Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A lessee company signed a lease for equipment from a lessor on January 1, Year 1. The lease requires equal rental payments of $43,810

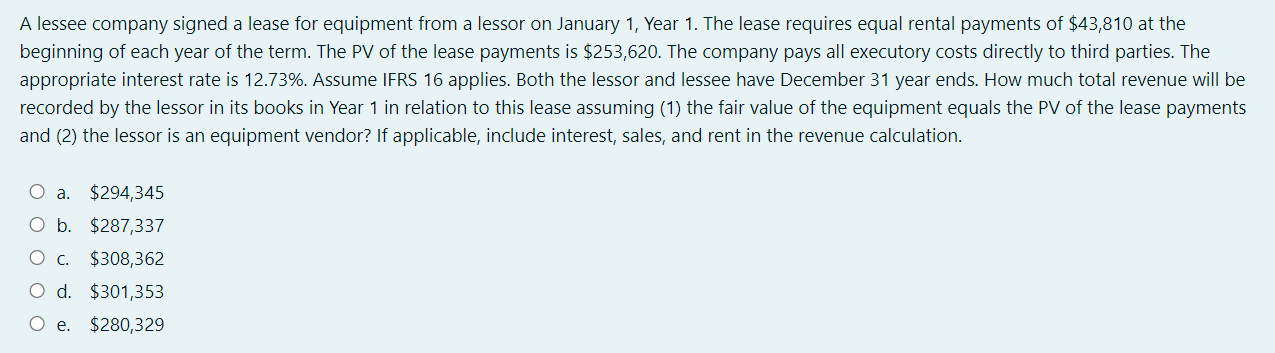

A lessee company signed a lease for equipment from a lessor on January 1, Year 1. The lease requires equal rental payments of $43,810 at the beginning of each year of the term. The PV of the lease payments is $253,620. The company pays all executory costs directly to third parties. The appropriate interest rate is 12.73%. Assume IFRS 16 applies. Both the lessor and lessee have December 31 year ends. How much total revenue will be recorded by the lessor in its books in Year 1 in relation to this lease assuming (1) the fair value of the equipment equals the PV of the lease payments and (2) the lessor is an equipment vendor? If applicable, include interest, sales, and rent in the revenue calculation. O a. $294,345 O b. $287,337 . $308,362 O d. $301,353 O e. $280,329

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Total Present Value of Lease Payments 253620 Lease Rents paid at the begi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started