Question

A leading cement manufacturer is considering the construction of a new cement production plant in the north of the United Kingdom. The proposed investment is

A leading cement manufacturer is considering the construction of a new cement production plant in the north of the United Kingdom. The proposed investment is split into the following three stages:

- An initial investment of £12k is required for market research, to assess national and international demand and forecast sales figures. The probability of satisfactory demand levels and high profitability is predicted to be 80%.

- The construction of the cement production plant will be carried out in two phases. Phase one will involve the construction of a small-scale plant with an estimated cost of £100 million. The probability of significant sales figures which will enable the manufacturer to embark on phase two is estimated to be 60%.

- Phase two of the investment concerns the expansion of the plant built in phase one. A medium-scale expansion would require the installation of an additional kiln and cement grinder with an approximate cost of £150 million, whereas a large-scale expansion would almost triple the output capacity of the initial small-scale plant but require the installation of two additional kilns and grinding units.

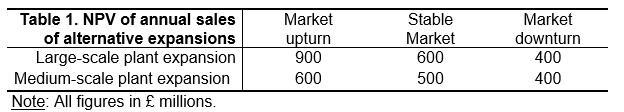

The cost of pursuing the large-scale expansion is estimated at £300 million. Economists’ projections of the regional and international economic outlook indicate a 50% probability that the economy will remain unchanged, a 20% probability of an economic upturn and a 30% probability of an economic downturn. The Net Present Values (NPV) of estimated annual sales for the medium and large-scale plant expansions are summarised in Table 1.

- Construct a decision tree and identify the alternative outcomes pertaining to the above project scenario.

- Carry out decision-tree analysis to identify and recommend the most economical investment alternative that the cement manufacturer should pursue.

Table 1. NPV of annual sales Market Stable Market of alternative expansions Large-scale plant expansion Medium-scale plant expansion Note: All figures in millions. upturn 900 Market downturn 600 400 600 500 400

Step by Step Solution

3.40 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

a Decision Tree of the above case Cost Cost 100000000 12000 Cement Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started