Question

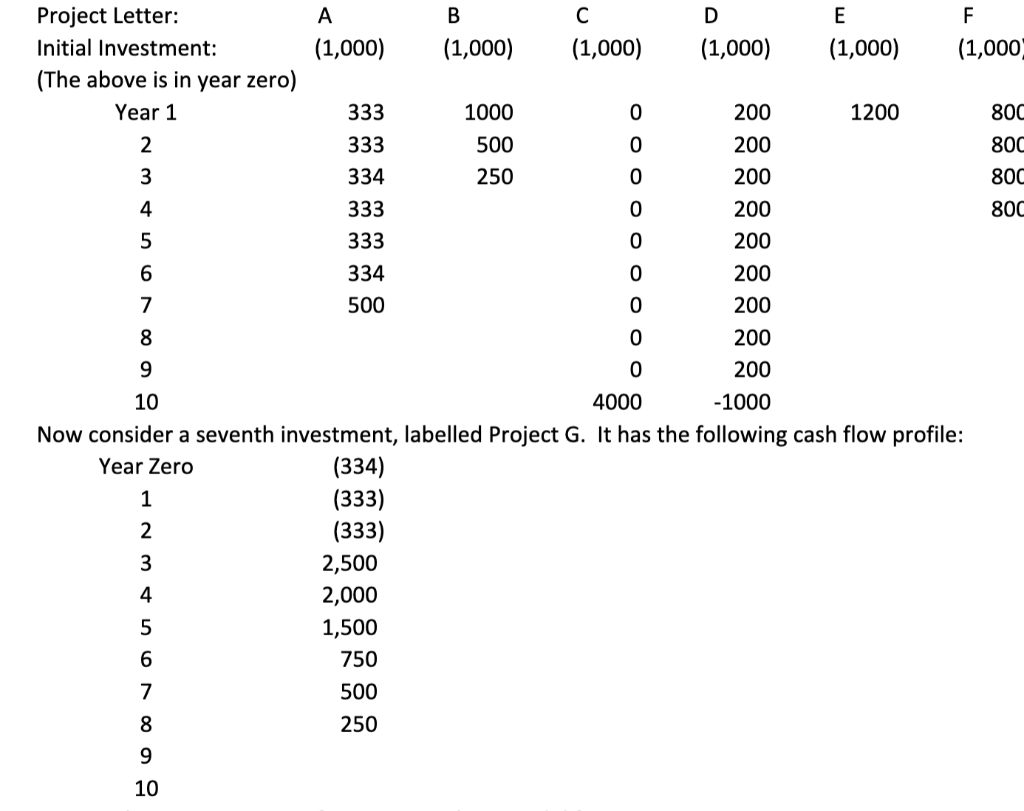

A large conglomerate has several different operating divisions, and its corporate capital allocation department has to determine which, if any, of the projects shown on

A large conglomerate has several different operating divisions, and its corporate capital allocation department has to determine which, if any, of the projects shown on the student spreadsheet for this assignment should approved. For each one of the projects listed on the spreadsheet answer the questions asked below. Assume that all of the projects shown in the spreadsheet have been standardized so that each project has a standardized cost of $1,000 in the table below. The positive cash flows have also been standardized, so that they represent the expected annual cash flow for every $1,000 of project costs. Assume that this company uses a discount rate (in nominal terms) of 10.0%, and that all of the cash flows in the table are nominal as well. Finally, assume that all of these projects are scalable, so that there are no constraints, at least not until later in this assignment, to increasing the size of any or all.

1a. Compute the payback period for each project.

1b .If the payback period is being used to rank these projects, what is the ranking, from best to worst?

2a. Compute the net present value for each project.

2b. If net present value is being used to rank these projects, what is the ranking, from best to worst?

3a. Compute the internal rate of return for each project.

3b. If the internal rate of return is being used to rank these projects, what is the ranking, from best to worst?

3c. If the corporations board of directors decided that it would spend a maximum of $5,000 this year on these projects, what would your recommendation to the board be? Why?

Answer the same questions for 4 that you did for questions 1-3. What conclusions do you draw from all of these calculations?

4,000 OOO Project Letter: A B C D E F Initial Investment: (1,000) (1,000) (1,000) (1,000) (1,000) (1,000 (The above is in year zero) Year 1 333 1000 200 1200 800 2 333 500 200 800 3 334 250 200 800 4 333 0 200 80d 5 333 0 200 6 334 0 200 7 500 0 200 8 0 200 9 0 200 10 4000 -1000 Now consider a seventh investment, labelled Project G. It has the following cash flow profile: Year Zero (334) 1 (333) 2 (333) 3 2,500 4 2,000 5 1,500 6 750 7 500 8 250 9 10 4,000 OOO Project Letter: A B C D E F Initial Investment: (1,000) (1,000) (1,000) (1,000) (1,000) (1,000 (The above is in year zero) Year 1 333 1000 200 1200 800 2 333 500 200 800 3 334 250 200 800 4 333 0 200 80d 5 333 0 200 6 334 0 200 7 500 0 200 8 0 200 9 0 200 10 4000 -1000 Now consider a seventh investment, labelled Project G. It has the following cash flow profile: Year Zero (334) 1 (333) 2 (333) 3 2,500 4 2,000 5 1,500 6 750 7 500 8 250 9 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started