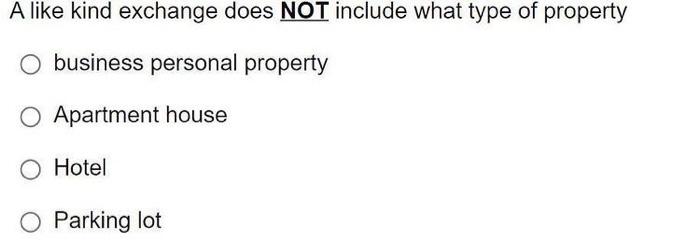

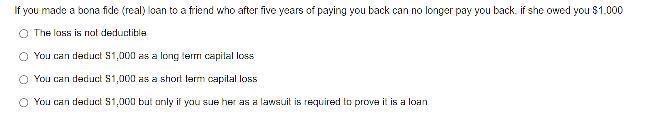

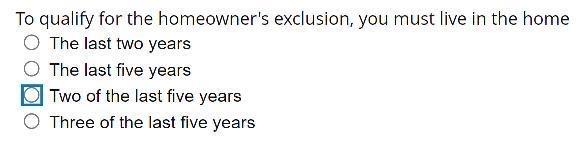

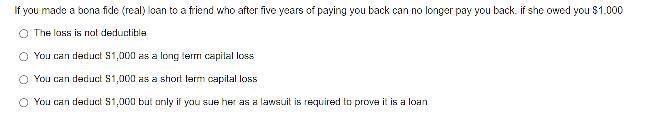

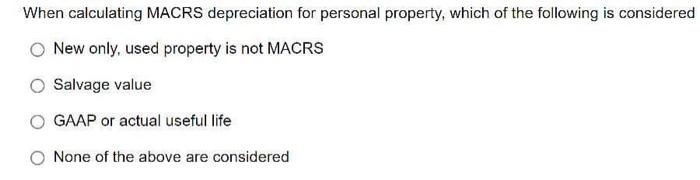

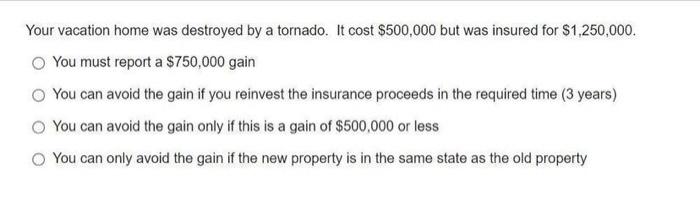

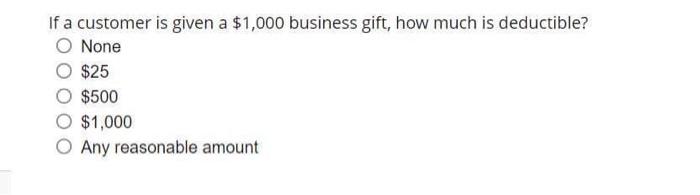

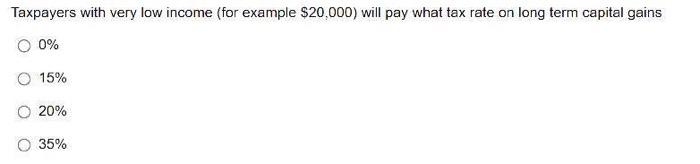

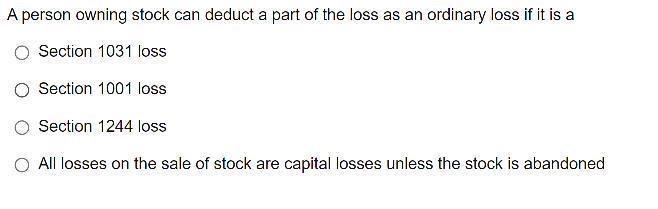

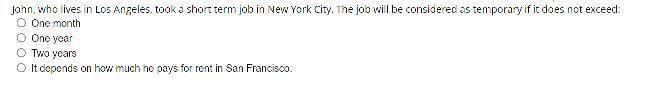

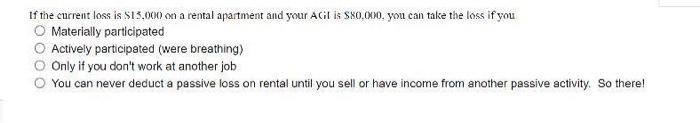

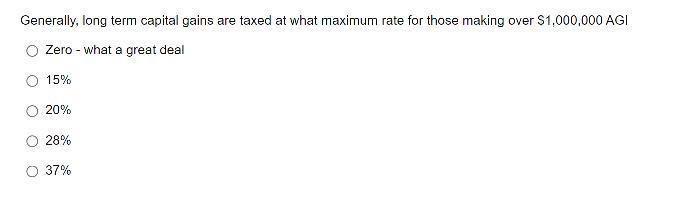

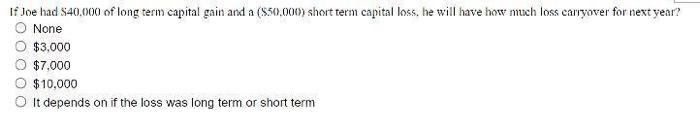

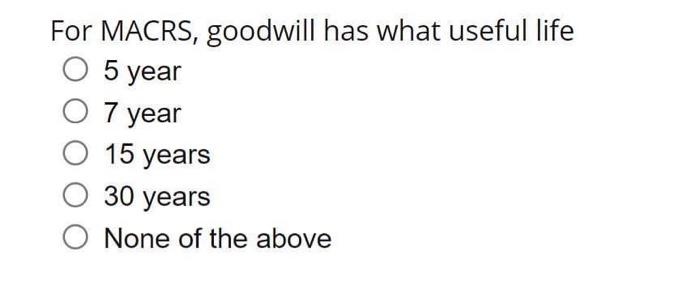

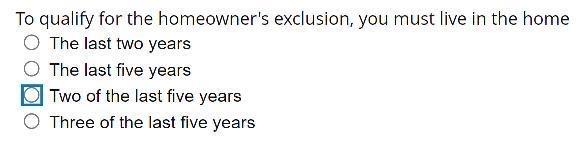

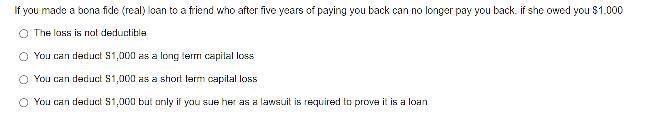

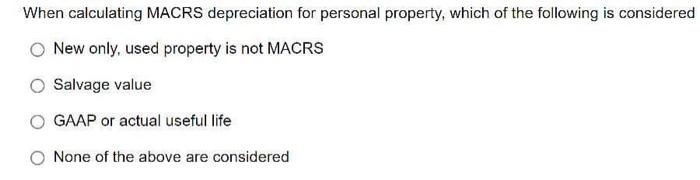

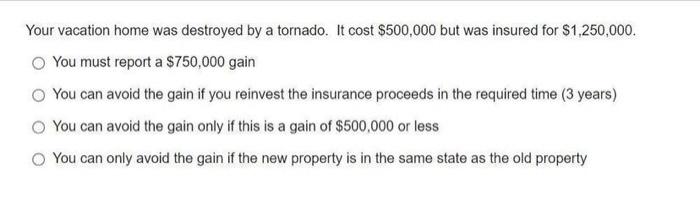

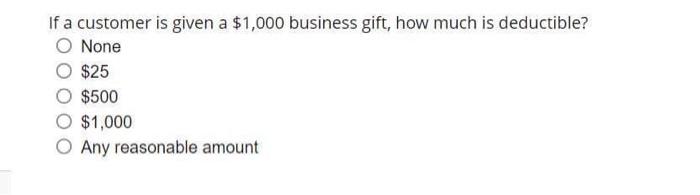

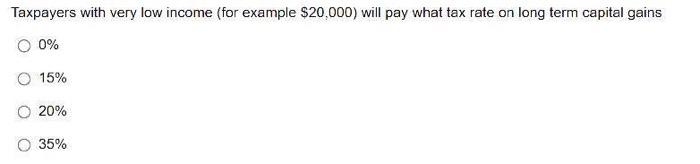

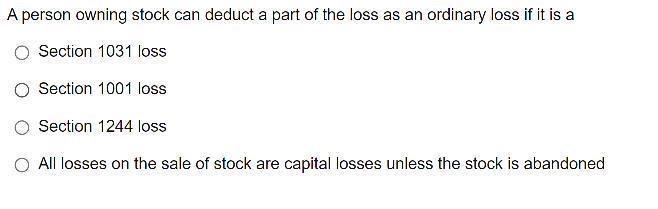

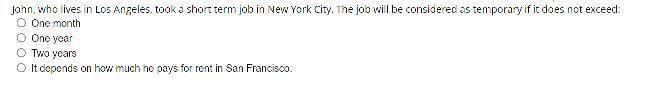

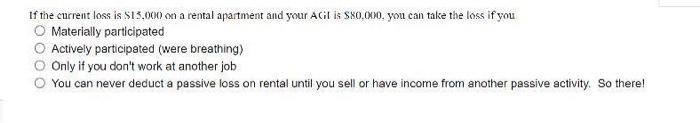

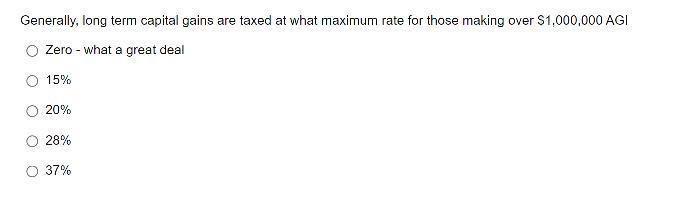

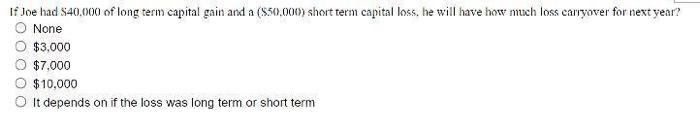

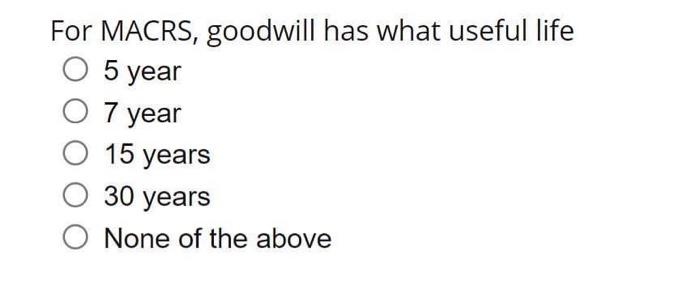

A like kind exchange does NOT include what type of property business personal property O Apartment house Hotel O Parking lot if you made a bona fide (real) loan to a friend who after five years of paying you back can no longer pay you back if she owed you $1.000 The loss is rol deductible O You can deduct $1,000 as a long term capital loss You can deduct S1,000 as a short term capilal loss You can deduct $1,000 but only if you sue her as a lawsuit is required to prove it is a loan To qualify for the homeowner's exclusion, you must live in the home The last two years The last five years Two of the last five years Three of the last five years if you made a bona fide (real) loan to a friend who after five years of paying you back can no longer pay you back if she owed you $1.000 The loss is rol deductible O You can deduct $1,000 as a long term capital loss You can deduct S1,000 as a short term capilal loss You can deduct $1,000 but only if you sue her as a lawsuit is required to prove it is a loan When calculating MACRS depreciation for personal property, which of the following is considered New only used property is not MACRS Salvage value GAAP or actual useful life None of the above are considered Your vacation home was destroyed by a tornado. It cost $500,000 but was insured for $1,250,000. You must report a $750,000 gain O You can avoid the gain if you reinvest the insurance proceeds in the required time (3 years) You can avoid the gain only if this is a gain of $500,000 or less You can only avoid the gain if the new property is in the same state as the old property If a customer is given a $1,000 business gift, how much is deductible? O None $25 $500 O $1,000 Any reasonable amount Taxpayers with very low income (for example $20,000) will pay what tax rate on long term capital gains 0% O 15% 20% 35% A person owning stock can deduct a part of the loss as an ordinary loss if it is a O Section 1031 loss Section 1001 loss Section 1244 loss O All losses on the sale of stock are capital losses unless the stock is abandoned Jonn, who lives in Los Angeles, took a short term job in New York City. The job wil be considered as temporary if it does not exceed: O One month One year Two years O It depends on how much he pays for rent in San Francisco If the current loss is $13.000 on a rental apartment and your Acil is $80,00. you can take the loss if you Materially participated Actively participated (were breathing) Only if you don't work at another job You can never deduct a passive loss on rental until you sell or have income from another passive activity. So there! Generally, long term capital gains are taxed at what maximum rate for those making over $1,000,000 AGI Zero - what a great deal 15% 20% 28% 0 37% If Joe had $40,000 of long term capital gain and a (550.000) short term capital loss, he will have how much loss carryover for next year? None $3.000 $7.000 $10,000 It depends on if the loss was long term or short term For MACRS, goodwill has what useful life O 5 year O 7 year O 15 years 30 years O None of the above