Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A large pension scheme allows normal age retirement to occur on any birthday (only) between ages 60 and 65 inclusive. Retirement through ill health

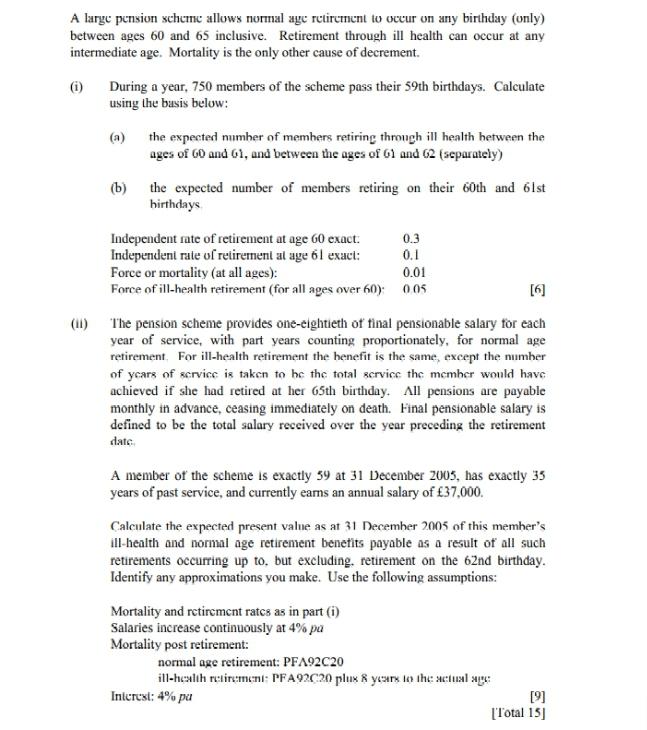

A large pension scheme allows normal age retirement to occur on any birthday (only) between ages 60 and 65 inclusive. Retirement through ill health can occur at any intermediate age. Mortality is the only other cause of decrement. (i) During a year, 750 members of the scheme pass their 59th birthdays. Calculate using the basis below: (a) the expected number of members retiring through ill health between the ages of 60 and 61, and between the ages of 61 and 62 (separately) (b) the expected number of members retiring on their 60th and 61st birthdays Independent rate of retirement at age 60 exact. Independent rate of retirement at age 61 exact: 0.1 Force or mortality (at all ages): 0.01 Force of ill-health retirement (for all ages over 60): 0.05 0.3 [6] (ii) The pension scheme provides one-eightieth of final pensionable salary for each year of service, with part years counting proportionately, for normal age retirement For ill-health retirement the benefit is the same, except the number of years of service is taken to be the total service the member would have achieved if she had retired at her 65th birthday. All pensions are payable monthly in advance, ceasing immediately on death. Final pensionable salary is defined to be the total salary received over the year preceding the retirement date. A member of the scheme is exactly 59 at 31 December 2005, has exactly 35 years of past service, and currently earns an annual salary of 37,000. Calculate the expected present value as at 31 December 2005 of this member's ill-health and normal age retirement benefits payable as a result of all such retirements occurring up to. but excluding, retirement on the 62nd birthday. Identify any approximations you make. Use the following assumptions: Mortality and retirement rates as in part (1) Salaries increase continuously at 4% pa Mortality post retirement: normal age retirement: PFA92C20 ill-health retirement: PFA 92C20 plux 8 years to the actual age Interest: 4% pa [9] [Total 15]

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

In the given question we are asked to calculate the expected present value as at 31 December 2005 of the pension scheme members illhealth and normalage retirement benefits given that retirements and m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started