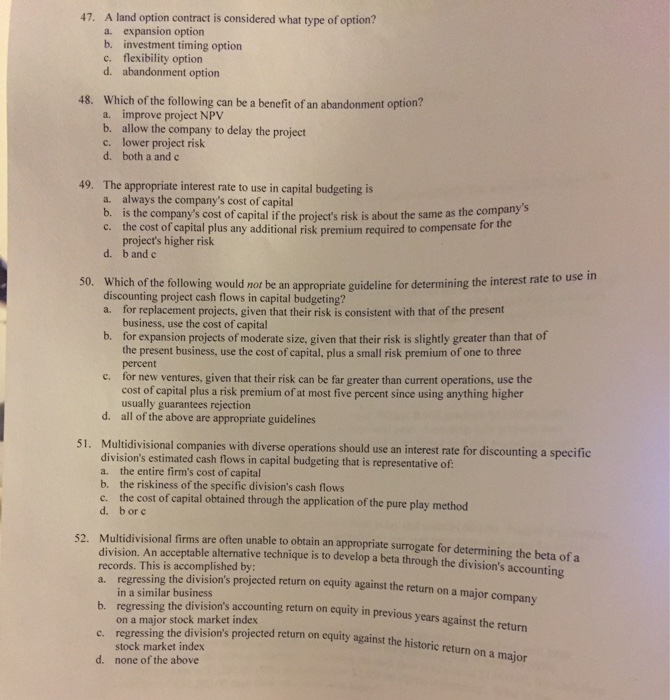

A land option contract is considered what type of option? a. expansion option b. investment timing option c. flexibility option d. abandonment option 48. Which of the following can be a benefit of an abandonment option? a. improve project NPV b. allow the company to delay the project c. lower project risk d. both a and c 49. The appropriate interest rate to use in capital budgeting is a. always the company's cost of capital company's b. is the company's cost of capital if the project's risk is about the same as the company's c. the cost of capital plus any additional risk premium required to compensate for the project's higher risk d. b and c 50. Which of the following would not be an appropriate guideline for determining the interest rate to used discounting project cash flows in capital budgeting? a. for replacement projects, given that their risk is consistent with that of the present business, use the cost of capital b. for expansion projects of moderate size, given that their risk is slightly greater than that of the present business, use the cost of capital, plus a small risk premium of one to three percent c. for new ventures, given that their risk can be far greater than current operations, use the cost of capital plus a risk premium of at most five percent since using anything higher usually guarantees rejection d. all of the above are appropriate guidelines 51. Multidivisional companies with diverse operations should use an interest rate for discounting a specific division's estimated cash flows in capital budgeting that is representative of: a. the entire firm's cost of capital b. the riskiness of the specific division's cash flows c. the cost of capital obtained through the application of the pure play method d. b or c 52. Multidivisional firms are often unable to obtain an appropriate surrogate for determining the beta of a division. An acceptable alternative technique is to develop a beta through the division's accounting records. This is accomplished by: a. regressing the division's projected return on equity against the return on a major company in a similar business b. regressing the division's accounting return on equity in previous years against the return on a major stock market index c. regressing the division's projected return on equity against the historic return on a major stock market index d. none of the above