Answered step by step

Verified Expert Solution

Question

1 Approved Answer

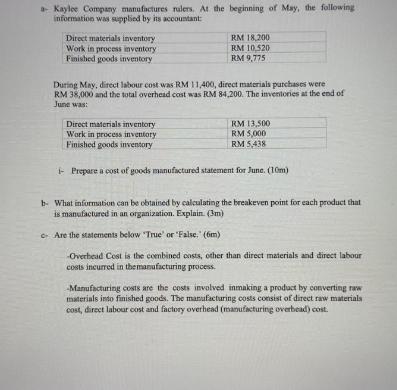

a Kaylee Company manufactures rulers. At the beginning of May, the following information was supplied by its accountant: Direct materials inventory Work in process

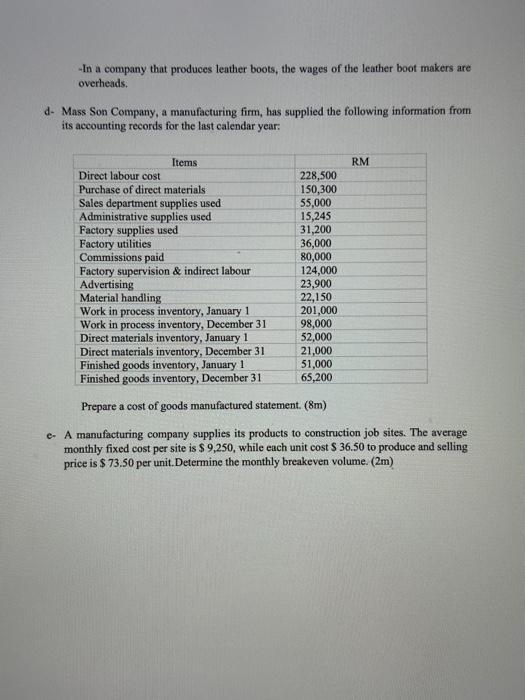

a Kaylee Company manufactures rulers. At the beginning of May, the following information was supplied by its accountant: Direct materials inventory Work in process inventory Finished goods inventory RM 18,200 RM 10,520 RM 9,775 During May, direct labour cost was RM 11,400, direct materials purchases were RM 38,000 and the total overhead cost was RM 84,200. The inventories at the end of June was: Direct materials inventory Work in process inventory RM 13,500 RM 5,000 RM 5,438 Finished goods inventory - Prepare a cost of goods manufactured statement for June. (10m) b- What information can be obtained by calculating the breakeven point for each product that is manufactured in an organization. Explain. (3m) - Are the statements below "True' or 'False." (6m) -Overhead Cost is the combined costs, other than direct materials and direct labour costs incurred in the manufacturing process. -Manufacturing costs are the costs involved inmaking a product by converting raw materials into finished goods. The manufacturing costs consist of direct raw materials cost, direct labour cost and factory overhead (manufacturing overbead) cost. -In a company that produces leather boots, the wages of the leather boot makers are overheads. d- Mass Son Company, a manufacturing firm, has supplied the following information from its accounting records for the last calendar year: Items Direct labour cost Purchase of direct materials Sales department supplies used Administrative supplies used Factory supplies used Factory utilities Commissions paid Factory supervision & indirect labour Advertising Material handling Work in process inventory, January 1 Work in process inventory, December 31 Direct materials inventory, January 1 228,500 150,300 55,000 15,245 31,200 36,000 80,000 RM 124,000 23,900 22,150 201,000 98,000 52,000 21,000 Direct materials inventory, December 31 Finished goods inventory, January 1 51,000 Finished goods inventory, December 31 65,200 Prepare a cost of goods manufactured statement. (8m) e- A manufacturing company supplies its products to construction job sites. The average monthly fixed cost per site is $ 9,250, while each unit cost $ 36.50 to produce and selling price is $ 73.50 per unit. Determine the monthly breakeven volume. (2m)

Step by Step Solution

★★★★★

3.57 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started