Answered step by step

Verified Expert Solution

Question

1 Approved Answer

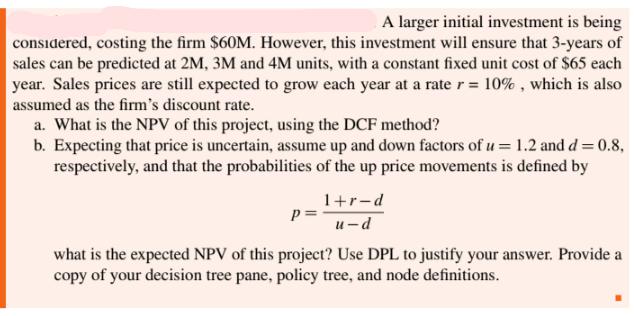

A larger initial investment is being considered, costing the firm $60M. However, this investment will ensure that 3-years of sales can be predicted at

A larger initial investment is being considered, costing the firm $60M. However, this investment will ensure that 3-years of sales can be predicted at 2M, 3M and 4M units, with a constant fixed unit cost of $65 each year. Sales prices are still expected to grow each year at a rate r = 10%, which is also assumed as the firm's discount rate. a. What is the NPV of this project, using the DCF method? b. Expecting that price is uncertain, assume up and down factors of u = 1.2 and d = 0.8, respectively, and that the probabilities of the up price movements is defined by p= 1+r-d u-d what is the expected NPV of this project? Use DPL to justify your answer. Provide a copy of your decision tree pane, policy tree, and node definitions.

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the project using the discounted cash flow DCF method we n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started