Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A life aged 40 purchases a whole life insurance of 1,000,000 payable at the end of the year of death. Level annual premiums, determined

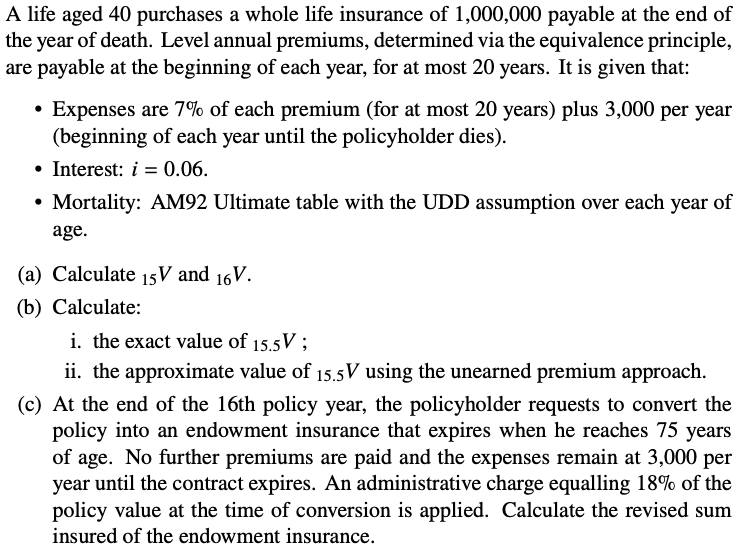

A life aged 40 purchases a whole life insurance of 1,000,000 payable at the end of the year of death. Level annual premiums, determined via the equivalence principle, are payable at the beginning of each year, for at most 20 years. It is given that: Expenses are 7% of each premium (for at most 20 years) plus 3,000 per year (beginning of each year until the policyholder dies). Interest: i = 0.06. Mortality: AM92 Ultimate table with the UDD assumption over each year of age. (a) Calculate 15V and 16V. (b) Calculate: i. the exact value of 15.5V; ii. the approximate value of 15.5V using the unearned premium approach. (c) At the end of the 16th policy year, the policyholder requests to convert the policy into an endowment insurance that expires when he reaches 75 years of age. No further premiums are paid and the expenses remain at 3,000 per year until the contract expires. An administrative charge equalling 18% of the policy value at the time of conversion is applied. Calculate the revised sum insured of the endowment insurance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started