Answered step by step

Verified Expert Solution

Question

1 Approved Answer

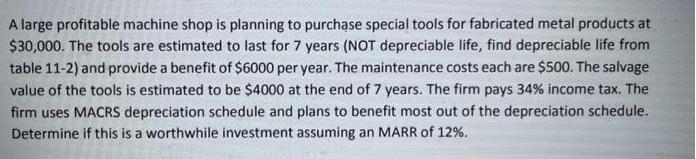

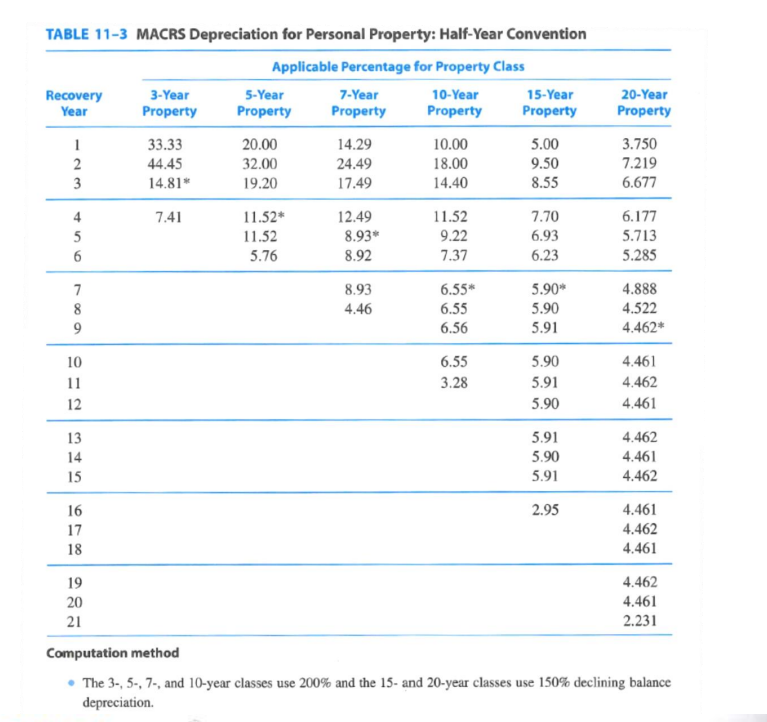

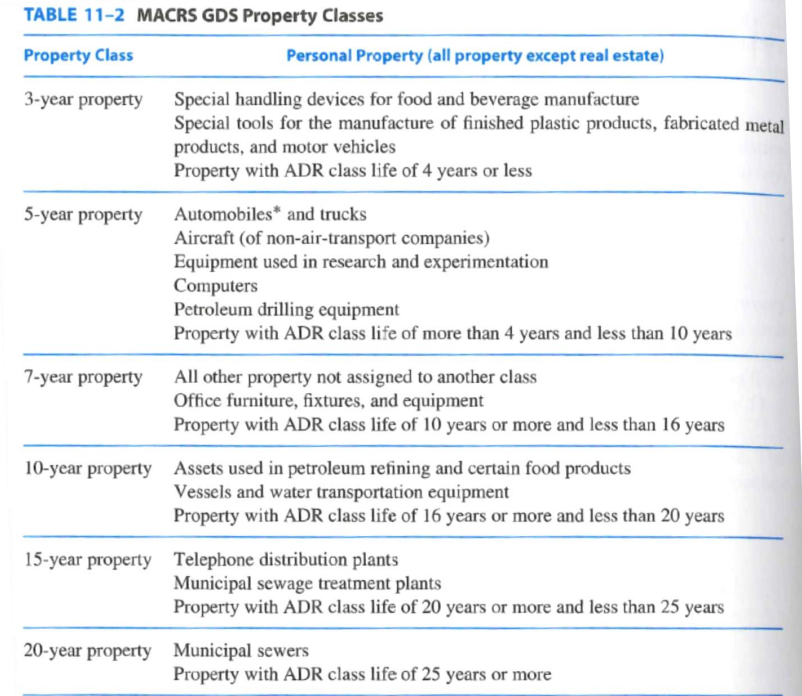

A large profitable machine shop is planning to purchase special tools for fabricated metal products at $30,000. The tools are estimated to last for

A large profitable machine shop is planning to purchase special tools for fabricated metal products at $30,000. The tools are estimated to last for 7 years (NOT depreciable life, find depreciable life from table 11-2) and provide a benefit of $6000 per year. The maintenance costs each are $500. The salvage value of the tools is estimated to be $4000 at the end of 7 years. The firm pays 34% income tax. The firm uses MACRS depreciation schedule and plans to benefit most out of the depreciation schedule. Determine if this is a worthwhile investment assuming an MARR of 12%. TABLE 11-3 MACRS Depreciation for Personal Property: Half-Year Convention Applicable Percentage for Property Class 10-Year Property Recovery Year 1 2 3 4 5 6 789 9 112 10 13 14 15 16 17 18 19 20 21 3-Year Property 33.33 44.45 14.81* 7.41 5-Year Property 20.00 32.00 19.20 11.52* 11.52 5.76 7-Year Property 14.29 24.49 17.49 12.49 8.93* 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 7.37 6.55* 6.55 6.56 6.55 3.28 15-Year Property 5.00 9.50 8.55 7.70 6.93 6.23 5.90* 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year Property 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462* 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 Computation method The 3-, 5-, 7-, and 10-year classes use 200% and the 15- and 20-year classes use 150% declining balance depreciation. TABLE 11-2 MACRS GDS Property Classes Property Class 3-year property 5-year property 7-year property Personal Property (all property except real estate) Special handling devices for food and beverage manufacture Special tools for the manufacture of finished plastic products, fabricated metal products, and motor vehicles Property with ADR class life of 4 years or less Automobiles and trucks Aircraft (of non-air-transport companies) Equipment used in research and experimentation Computers Petroleum drilling equipment Property with ADR class life of more than 4 years and less than 10 years All other property not assigned to another class Office furniture, fixtures, and equipment Property with ADR class life of 10 years or more and less than 16 years 10-year property Assets used in petroleum refining and certain food products Vessels and water transportation equipment Property with ADR class life of 16 years or more and less than 20 years 15-year property Telephone distribution plants Municipal sewage treatment plants Property with ADR class life of 20 years or more and less than 25 years 20-year property Municipal sewers Property with ADR class life of 25 years or more A large profitable machine shop is planning to purchase special tools for fabricated metal products at $30,000. The tools are estimated to last for 7 years (NOT depreciable life, find depreciable life from table 11-2) and provide a benefit of $6000 per year. The maintenance costs each are $500. The salvage value of the tools is estimated to be $4000 at the end of 7 years. The firm pays 34% income tax. The firm uses MACRS depreciation schedule and plans to benefit most out of the depreciation schedule. Determine if this is a worthwhile investment assuming an MARR of 12%. TABLE 11-3 MACRS Depreciation for Personal Property: Half-Year Convention Applicable Percentage for Property Class 10-Year Property Recovery Year 1 2 3 4 5 6 789 9 112 10 13 14 15 16 17 18 19 20 21 3-Year Property 33.33 44.45 14.81* 7.41 5-Year Property 20.00 32.00 19.20 11.52* 11.52 5.76 7-Year Property 14.29 24.49 17.49 12.49 8.93* 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 7.37 6.55* 6.55 6.56 6.55 3.28 15-Year Property 5.00 9.50 8.55 7.70 6.93 6.23 5.90* 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year Property 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462* 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 Computation method The 3-, 5-, 7-, and 10-year classes use 200% and the 15- and 20-year classes use 150% declining balance depreciation. TABLE 11-2 MACRS GDS Property Classes Property Class 3-year property 5-year property 7-year property Personal Property (all property except real estate) Special handling devices for food and beverage manufacture Special tools for the manufacture of finished plastic products, fabricated metal products, and motor vehicles Property with ADR class life of 4 years or less Automobiles and trucks Aircraft (of non-air-transport companies) Equipment used in research and experimentation Computers Petroleum drilling equipment Property with ADR class life of more than 4 years and less than 10 years All other property not assigned to another class Office furniture, fixtures, and equipment Property with ADR class life of 10 years or more and less than 16 years 10-year property Assets used in petroleum refining and certain food products Vessels and water transportation equipment Property with ADR class life of 16 years or more and less than 20 years 15-year property Telephone distribution plants Municipal sewage treatment plants Property with ADR class life of 20 years or more and less than 25 years 20-year property Municipal sewers Property with ADR class life of 25 years or more

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started