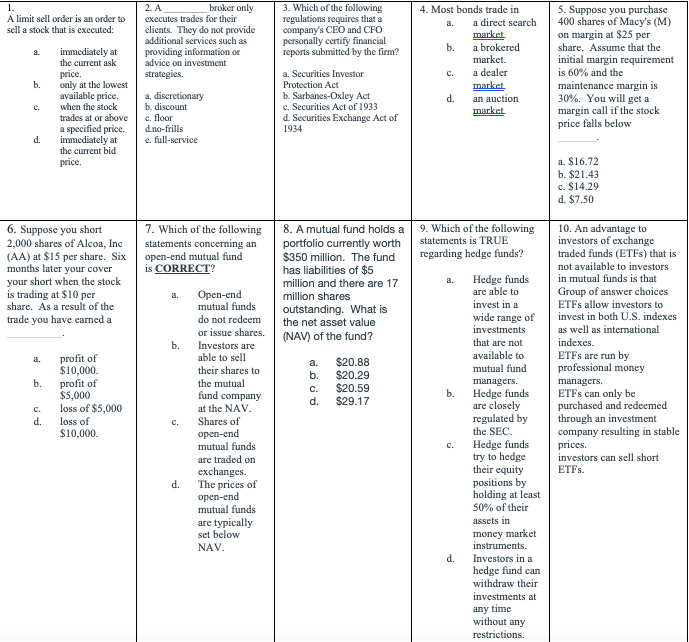

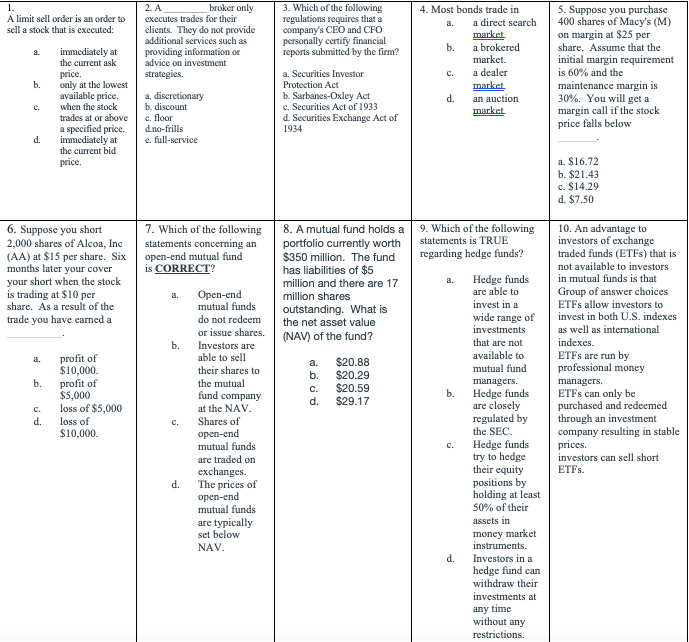

A limit sell order is an order to sell a stock that is executed: 2. A broker only executes trades for their clients. They do not provide additional services such as providing information or advice on investment strategies. 3. Which of the following regulations requires that a company's CEO and CFO personally certify financial reports submitted by the firm? immediately at the current ask price. only at the lowest available price. when the stock trades at or above a specified price. immediately at the current bid price. 4. Most bonds trade in a direct search market b. a brokered market. a dealer market an auction market 5. Suppose you purchase 400 shares of Macy's (M) on margin at $25 per share. Assume that the initial margin requirement is 60% and the maintenance margin is 30%. You will get a margin call if the stock price falls below a. discretionary b. discount c. floor dino-frills e. full-service a. Securities Investor Protection Act b. Sarbanes-Oxley Act c. Securities Act of 1933 d Securities Exchange Act of 1934 a. $16.72 b. $21.43 c. $14.29 d. $7.50 7. Which of the following statements concerning an open-end mutual fund is CORRECT? 9. Which of the following statements is TRUE regarding hedge funds? 6. Suppose you short 2,000 shares of Alcoa, Inc (AA) at $15 per share. Six months later your cover your short when the stock is trading at $10 per share. As a result of the trade you have earned a 8. A mutual fund holds a portfolio currently worth $350 million. The fund has liabilities of $5 million and there are 17 million shares outstanding. What is the net asset value (NAV) of the fund? b. 10. An advantage to investors of exchange traded funds (ETFs) that is not available to investors in mutual funds is that Group of answer choices ETFs allow investors to invest in both U.S. indexes as well as international indexes. ETFs are run by professional money managers. ETFs can only be purchased and redeemed through an investment company resulting in stable prices. investors can sell short ETFs. profit of $10,000. profit of $5,000 loss of $5,000 loss of $10,000 a. b. c. d. Open-end mutual funds do not redeem or issue shares. Investors are able to sell their shares to the mutual fund company at the NAV. Shares of open-end mutual funds are traded on exchanges The prices of open-end mutual funds are typically set below NAV. $20.88 $20.29 $20.59 $29.17 Hedge funds are able to invest in a wide range of investments that are not available to mutual fund managers. Hedge funds are closely regulated by the SEC. Hedge funds try to hedge their equity positions by holding at least 50% of their assets in money market instruments Investors in a hedge fund can withdraw their investments at any time without any restrictions. d