can afford to save a substantial amount of money every month. He is asking you for some advice to help him reach his goal. help him to Justin just found a very nice house today that is currently selling for RM150,000. Based on an inflation rate of 5% in the local real estate market, calculate how much will this house sell for in 5 years? [6 marks] ii. Assume that Justin will need RM30,000 for his 20% downpayment in 5 years. Calculate the amount that he will have to save every year in an investment that pays 9%, compounded annually? [6 marks] iii. It is now 5 years later and Justin has saved up enough money to make a 20% downpayment on a new house. He will have to borrow RM135,000 at an annual rate 6% for 30 years, compounded monthly. Calculate his monthly mortgage payment? [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started