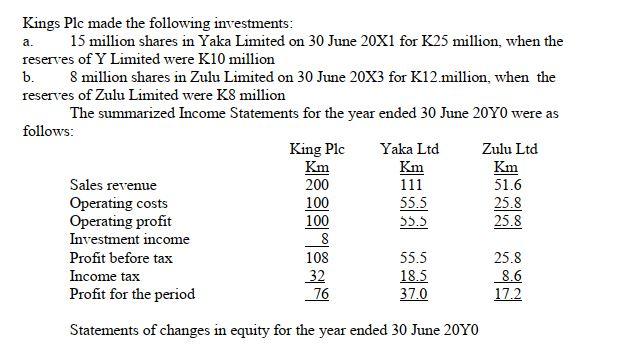

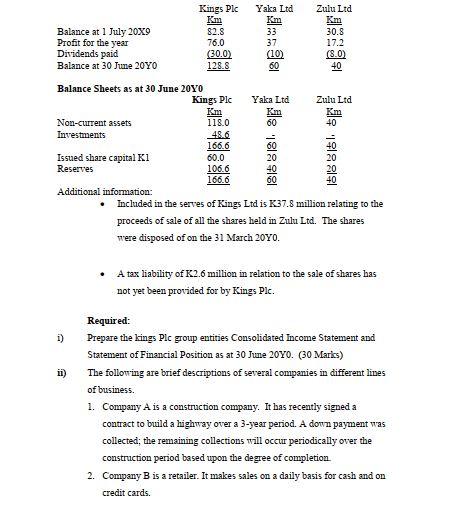

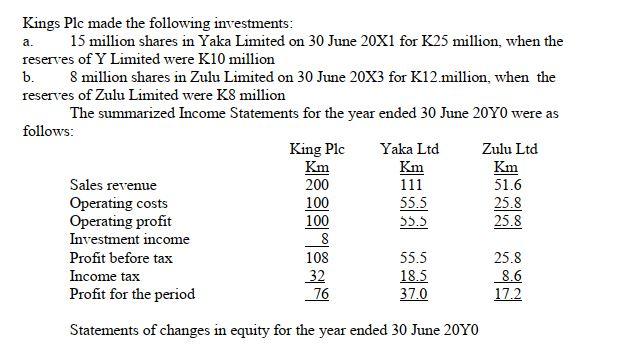

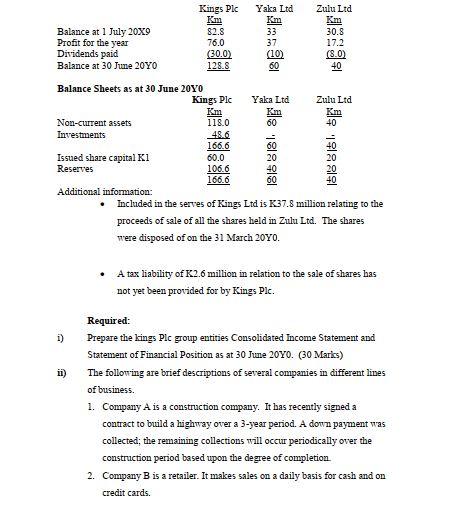

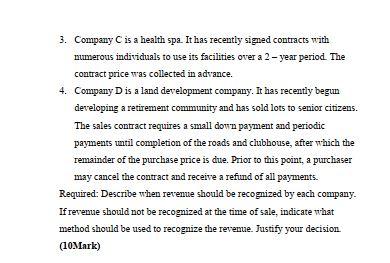

a. Kings Plc made the following investments: 15 million shares in Yaka Limited on 30 June 20x1 for K25 million, when the reserves of Y Limited were K10 million b. 8 million shares in Zulu Limited on 30 June 20X3 for K12 million, when the reserves of Zulu Limited were K8 million The summarized Income Statements for the year ended 30 June 20Y0 were as follows: King Plc Yaka Ltd Zulu Ltd Km Km Km Sales revenue 200 111 51.6 Operating costs 100 55.5 25.8 Operating profit 100 55.5 25.8 Investment income 8 Profit before tax 108 55.5 25.8 Income tax 32 18.5 8.6 Profit for the period 37.0 17.2 Statements of changes in equity for the year ended 30 June 20Y0 76 Kom Kings Pic Yaka Ltd Zulu Ltd Km Kom Balance at 1 July 20X9 82.8 33 30.8 Profit for the year 76.0 37 17.2 Dividends paid (30.0) (10) (8.0) Balance at 30 June 20Y0 128.8 60 40 Balance Sheets as at 30 June 2010 Kings Pic Yaka Ltd Zulu Ltd Km Km Non-current assets 118.0 60 40 Investments 48.6 166.6 60 Issued share capital K1 60.0 20 Reserves 106.6 166.6 Additional information: Included in the serves of Kings Ltd is K37.8 million relating to the proceeds of sale of all the shares held in Zulu Ltd. The shares were disposed of on the 31 March 20Y0. ' 1818 181 29 91 811 A tax liability of K2.6 million in relation to the sale of shares has not yet been provided for by Kings Plc. 1) ii) Required: Prepare the kings Pic group entities Consolidated Income Statement and Statement of Financial Position as at 30 June 20YO. (30 Marks) The following are brief descriptions of several companies in different lines of business. 1. Company A is a construction company. It has recently signed a contract to build a highway over a 3-year period. A down payment was collected; the remaining collections will occur periodically over the construction period based upon the degree of completion 2. Company B is a retailer. It makes sales on a daily basis for cash and on credit cards. 3. Company C is a health spa. It has recently signed contracts with numerous individuals to use its facilities over a 2-year period. The contract price was collected in advance. 4. Company D is a land development company. It has recently begun developing a retirement community and has sold lots to senior citizens. The sales contract requires a small down payment and periodic payments until completion of the roads and chubhouse, after which the remainder of the purchase price is due. Prior to this point, a purchaser may cancel the contract and receive a refund of all payments. Required: Describe when revenue should be recognized by each company. If revenue should not be recognized at the time of sale, indicate what method should be used to recognize the revenue. Justify your decision (10Mark) a. Kings Plc made the following investments: 15 million shares in Yaka Limited on 30 June 20x1 for K25 million, when the reserves of Y Limited were K10 million b. 8 million shares in Zulu Limited on 30 June 20X3 for K12 million, when the reserves of Zulu Limited were K8 million The summarized Income Statements for the year ended 30 June 20Y0 were as follows: King Plc Yaka Ltd Zulu Ltd Km Km Km Sales revenue 200 111 51.6 Operating costs 100 55.5 25.8 Operating profit 100 55.5 25.8 Investment income 8 Profit before tax 108 55.5 25.8 Income tax 32 18.5 8.6 Profit for the period 37.0 17.2 Statements of changes in equity for the year ended 30 June 20Y0 76 Kom Kings Pic Yaka Ltd Zulu Ltd Km Kom Balance at 1 July 20X9 82.8 33 30.8 Profit for the year 76.0 37 17.2 Dividends paid (30.0) (10) (8.0) Balance at 30 June 20Y0 128.8 60 40 Balance Sheets as at 30 June 2010 Kings Pic Yaka Ltd Zulu Ltd Km Km Non-current assets 118.0 60 40 Investments 48.6 166.6 60 Issued share capital K1 60.0 20 Reserves 106.6 166.6 Additional information: Included in the serves of Kings Ltd is K37.8 million relating to the proceeds of sale of all the shares held in Zulu Ltd. The shares were disposed of on the 31 March 20Y0. ' 1818 181 29 91 811 A tax liability of K2.6 million in relation to the sale of shares has not yet been provided for by Kings Plc. 1) ii) Required: Prepare the kings Pic group entities Consolidated Income Statement and Statement of Financial Position as at 30 June 20YO. (30 Marks) The following are brief descriptions of several companies in different lines of business. 1. Company A is a construction company. It has recently signed a contract to build a highway over a 3-year period. A down payment was collected; the remaining collections will occur periodically over the construction period based upon the degree of completion 2. Company B is a retailer. It makes sales on a daily basis for cash and on credit cards. 3. Company C is a health spa. It has recently signed contracts with numerous individuals to use its facilities over a 2-year period. The contract price was collected in advance. 4. Company D is a land development company. It has recently begun developing a retirement community and has sold lots to senior citizens. The sales contract requires a small down payment and periodic payments until completion of the roads and chubhouse, after which the remainder of the purchase price is due. Prior to this point, a purchaser may cancel the contract and receive a refund of all payments. Required: Describe when revenue should be recognized by each company. If revenue should not be recognized at the time of sale, indicate what method should be used to recognize the revenue. Justify your decision (10Mark)