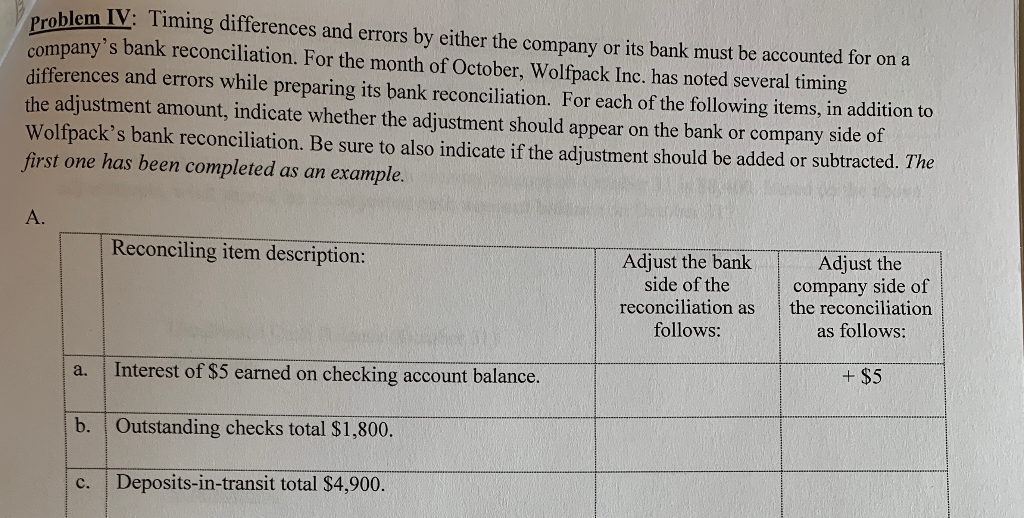

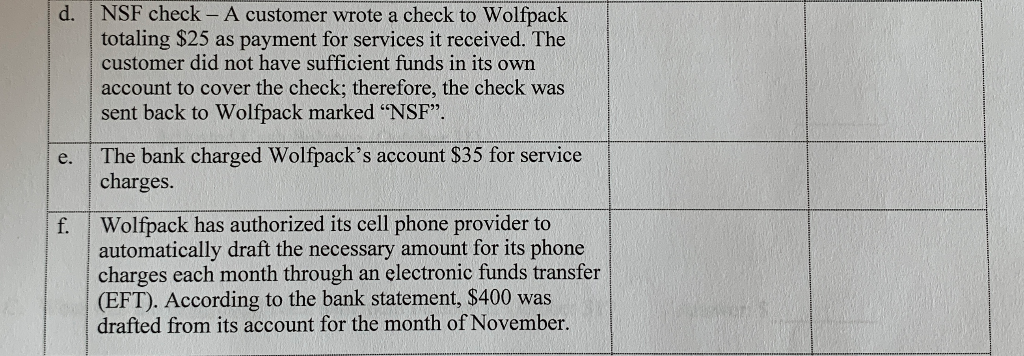

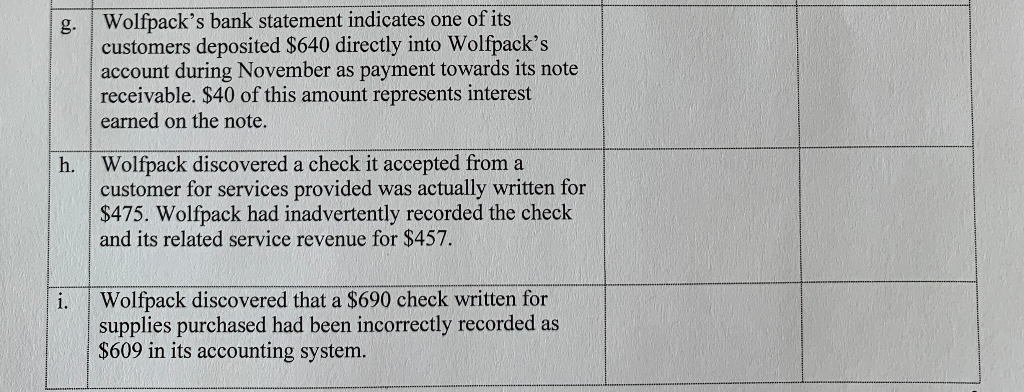

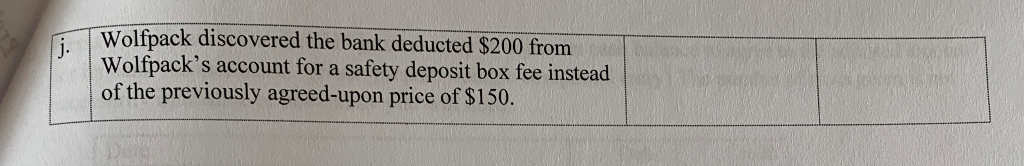

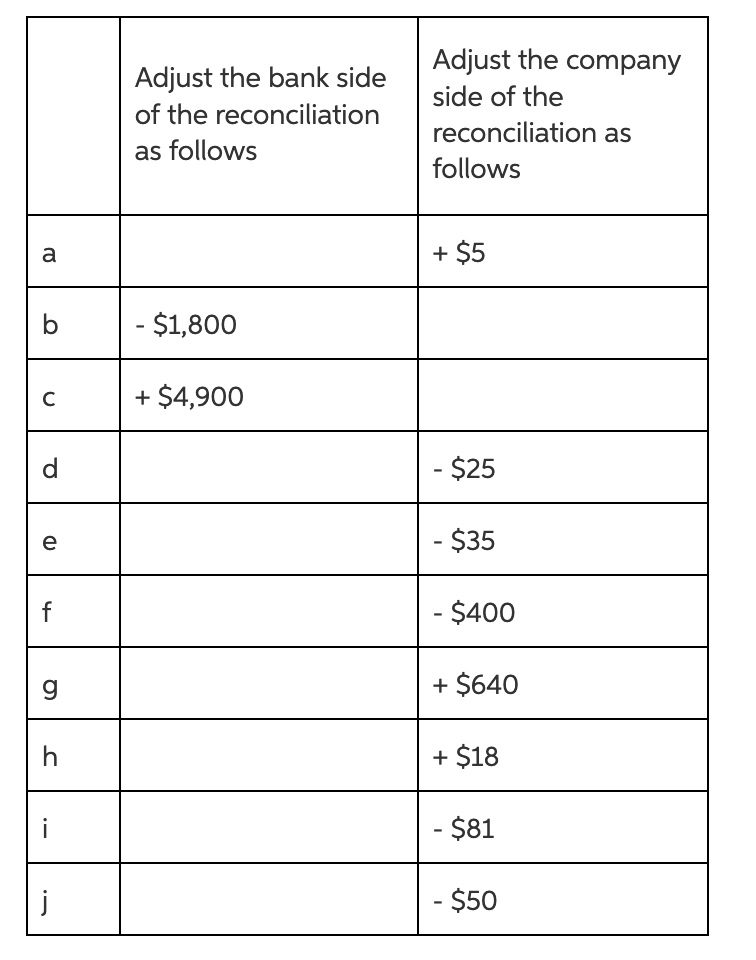

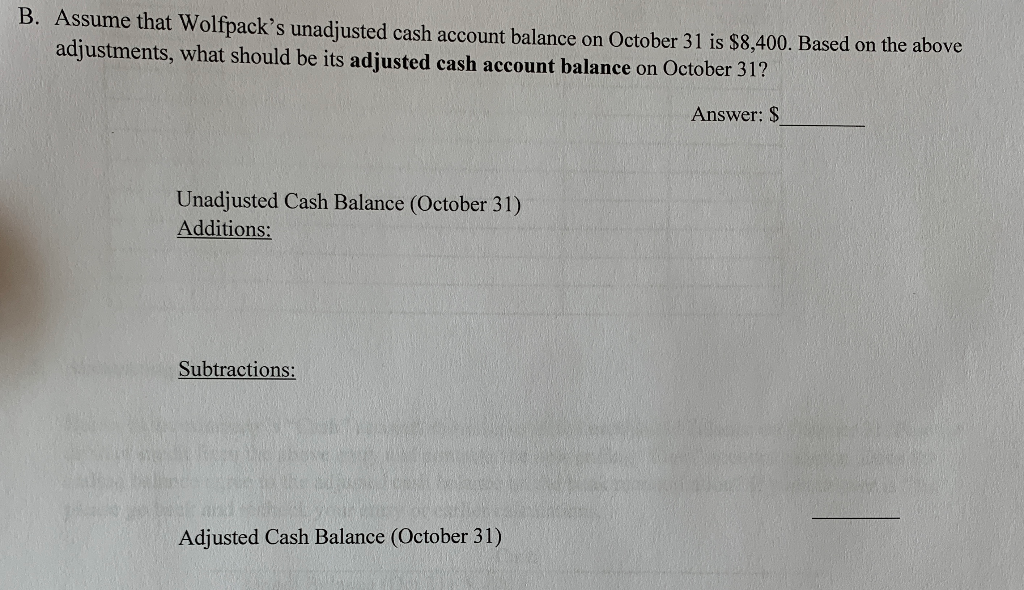

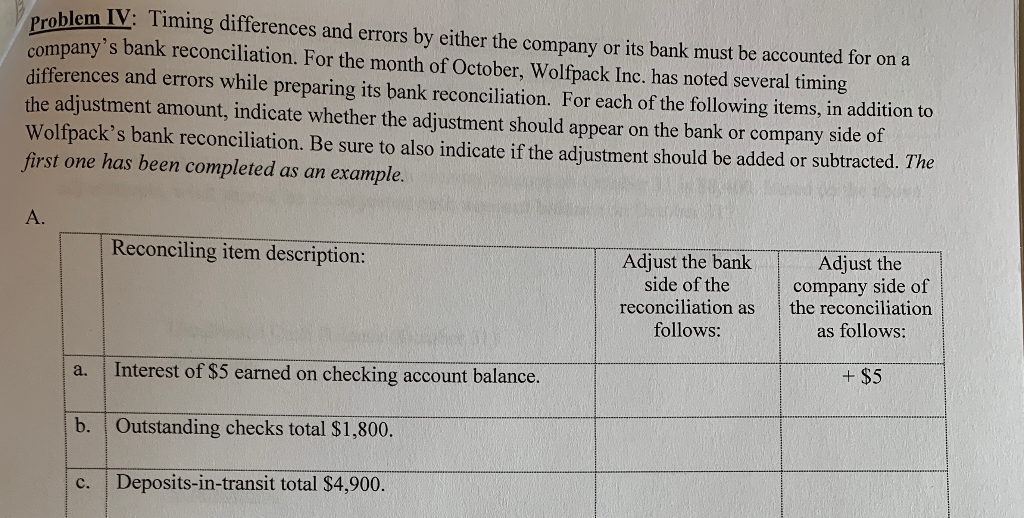

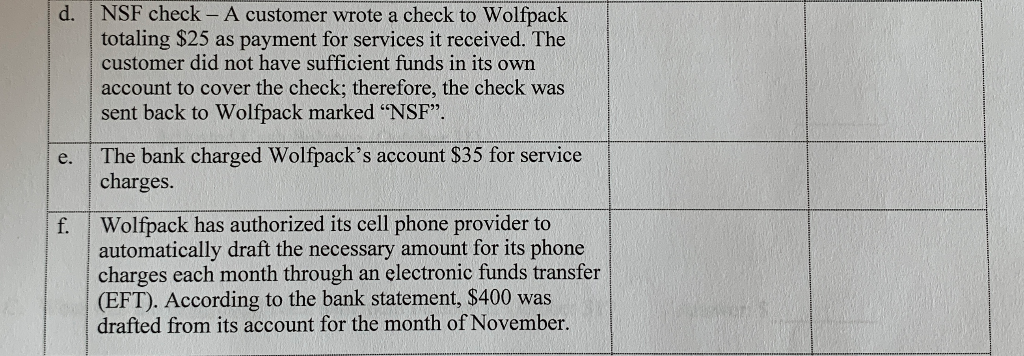

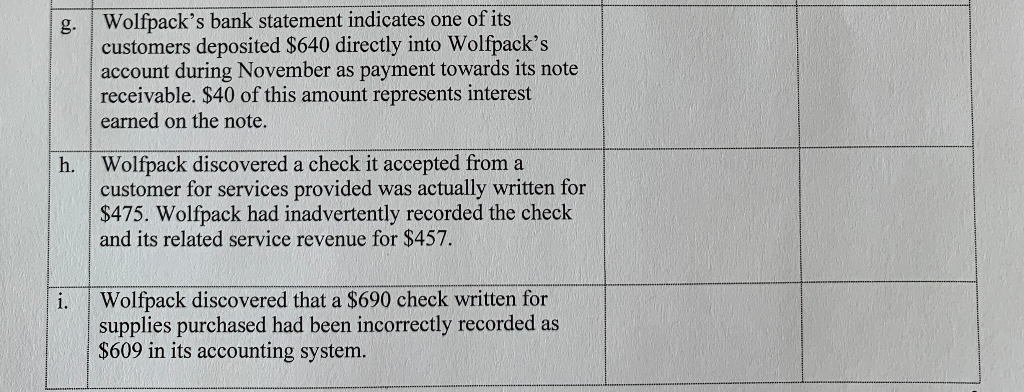

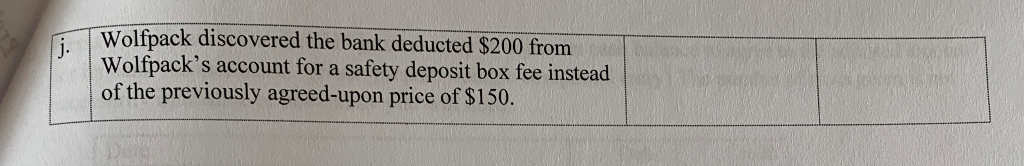

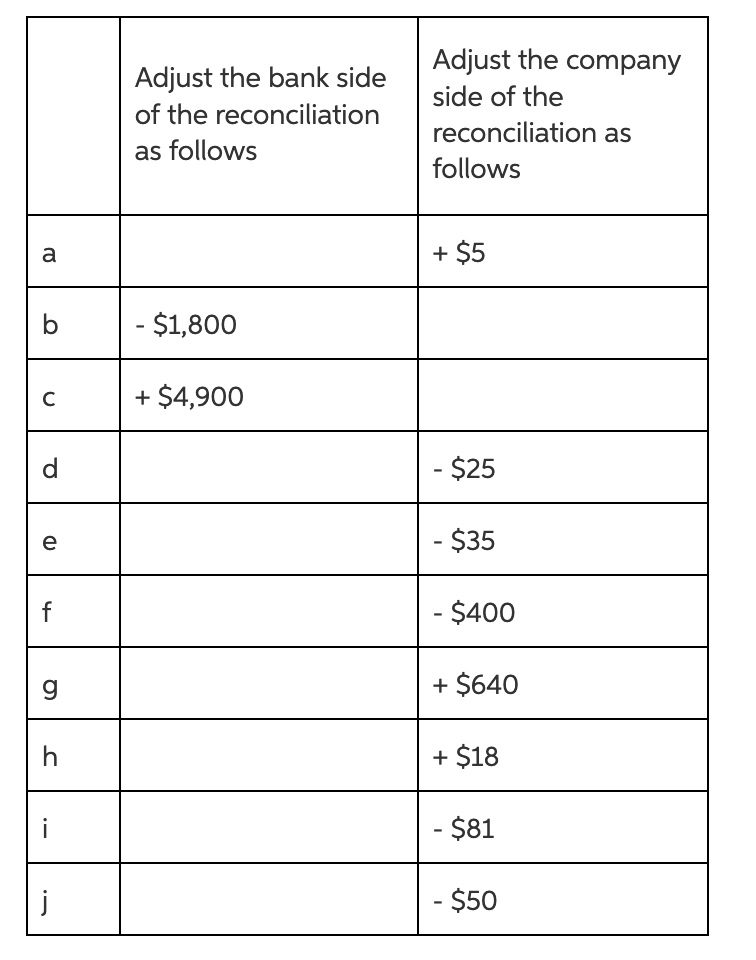

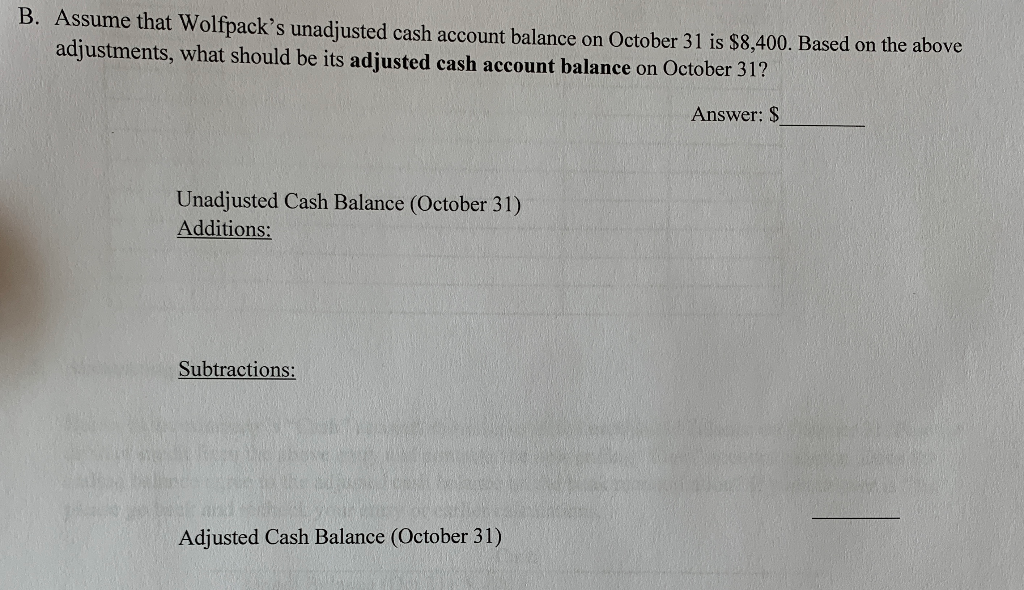

Problem IV: Timing differences and errors by either the company or its bank must be accounted for on a company's bank reconciliation. For the month of October, Wolfpack Inc. has noted several timing differences and errors while preparing its bank reconciliation. For each of the following items, in addition to the adjustment amount, indicate whether the adjustment should appear on the bank or company side of Wolfpack's bank reconciliation. Be sure to also indicate if the adjustment should be added or subtracted. The first one has been completed as an example. A. Reconciling item description Adjust the bank Adjust the side of the reconciliation as follows: company side of the reconciliation as follows: + $5 a. Interest of $5 earned on checking account balance. b. Outstanding checks total $1,800. c. Deposits-in-transit total $4,900. d. NSF check - A customer wrote a check to Wolfpack totaling $25 as payment for services it received. The customer did not have sufficient funds in its own account to cover the check; therefore, the check was sent back to Wolfpack marked "NSF" e. The bank charged Wolfpack's account $35 for service charges. f. Wolfpack has authorized its cell phone provider to automatically draft the necessary amount for its phone charges each month through an electronic funds transfer (EFT). According to the bank statement, $400 was drafted from its account for the month of November. g. Wolfpack's bank statement indicates one of its customers deposited $640 directly into Wolfpack's account during November as payment towards its note receivable. $40 of this amount represents interest earned on the note. h. Wolfpack discovered a check it accepted from a customer for services provided was actually written for $475. Wolfpack had inadvertently recorded the check and its related service revenue for $457 i. Wolfpack discovered that a $690 check written for supplies purchased had been incorrectly recorded as $609 in its accounting system. Wolfpack discovered the bank deducted S200 from Wolfpack's account for a safety deposit box fee instead of the previously agreed-upon price of $150. J. Adjust the bank side of the reconciliation as follows Adjust the company side of the reconciliation as follows + $5 $1,800 c $4,900 $25 $35 $400 $640 +$18 $81 $50 9 B. Assume that Wolfpack's unadjusted cash account balance on October 31 is $8,400. Based on the above adjustments, what should be its adjusted cash account balance on October 31? Answer: $ Unadjusted Cash Balance (October 31) Additions: Subtractions Adjusted Cash Balance (October 31) C. What was the unadjusted bank statement balance at October 31? Answer:S