Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A large corporate customer approaches your bank for a US$20 million loan at a fixed rate of 7% p.a. over five years. Interest to be

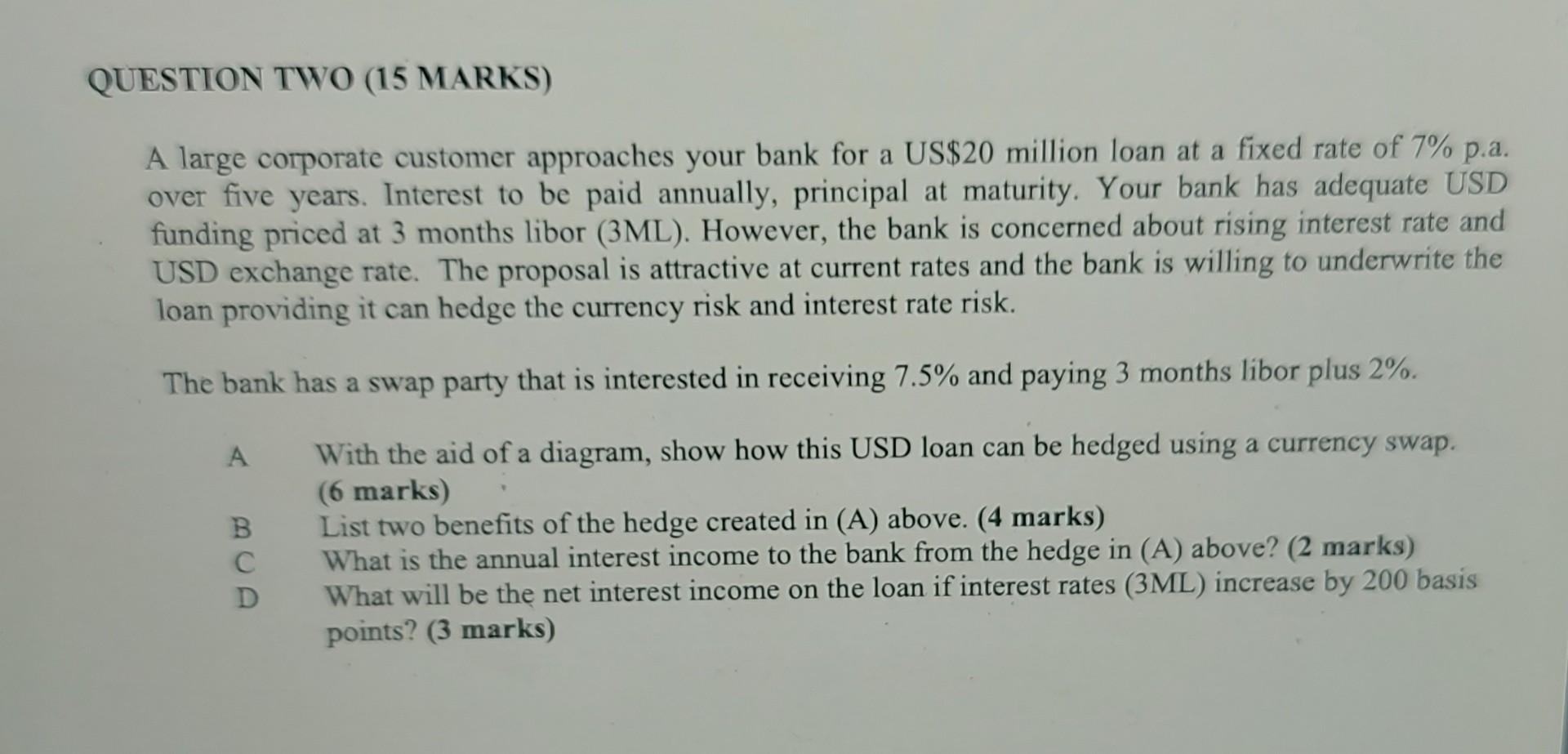

A large corporate customer approaches your bank for a US\$20 million loan at a fixed rate of 7% p.a. over five years. Interest to be paid annually, principal at maturity. Your bank has adequate USD funding priced at 3 months libor (3ML). However, the bank is concerned about rising interest rate and USD exchange rate. The proposal is attractive at current rates and the bank is willing to underwrite the loan providing it can hedge the currency risk and interest rate risk. The bank has a swap party that is interested in receiving 7.5% and paying 3 months libor plus 2%. A With the aid of a diagram, show how this USD loan can be hedged using a currency swap. (6 marks) B List two benefits of the hedge created in (A) above. (4 marks) What is the annual interest income to the bank from the hedge in (A) above? (2 marks) D What will be the net interest income on the loan if interest rates (3ML) increase by 200 basis points? (3 marks) A large corporate customer approaches your bank for a US\$20 million loan at a fixed rate of 7% p.a. over five years. Interest to be paid annually, principal at maturity. Your bank has adequate USD funding priced at 3 months libor (3ML). However, the bank is concerned about rising interest rate and USD exchange rate. The proposal is attractive at current rates and the bank is willing to underwrite the loan providing it can hedge the currency risk and interest rate risk. The bank has a swap party that is interested in receiving 7.5% and paying 3 months libor plus 2%. A With the aid of a diagram, show how this USD loan can be hedged using a currency swap. (6 marks) B List two benefits of the hedge created in (A) above. (4 marks) What is the annual interest income to the bank from the hedge in (A) above? (2 marks) D What will be the net interest income on the loan if interest rates (3ML) increase by 200 basis points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started