The CFO of Acme Manufacturing is considering the purchase of a special diamond-tipped cutting tool. This tool has the following initial costs to put

![]()

![]()

![]()

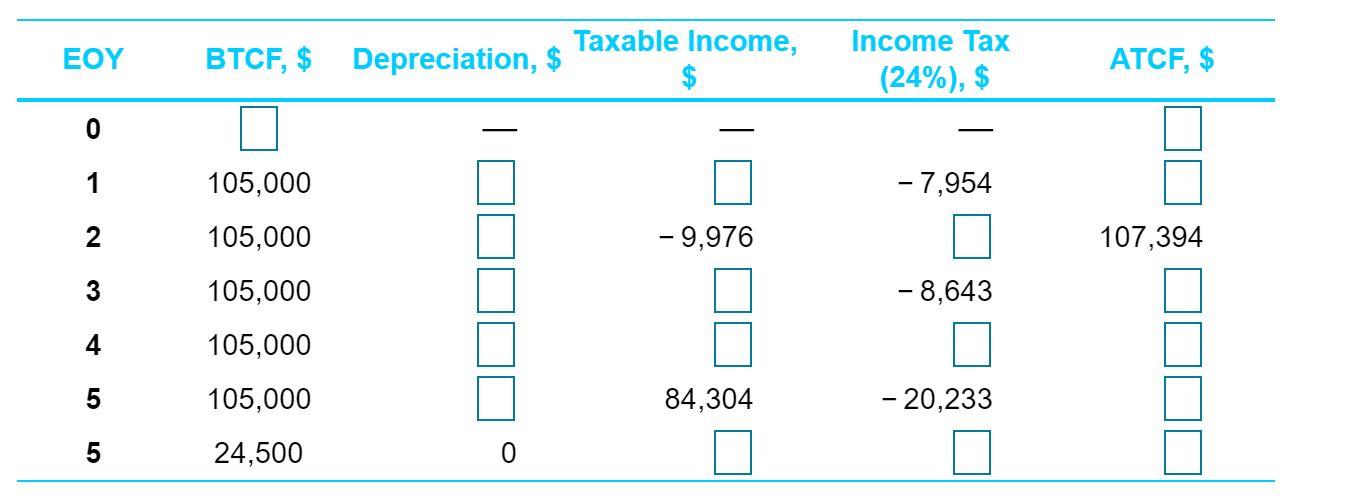

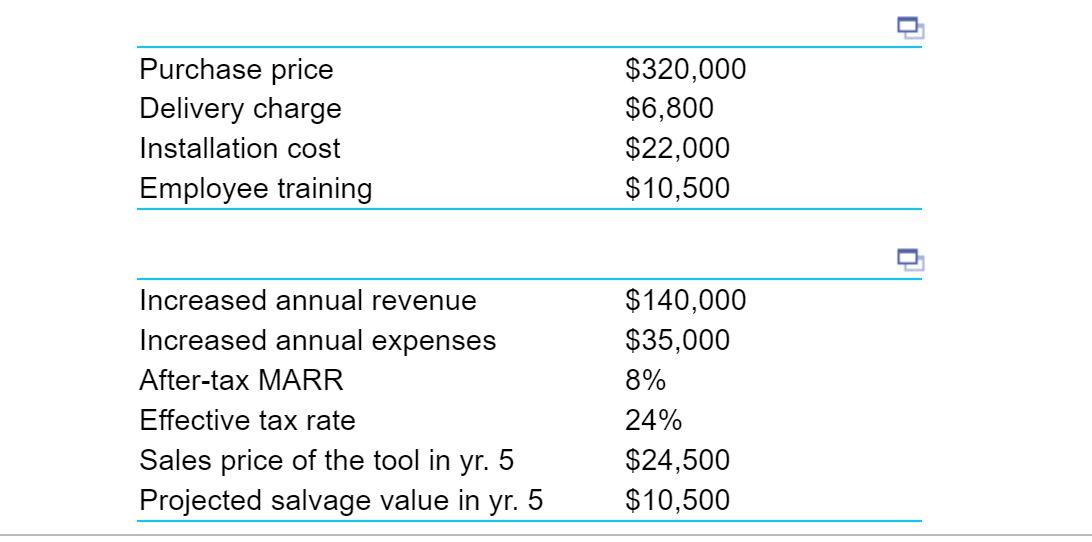

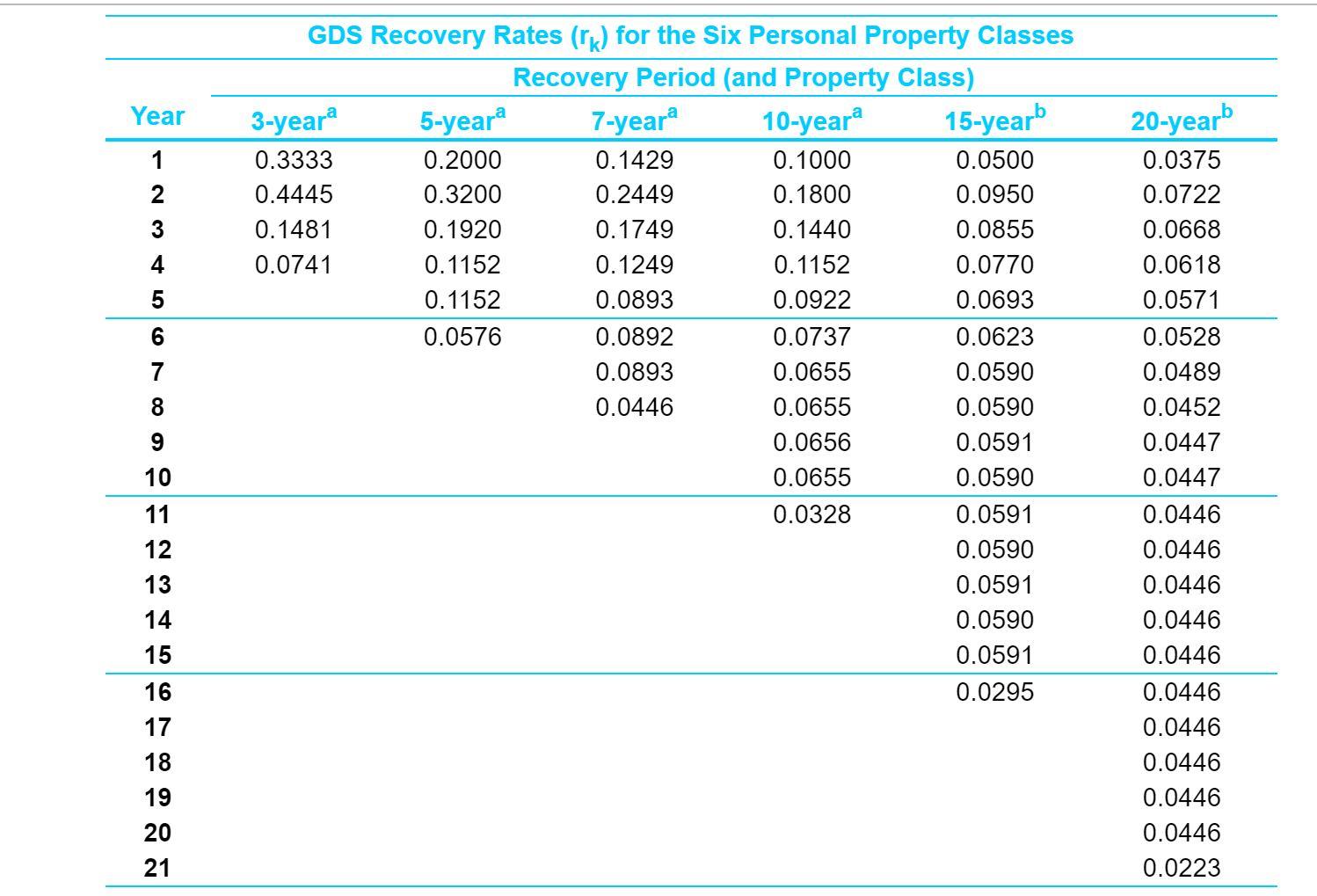

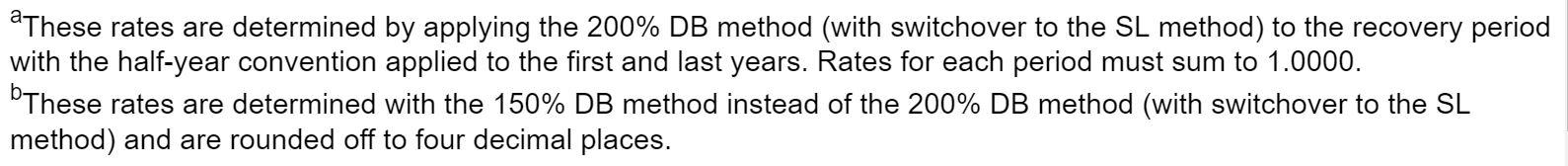

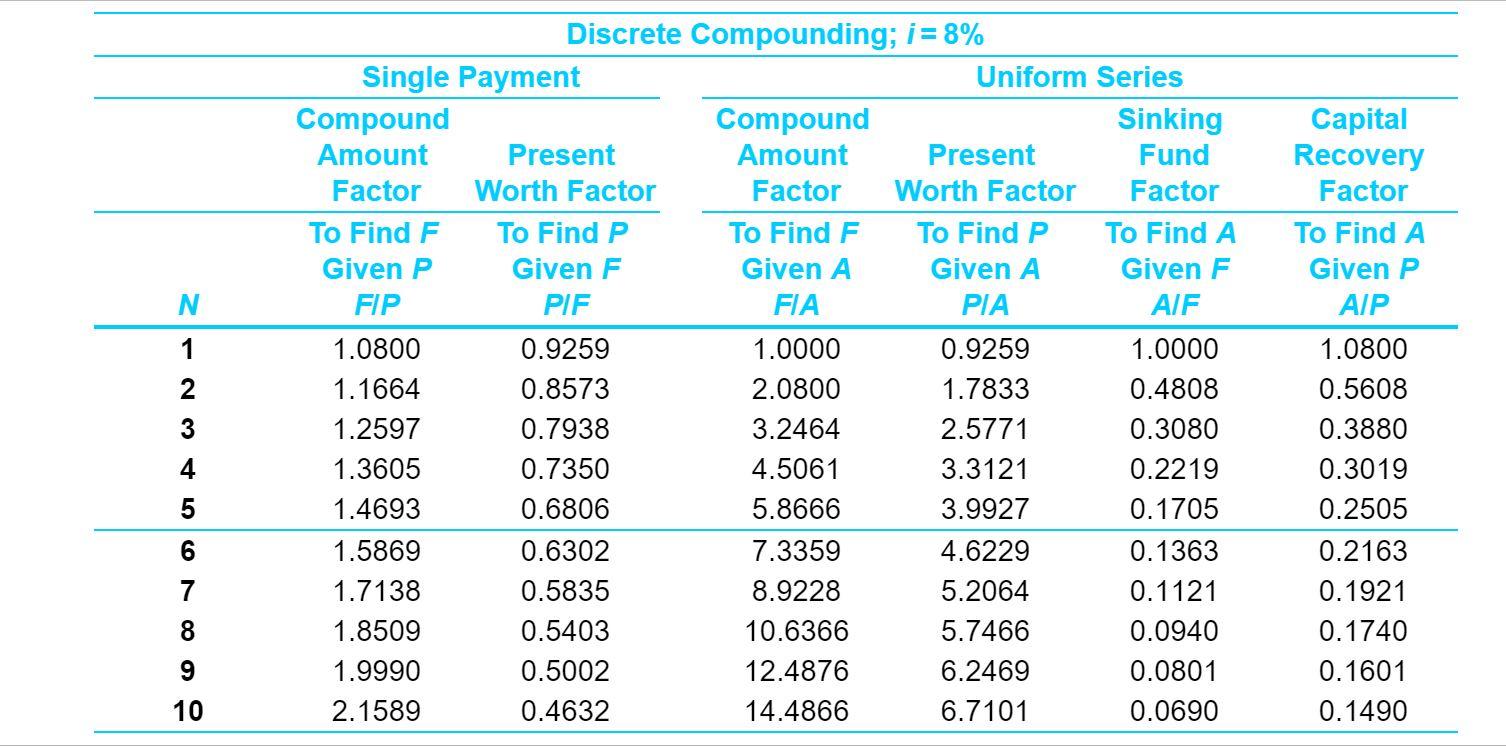

The CFO of Acme Manufacturing is considering the purchase of a special diamond-tipped cutting tool. This tool has the following initial costs to put into service. Acme will use cash to pay for all of these expenses, some of which was borrowed on a long-term credit line with the local bank. The CFO has been directed by Acme to use the MACRS depreciation method with a GDS recovery period of 5 years. 0 1 2 3 4 5 5 BTCF, $ Depreciation, $ 105,000 105,000 105,000 105,000 105,000 24,500 0 Taxable Income, - 9,976 84,304 Income Tax (24%), $ - 7,954 - 8,643 - 20,233 ATCF, $ 107,394 Purchase price Delivery charge Installation cost Employee training Increased annual revenue Increased annual expenses After-tax MARR Effective tax rate Sales price of the tool in yr. 5 Projected salvage value in yr. 5 $320,000 $6,800 $22,000 $10,500 $140,000 $35,000 8% 24% $24,500 $10,500 0 Year 1 2 3 4 LO 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) 3-yeara 0.3333 0.4445 0.1481 0.0741 5-yeara 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 7-year 10-yeara 0.1429 0.1000 0.2449 0.1800 0.1749 0.1440 0.1249 0.1152 0.0893 0.0922 0.0892 0.0737 0.0893 0.0655 .0446 0.0655 0.0656 0.0655 0.0328 15-yearb 0.0500 0.0950 0.0855 0.0770 0.0693 0.0623 0.0590 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 20-yearb 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.045 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 aThese rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000. These rates are determined with the 150% DB method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four decimal places. N 123 4 LO 6 7 68 9 10 Single Payment Discrete Compounding; i = 8% Compound Amount Present Factor Worth Factor To Find F Given P FIP 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 To Find P Given F PIF 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 Compound Amount Factor To Find F Given A FIA 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 Uniform Series Present Worth Factor To Find P Given A PIA 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 Sinking Fund Factor To Find A Given F AIF 1.0000 0.4808 0.3080 0.2219 0.1705 0.1363 0.1121 0.0940 0.0801 0.0690 Capital Recovery Factor To Find A Given P AIP 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490

Step by Step Solution

3.27 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

EOY BTCF Depreciation Taxable Income Income Tax 24 ATCF 0 105000 1 105000 64000 31142 7954 31160 2 105000 102400 9976 2346 107394 3 105000 61440 43560 104544 331056 4 105000 36864 68136 1635264 517823...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started