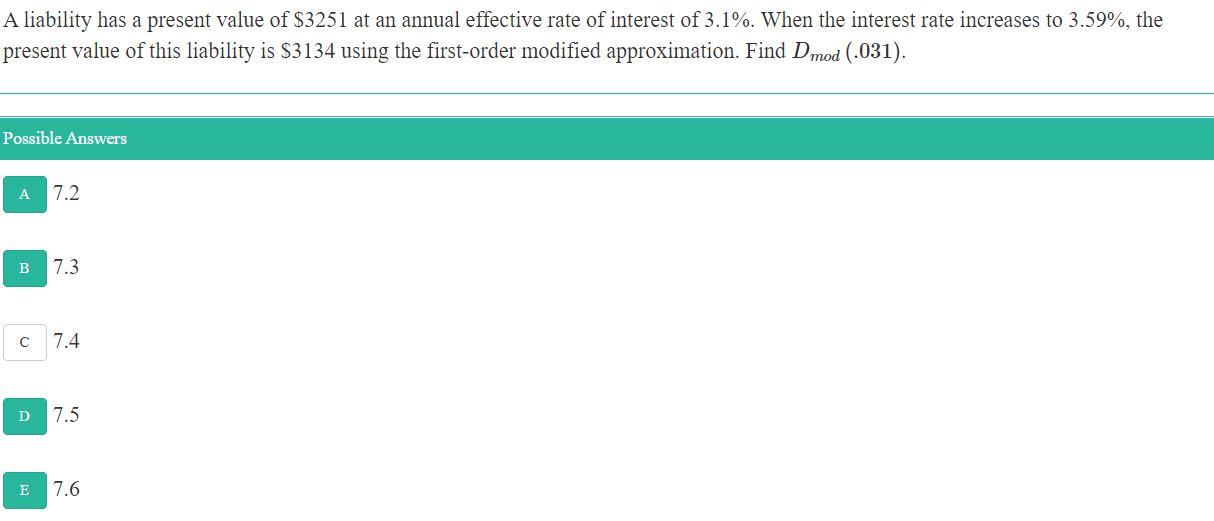

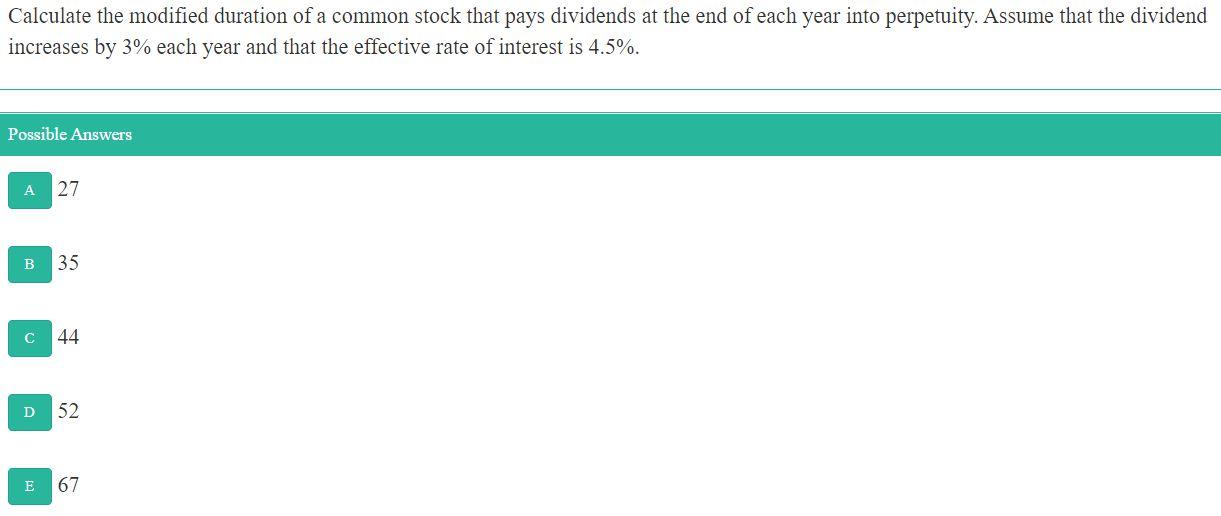

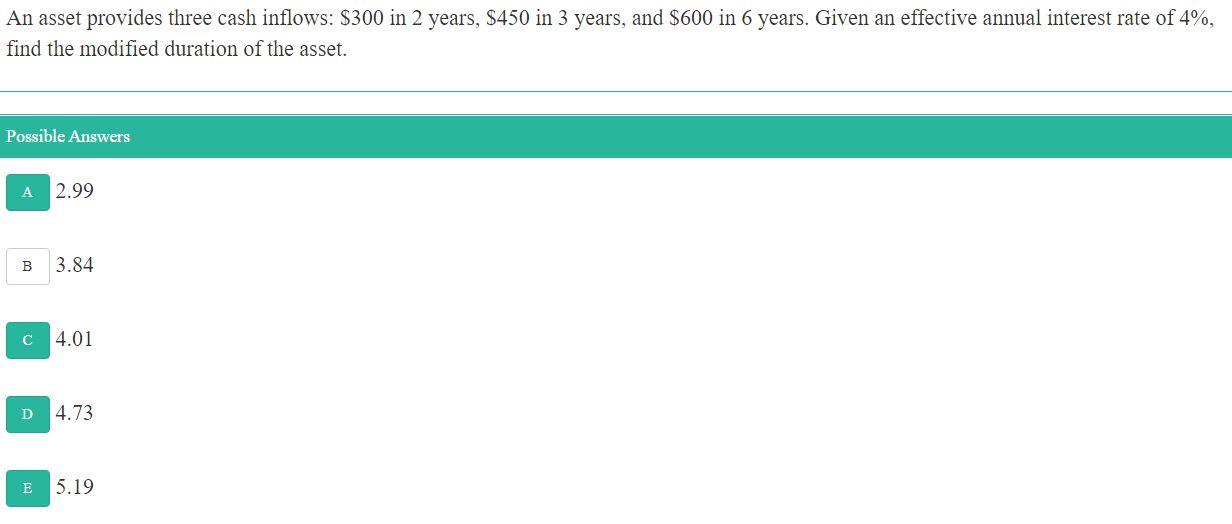

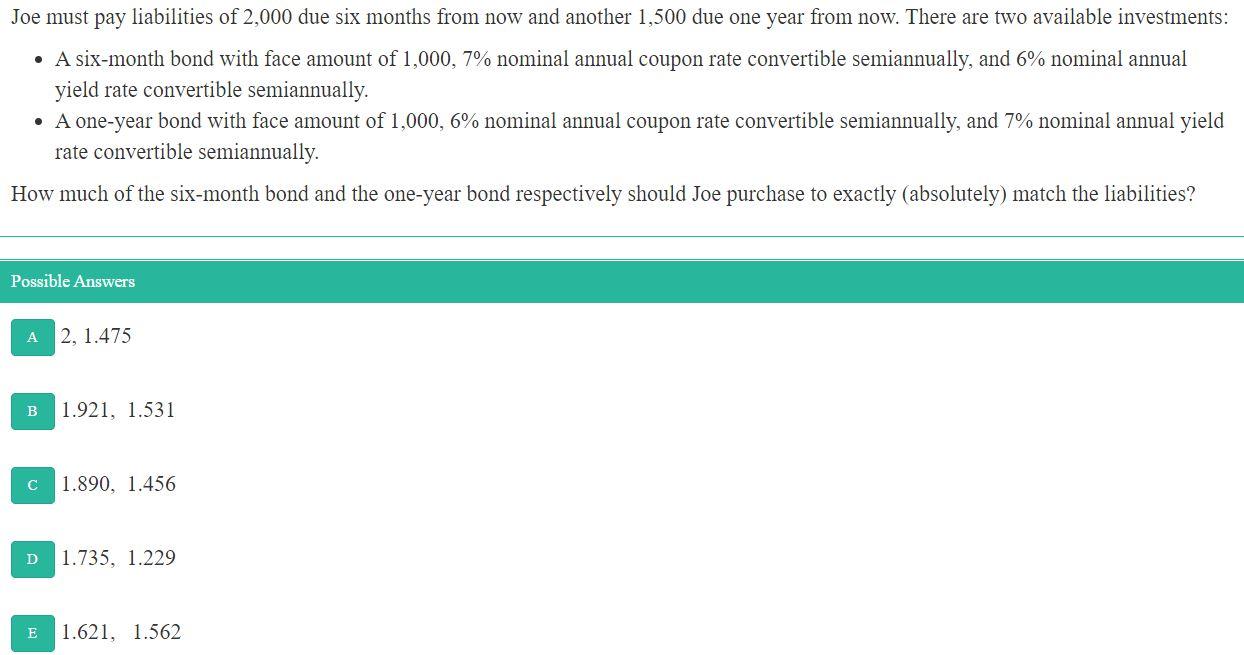

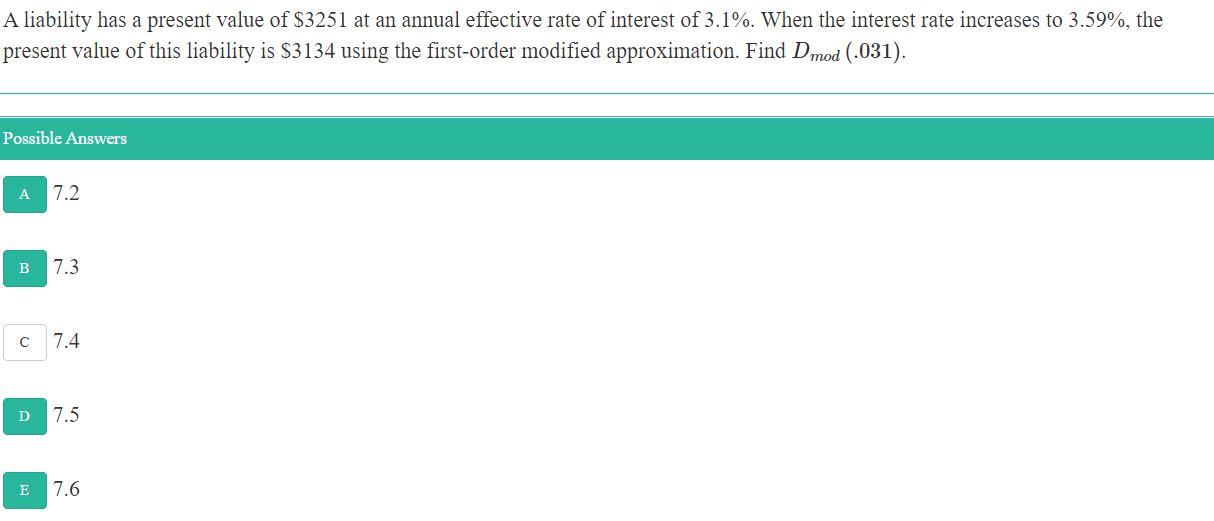

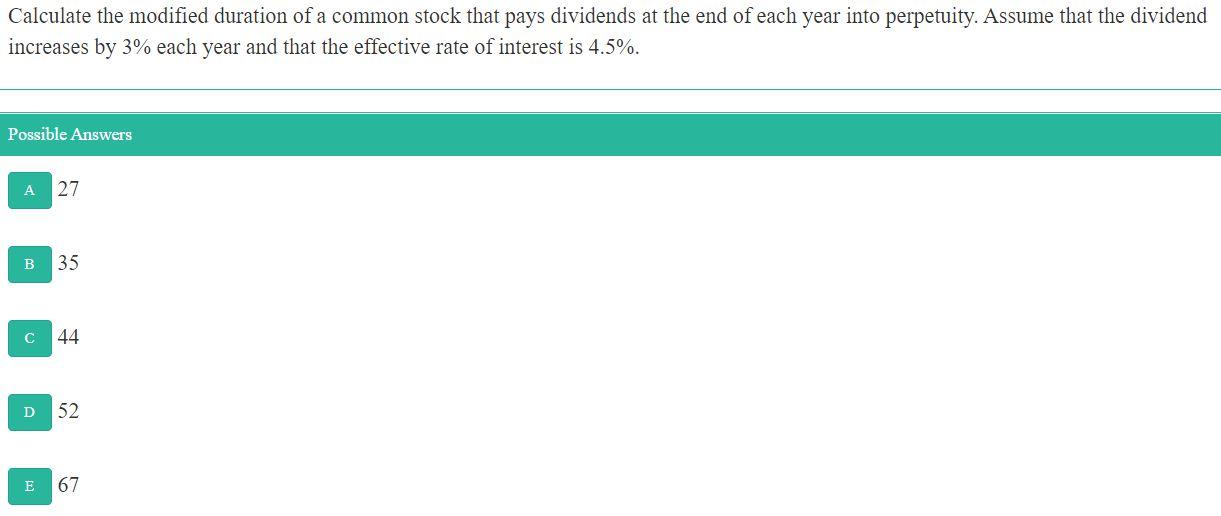

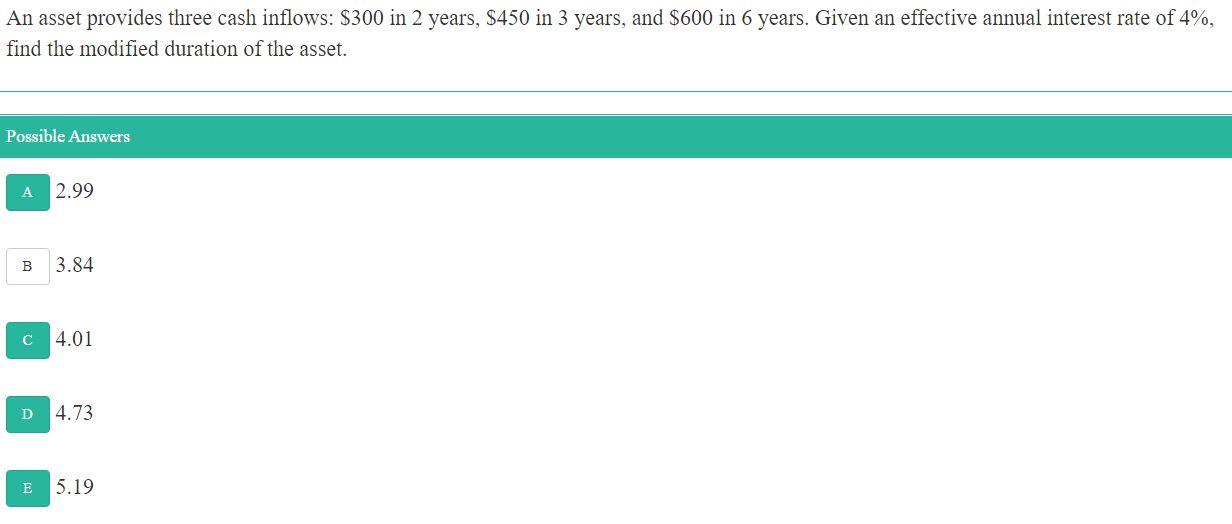

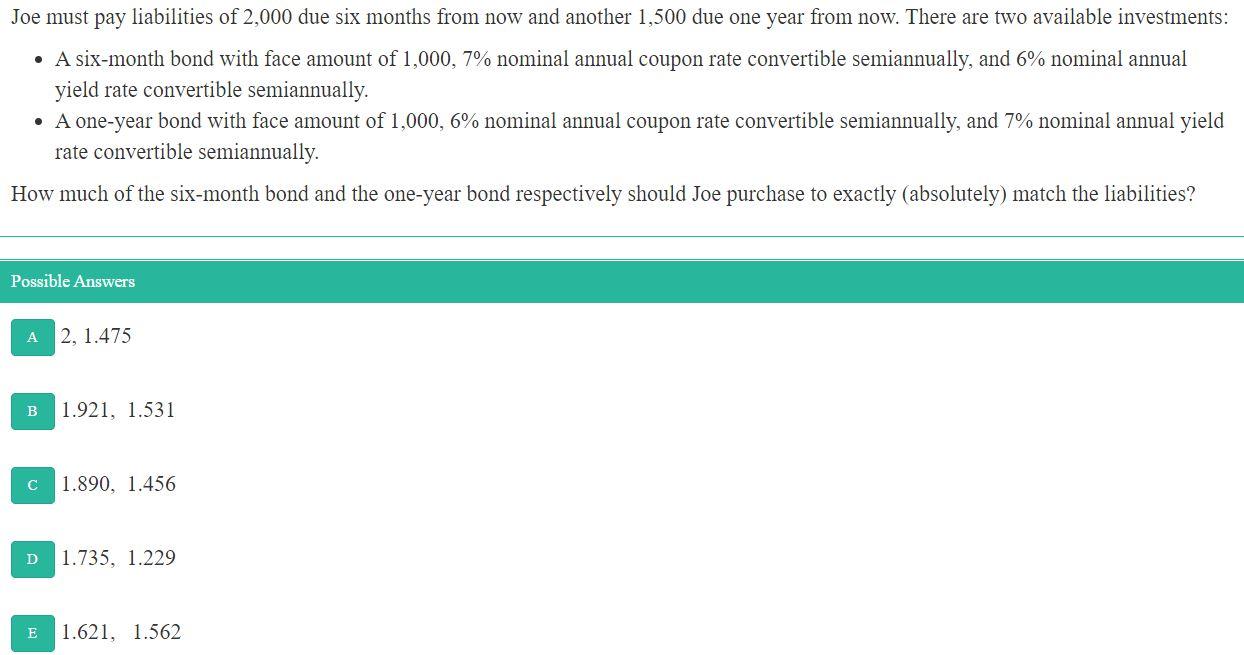

A liability has a present value of $3251 at an annual effective rate of interest of 3.1%. When the interest rate increases to 3.59%, the present value of this liability is $3134 using the first-order modified approximation. Find Dmod (.031). Possible Answers 7.2 B 7.3 C 7.4 D 7.5 E 7.6 Calculate the modified duration of a common stock that pays dividends at the end of each year into perpetuity. Assume that the dividend increases by 3% each year and that the effective rate of interest is 4.5%. Possible Answers 27 B 35 C 44 D 52 E 67 An asset provides three cash inflows: $300 in 2 years, $450 in 3 years, and $600 in 6 years. Given an effective annual interest rate of 4%, find the modified duration of the asset. Possible Answers 2.99 B 3.84 C 4.01 D 4.73 E 5.19 Joe must pay liabilities of 2,000 due six months from now and another 1,500 due one year from now. There are two available investments: A six-month bond with face amount of 1,000, 7% nominal annual coupon rate convertible semiannually, and 6% nominal annual yield rate convertible semiannually. A one-year bond with face amount of 1,000, 6% nominal annual coupon rate convertible semiannually, and 7% nominal annual yield rate convertible semiannually. How much of the six-month bond and the one-year bond respectively should Joe purchase to exactly (absolutely) match the liabilities? Possible Answers A 2, 1.475 B 1.921, 1.531 1.890, 1.456 D 1.735, 1.229 E 1.621, 1.562 A liability has a present value of $3251 at an annual effective rate of interest of 3.1%. When the interest rate increases to 3.59%, the present value of this liability is $3134 using the first-order modified approximation. Find Dmod (.031). Possible Answers 7.2 B 7.3 C 7.4 D 7.5 E 7.6 Calculate the modified duration of a common stock that pays dividends at the end of each year into perpetuity. Assume that the dividend increases by 3% each year and that the effective rate of interest is 4.5%. Possible Answers 27 B 35 C 44 D 52 E 67 An asset provides three cash inflows: $300 in 2 years, $450 in 3 years, and $600 in 6 years. Given an effective annual interest rate of 4%, find the modified duration of the asset. Possible Answers 2.99 B 3.84 C 4.01 D 4.73 E 5.19 Joe must pay liabilities of 2,000 due six months from now and another 1,500 due one year from now. There are two available investments: A six-month bond with face amount of 1,000, 7% nominal annual coupon rate convertible semiannually, and 6% nominal annual yield rate convertible semiannually. A one-year bond with face amount of 1,000, 6% nominal annual coupon rate convertible semiannually, and 7% nominal annual yield rate convertible semiannually. How much of the six-month bond and the one-year bond respectively should Joe purchase to exactly (absolutely) match the liabilities? Possible Answers A 2, 1.475 B 1.921, 1.531 1.890, 1.456 D 1.735, 1.229 E 1.621, 1.562