Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A large pharmaceutical company is analysing its debt capacity. The company has a market value of equity of $25 billion, market value of debt

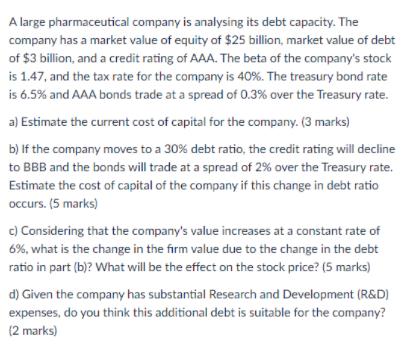

A large pharmaceutical company is analysing its debt capacity. The company has a market value of equity of $25 billion, market value of debt of $3 billion, and a credit rating of AAA. The beta of the company's stock is 1.47, and the tax rate for the company is 40%. The treasury bond rate is 6.5% and AAA bonds trade at a spread of 0.3% over the Treasury rate. a) Estimate the current cost of capital for the company. (3 marks) b) If the company moves to a 30% debt ratio, the credit rating will decline to BBB and the bonds will trade at a spread of 2% over the Treasury rate. Estimate the cost of capital of the company if this change in debt ratio occurs. (5 marks) c) Considering that the company's value increases at a constant rate of 6%, what is the change in the firm value due to the change in the debt ratio in part (b)? What will be the effect on the stock price? (5 marks) d) Given the company has substantial Research and Development (R&D) expenses, do you think this additional debt is suitable for the company? (2 marks)

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Question Ans a By extracting the information Market value of equity25 billion Market value of debt3 billion Beta of companys stock 147 Tax rate of the company40 Treasury bond rate65 Spread03 over the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started