Answered step by step

Verified Expert Solution

Question

1 Approved Answer

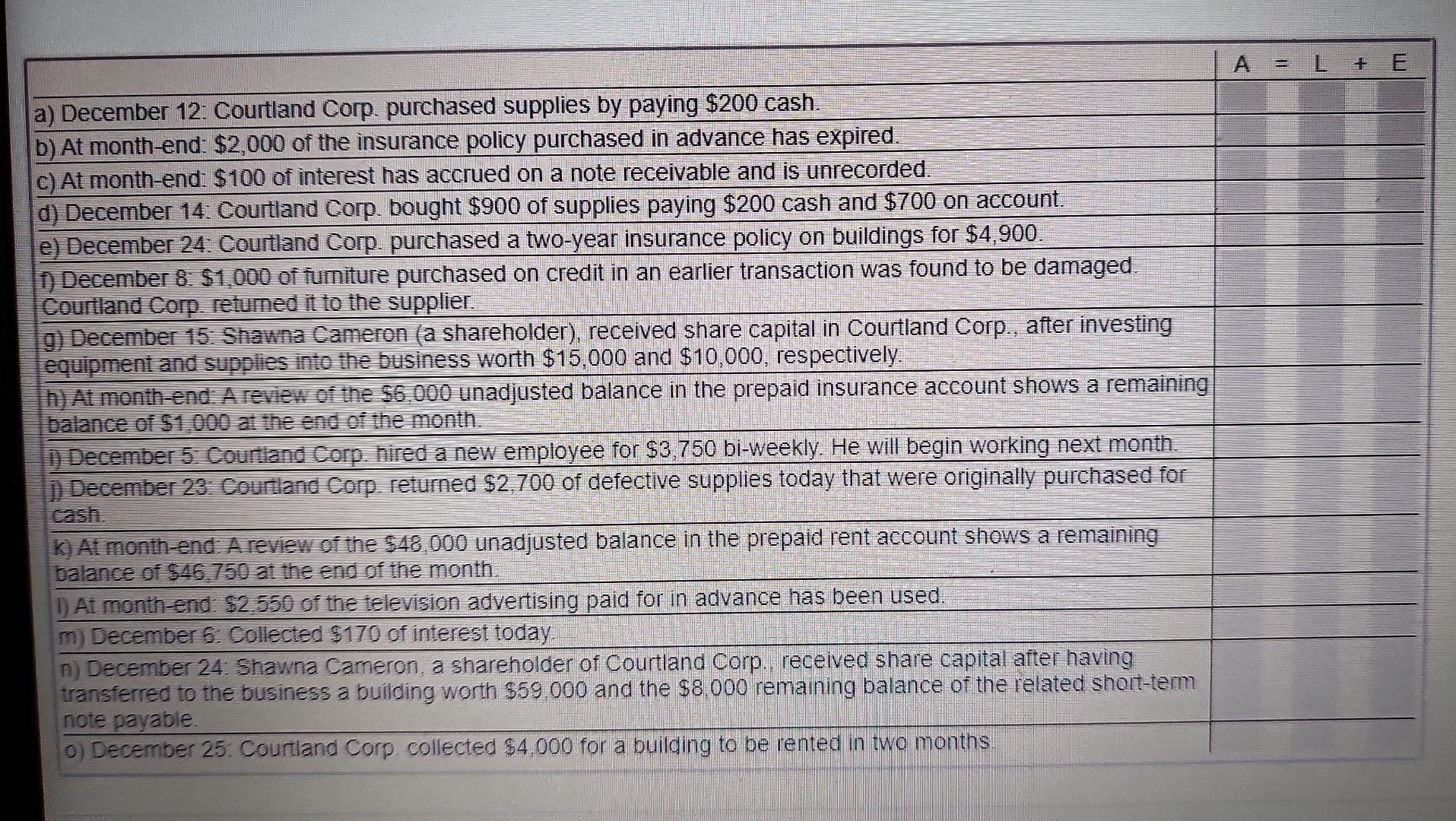

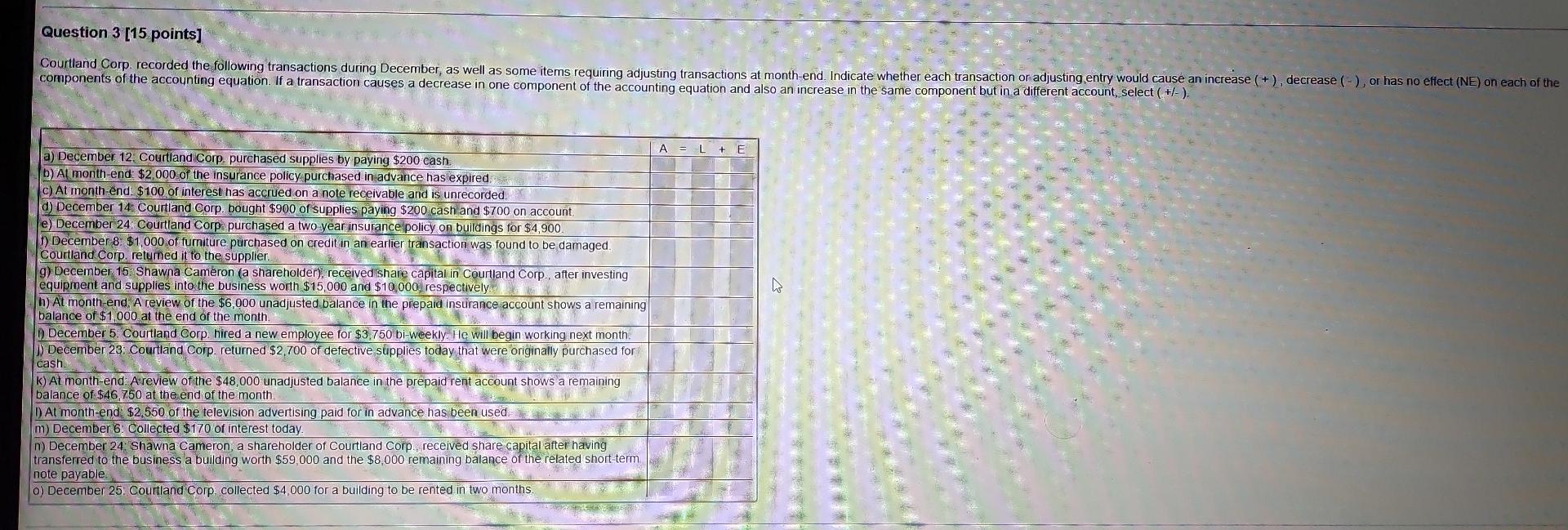

A = L + E a) December 12: Courtland Corp. purchased supplies by paying $200 cash. b) At month-end: $2,000 of the insurance policy purchased

A = L + E a) December 12: Courtland Corp. purchased supplies by paying $200 cash. b) At month-end: $2,000 of the insurance policy purchased in advance has expired. c)At month-end: $100 of interest has accrued on a note receivable and is unrecorded. d) December 14: Courtland Corp. bought $900 of supplies paying $200 cash and $700 on account. e) December 24: Courtland Corp. purchased a two-year insurance policy on buildings for $4,900. 1) December 8: $1,000 of fumiture purchased on credit in an earlier transaction was found to be damaged. Courtland Corp. returned it to the supplier. 9) December 15: Shawna Cameron (a shareholder), received share capital in Courtland Corp., after investing equipment and supplies into the business worth $15,000 and $10,000, respectively. h) At month-end. A review of the $6.000 unadjusted balance in the prepaid insurance account shows a remaining balance of $1.000 at the end of the month. D) December 5. Courtland Corp. hired a new employee for $3,750 bi-weekly. He will begin working next month. ) December 23: Courtland Corp. returned $2.700 of defective supplies today that were originally purchased for cash. k) At month-end. A review of the $48.000 unadjusted balance in the prepaid rent account shows a remaining balance of $46 750 at the end of the month. D) At month-end: $2.550 of the television advertising paid for in advance has been used. m) December 6: Collected $170 of interest today. n) December 24: Shawna Cameron, a shareholder of Courtland Corp., received share capital after having transferred to the business a building worth $59,000 and the $8.000 remaining balance of the related short-term note payable 0) December 25. Courtland Corp, collected $4,000 for a building to be rented in two months. Question 3 [15 points] Courtland Corp. recorded the following transactions during December, as well as some items requiring adjusting transactions at month-end. Indicate whether each transaction or adjusting entry would cause an increase (+), decrease ( - ), or has no effect (NE) on each of the components of the accounting equation. If a transaction causes a decrease in one component of the accounting equation and also an increase in the same component but in a different account, select (+/-). A = L + E a) December 12. Courtland Corp purchased supplies by paying $200 cash. b) At month-end $2,000 of the insurance policy purchased in advance has expired. c) At month end: $100 of interest has accrued on a note receivable and is unrecorded. d) December 14: Courtland Corp. bought $900 of supplies paying $200 cash and $700 on account e) December 24. Courtland Corp purchased a two year insurance policy on buildings for $4,900. 1) December 8: $1,000 of furniture purchased on credit in an earlier transaction was found to be damaged. Courtland Corp. returned it to the supplier. g) December 15. Shawna Cameron (a shareholder), received share capital in Courtland Corp., after investing equipment and supplies into the business worth $15,000 and $10,000 respectively h) At month-end. A review of the $6,000 unadjusted balance in the prepaid insurance account shows a remaining balance of $1,000 at the end of the month ) December 5. Courtland Corp. hired a new employee for $3,750 bi-weekly. He will begin working next month ) December 23: Courtland Corp. returned $2,700 of defective supplies today that were originally purchased for cash k) Al month-end. A review of the $48,000 unadjusted balance in the prepaid rent account shows a remaining balance of $46.750 at the end of the month D At month-end: $2,550 of the television advertising paid for in advance has been used. m) December 6. Collected $170 of interest today. n) December 24, Shawna Cameron, a shareholder of Courtland Corp., received share capital after having transferred to the business a building worth $59,000 and the $8,000 remaining balance of the related short-term note payable 0) December 25. Courtland Corp, collected $4,000 for a building to be rented in two months Questlon 3 (15 points] Courtland Corp recorded the following transactions during December, as well as some items requiring adjusting transactions at month-end. Indicate whether each transaction or adjusting entry would cause an increase (+) decrease (-) or has no efect (NE) on each components of the accounting equation. If a transaction causes a decrease in one component of the accounting equation and also an increase in the same component but in a different account, select ( + -)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started