Question: A lender just closed a standard fixed - rate, home mortgage for a $ 3 5 0 , 0 0 0 loan amount. The annual

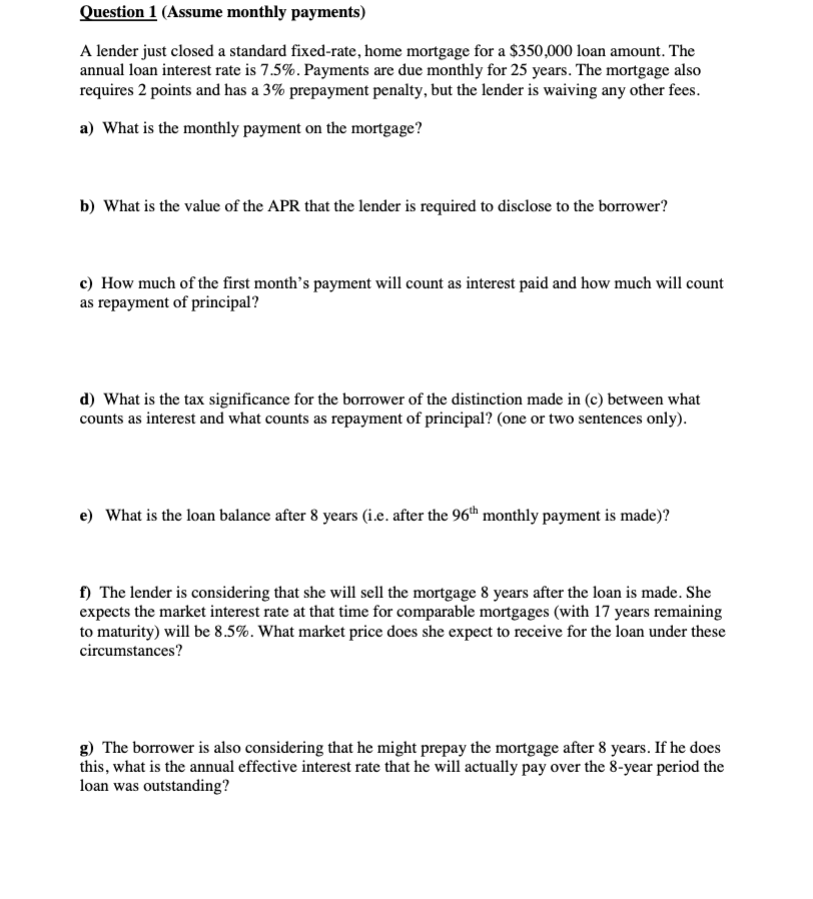

A lender just closed a standard fixedrate, home mortgage for a $ loan amount. The annual loan interest rate is Payments are due monthly for years. The mortgage also requires points and has a prepayment penalty, but the lender is waiving any other fees. a What is the monthly payment on the mortgage? b What is the value of the APR that the lender is required to disclose to the borrower? c How much of the first months payment will count as interest paid and how much will count as repayment of principal? d What is the tax significance for the borrower of the distinction made in c between what counts as interest and what counts as repayment of principal? one or two sentences only e What is the loan balance after years ie after the th monthly payment is made f The lender is considering that she will sell the mortgage years after the loan is made. She expects the market interest rate at that time for comparable mortgages with years remaining to maturity will be What market price does she expect to receive for the loan under these circumstances? g The borrower is also considering that he might prepay the mortgage after years. If he does this, what is the annual effective interest rate that he will actually pay over the year period the loan was outstanding? Question Assume monthly payments A lender just closed a standard fixedrate, home mortgage for a $ loan amount. The annual loan interest rate is Payments are due monthly for years. The mortgage also requires points and has a prepayment penalty, but the lender is waiving any other fees. a What is the monthly payment on the mortgage? b What is the value of the APR that the lender is required to disclose to the borrower? c How much of the first month's payment will count as interest paid and how much will count as repayment of principal? d What is the tax significance for the borrower of the distinction made in c between what counts as interest and what counts as repayment of principal? one or two sentences only e What is the loan balance after years ie after the text th monthly payment is made f The lender is considering that she will sell the mortgage years after the loan is made. She expects the market interest rate at that time for comparable mortgages with years remaining to maturity will be What market price does she expect to receive for the loan under these circumstances? g The borrower is also considering that he might prepay the mortgage after years. If he does this, what is the annual effective interest rate that he will actually pay over the year period the loan was outstanding?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock