Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Kenyan holding company which receives management fees and interest income from its 3 wholly owned subsidiaries. The 3 subsidiaries are involved in trading

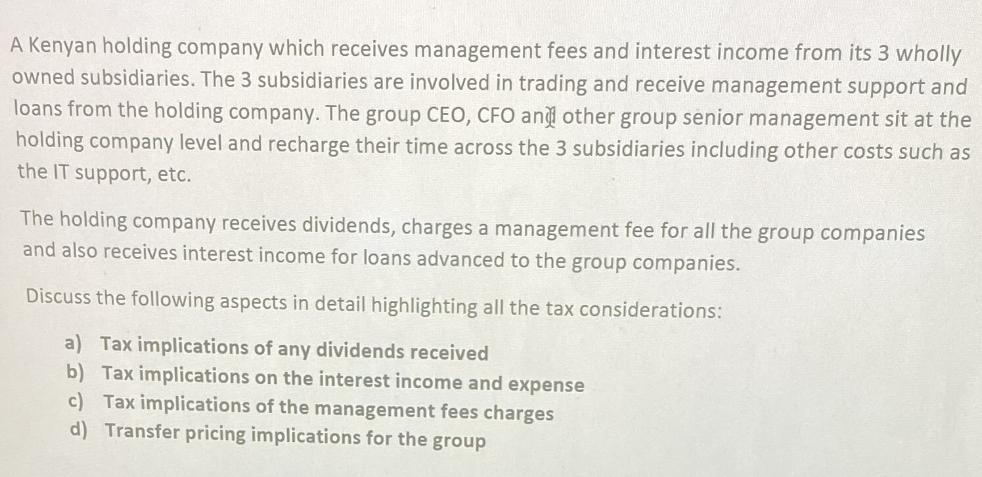

A Kenyan holding company which receives management fees and interest income from its 3 wholly owned subsidiaries. The 3 subsidiaries are involved in trading and receive management support and loans from the holding company. The group CEO, CFO and other group senior management sit at the holding company level and recharge their time across the 3 subsidiaries including other costs such as the IT support, etc. The holding company receives dividends, charges a management fee for all the group companies and also receives interest income for loans advanced to the group companies. Discuss the following aspects in detail highlighting all the tax considerations: a) Tax implications of any dividends received b) Tax implications on the interest income and expense c) Tax implications of the management fees charges d) Transfer pricing implications for the group

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Tax implications of any dividends received Dividends received by the holding company from its subsidiaries will be taxed as income in the hands of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started