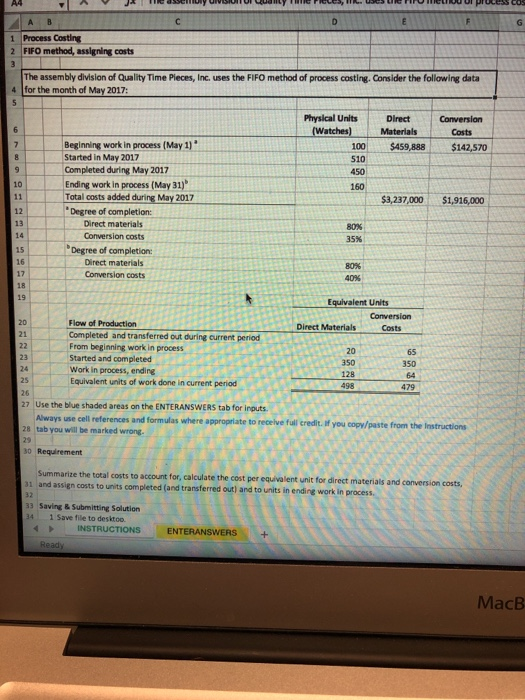

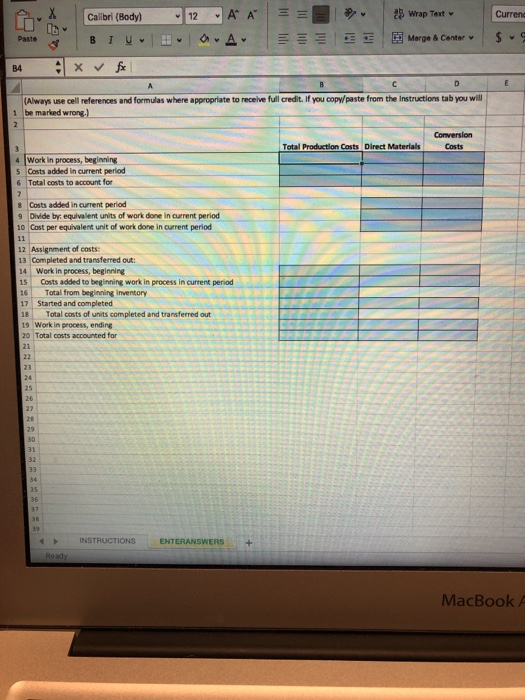

A l assenly UIVISIOITUI Quality The FIGLE, U UE HIFUMLUU UI PEUCES COS 1 Process Costing 2 FIFO method, assigning costs The assembly division of Quality Time Pleces, Inc. uses the FIFO method of process costing. Consider the following data 4 for the month of May 2017: Physical Units (Watches) 100 510 Direct Materials $459,888 Conversion Costs $142,570 450 160 $3,237,000 $1,916,000 Beginning work in process (May 1) Started in May 2017 Completed during May 2017 Ending work in process (May 31) Total costs added during May 2017 Degree of completion: Direct materials Conversion costs Degree of completion: Direct materials Conversion costs 80% 35% Equivalent Units Conversion Flow of Production Direct Materials Costs Completed and transferred out during current period From beginning work in process 20 Started and completed 350 Work in process, ending 128 Equivalent units of work done in current period 498 27 Use the blue shaded areas on the ENTERANSWERS tab for inputs. ab for inte Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions 28 tab you will be marked wrong. 30 Requirement Summarize the total costs to account for calculate the cost per equivalent unit for direct materials and conversion costs. 31 and assign costs to units completed (and transferred out and to units in ending work in process 33 Saving & Submitting Solution 34 Save file to desktop INSTRUCTIONS ENTERANSWERS Ready MacB AA 2 X C alibri (Body) Paste a BI B4 x fx 12 A Wrap Tout Merge & Center Currenc $ 9 SEE (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will 1 be marked wrong.) Conversion Costs Total Production Costs Direct Materials 4 Work in process, beginning 5 Costs added in current period 6 Total costs to account for & Costs added in current period 9 Divide bys equivalent units of work done in current period 10 Cost per equivalent unit of work done in current period 12 Assignment of costs 13 Completed and transferred out: 14 Work in process, beginning 15 Costs added to beginning work in process in current period 16 Total from beginning inventory 17 Started and completed 18 Total costs of units completed and transferred out 19 Work in process, ending 20 Total costs accounted for INSTRUCTIONS ENTERANSWERS + MacBook A