Answered step by step

Verified Expert Solution

Question

1 Approved Answer

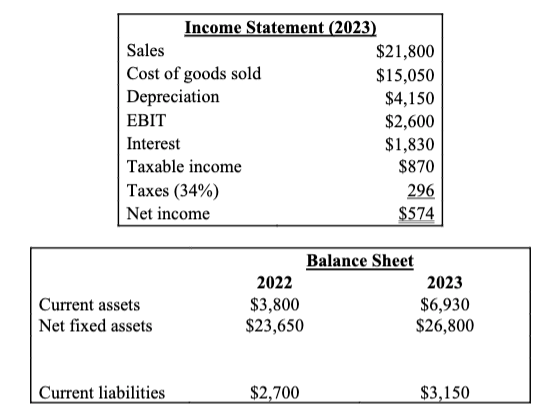

A leading AI technology firm BOOM, is publicly traded on the US stock market with shares currently valued at $ 1 5 each. Some information

A leading AI technology firm BOOM, is publicly traded on the US stock market with shares currently valued at $ each. Some information from its annual report of Year is presented in the following tables Unit

Compute the cash flow from assets CFFA of BOOM for the year and show how you interpret the number you get for CFFA.

In a noteworthy turn of events, Elon Musk, a renowned billionaire, has expressed keen interest in acquiring all outstanding shares of BOOM at an attractive price of $ per share. Despite the enticing offer, the management team has promptly declined Musk's proposal, opting instead to deploy a series of strategic measures aimed at foiling the

acquisition bid. Discuss whether the management team is acting in the shareholders best interest and explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started