Question

A knock-out call is an exotic option that behaves exactly like a vanilla, European call option UNLESS the underlying trades at or above a particular

A knock-out call is an exotic option that behaves exactly like a vanilla, European call option UNLESS the underlying trades at or above a particular value, called the out-strike. If the underlying ever trades at or above the outstrike, the option will cease to exist and is said to be knocked out. As an example, if a 100 Call has an out-strike of 120, the call will behave just like a European Call except if underlying ever trades at or above 120. If the underlying ever does trade at or above 120, the call will be knocked out and no longer exists. Even if the call were to be in-the-money on the date when this call was originally scheduled to expire, there would be no payoff to the call buyer because the option had been knocked out and no longer exists at expiration. Use the binomial tree from your previous question to compute the price for a knock-out call. The strike of the call is $51 and the out-strike is $53.

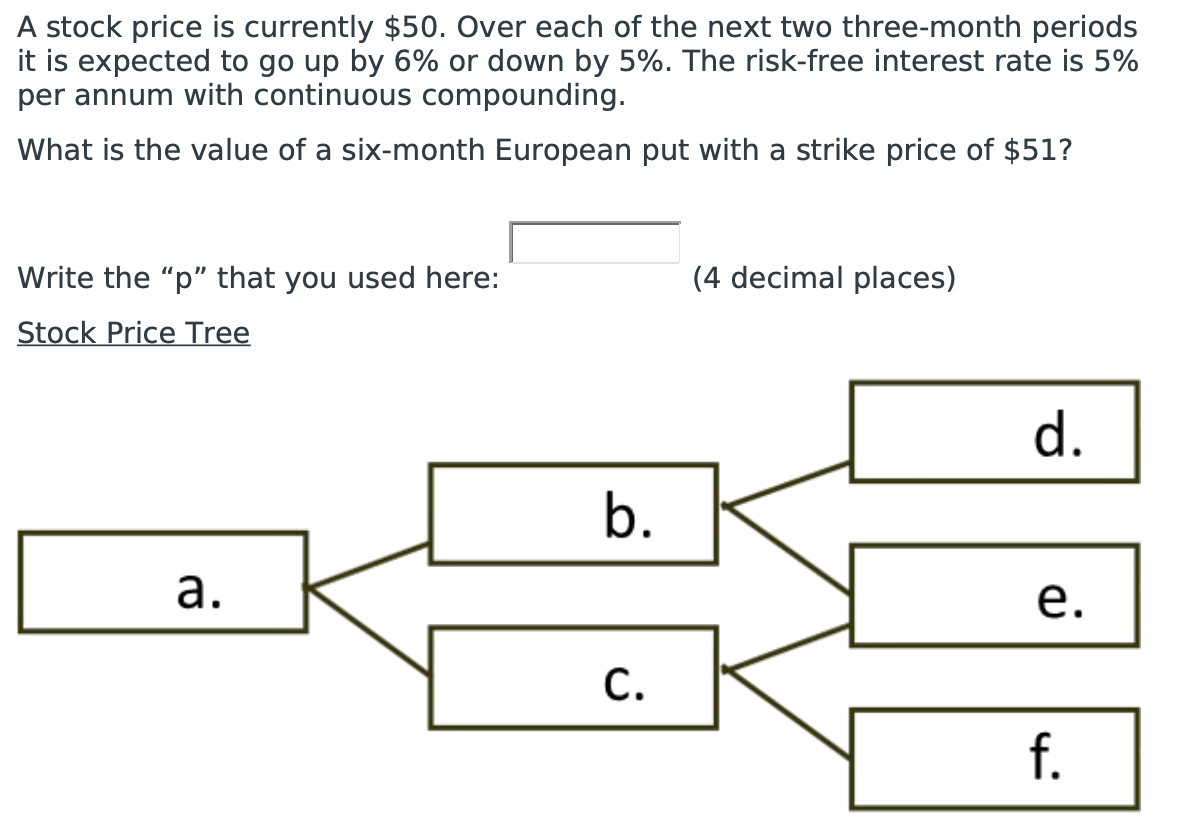

A stock price is currently $50. Over each of the next two three-month periods it is expected to go up by 6% or down by 5%. The risk-free interest rate is 5% per annum with continuous compounding. What is the value of a six-month European put with a strike price of $51? Write the "p" that you used here: (4 decimal places) Stock Price TreeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started