Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A like will be given if answered:) The following issues relate to company clients of the firm of accountants you work for. Each company has

A like will be given if answered:)

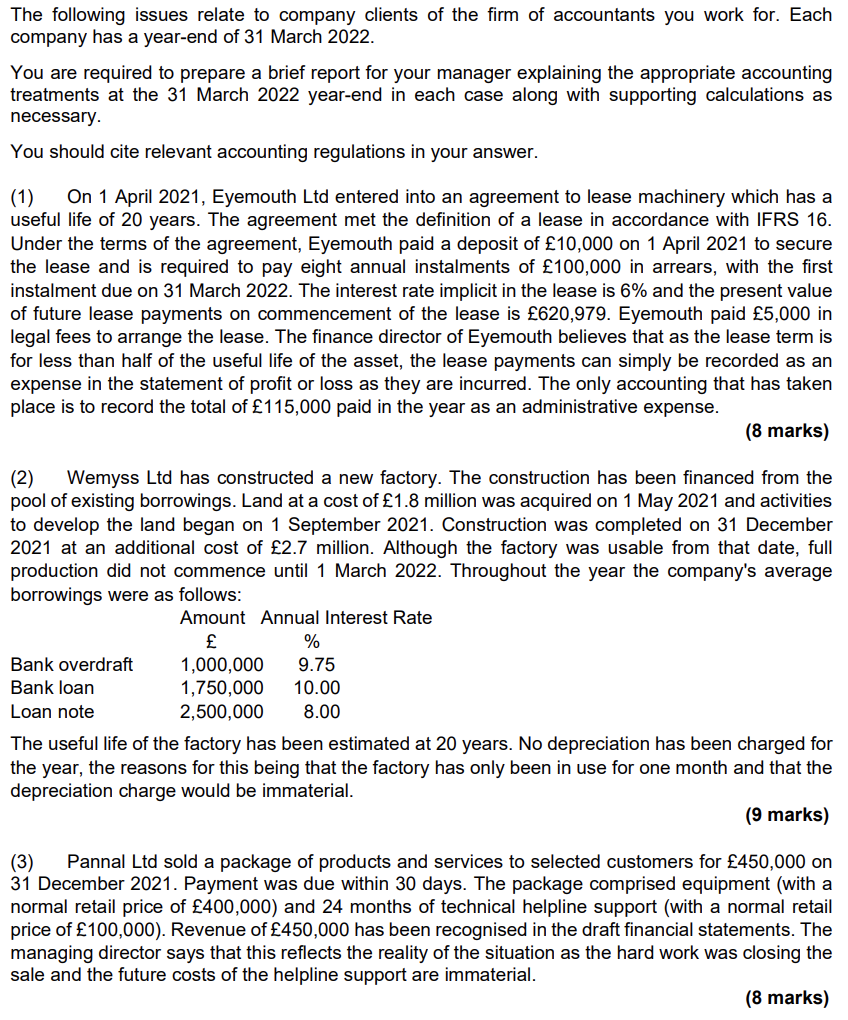

The following issues relate to company clients of the firm of accountants you work for. Each company has a year-end of 31 March 2022. You are required to prepare a brief report for your manager explaining the appropriate accounting treatments at the 31 March 2022 year-end in each case along with supporting calculations as necessary. You should cite relevant accounting regulations in your answer. (1) On 1 April 2021, Eyemouth Ltd entered into an agreement to lease machinery which has a useful life of 20 years. The agreement met the definition of a lease in accordance with IFRS 16. Under the terms of the agreement, Eyemouth paid a deposit of 10,000 on 1 April 2021 to secure the lease and is required to pay eight annual instalments of 100,000 in arrears, with the first instalment due on 31 March 2022. The interest rate implicit in the lease is 6% and the present value of future lease payments on commencement of the lease is 620,979. Eyemouth paid 5,000 in legal fees to arrange the lease. The finance director of Eyemouth believes that as the lease term is for less than half of the useful life of the asset, the lease payments can simply be recorded as an expense in the statement of profit or loss as they are incurred. The only accounting that has taken place is to record the total of 115,000 paid in the year as an administrative expense. (8 marks) (2) Wemyss Ltd has constructed a new factory. The construction has been financed from the pool of existing borrowings. Land at a cost of 1.8 million was acquired on 1 May 2021 and activities to develop the land began on 1 September 2021. Construction was completed on 31 December 2021 at an additional cost of 2.7 million. Although the factory was usable from that date, full production did not commence until 1 March 2022. Throughout the year the company's average borrowings were as follows: Amount Annual Interest Rate % Bank overdraft 1,000,000 9.75 Bank loan 10.00 1,750,000 2,500,000 Loan note 8.00 The useful life of the factory has been estimated at 20 years. No depreciation has been charged for the year, the reasons for this being that the factory has only been in use for one month and that the depreciation charge would be immaterial. (9 marks) (3) Pannal Ltd sold a package of products and services to selected customers for 450,000 on 31 December 2021. Payment was due within 30 days. The package comprised equipment (with a normal retail price of 400,000) and 24 months of technical helpline support (with a normal retail price of 100,000). Revenue of 450,000 has been recognised in the draft financial statements. The managing director says that this reflects the reality of the situation as the hard work was closing the sale and the future costs of the helpline support are immaterial. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started