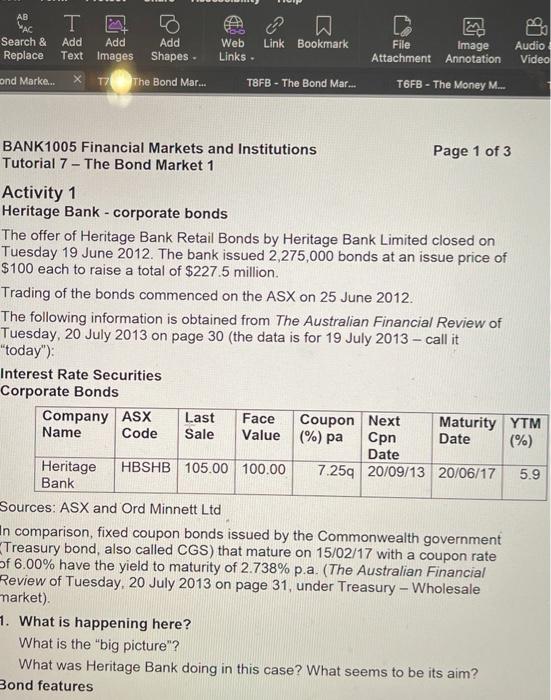

a Link Bookmark AB Search & Add Add Add Replace Text Images Shapes - ond Marke... T7 The Bond Mar... Web Links - File Attachment Image Annotation Audio Video T8FB - The Bond Mar... T6FB - The Money M... BANK1005 Financial Markets and Institutions Tutorial 7 The Bond Market 1 Page 1 of 3 Activity 1 Heritage Bank - corporate bonds The offer of Heritage Bank Retail Bonds by Heritage Bank Limited closed on Tuesday 19 June 2012. The bank issued 2,275,000 bonds at an issue price of $100 each to raise a total of $227.5 million. Trading of the bonds commenced on the ASX on 25 June 2012 The following information is obtained from The Australian Financial Review of Tuesday, 20 July 2013 on page 30 (the data is for 19 July 2013 - call it "today"); Interest Rate Securities Corporate Bonds Company ASX Last Face Coupon Next Maturity YTM Name Code Sale Value (%) pa Cpn Date (%) Date Heritage HBSHB 105.00 100.00 7.259 20/09/13 20/06/17 5.9 Bank Sources: ASX and Ord Minnett Ltd In comparison, fixed coupon bonds issued by the Commonwealth government Treasury bond, also called CGS) that mature on 15/02/17 with a coupon rate of 6.00% have the yield to maturity of 2.738% p.a. (The Australian Financial Review of Tuesday, 20 July 2013 on page 31, under Treasury - Wholesale market). 1. What is happening here? What is the "big picture"? What was Heritage Bank doing in this case? What seems to be its aim? Bond features a Link Bookmark AB Search & Add Add Add Replace Text Images Shapes - ond Marke... T7 The Bond Mar... Web Links - File Attachment Image Annotation Audio Video T8FB - The Bond Mar... T6FB - The Money M... BANK1005 Financial Markets and Institutions Tutorial 7 The Bond Market 1 Page 1 of 3 Activity 1 Heritage Bank - corporate bonds The offer of Heritage Bank Retail Bonds by Heritage Bank Limited closed on Tuesday 19 June 2012. The bank issued 2,275,000 bonds at an issue price of $100 each to raise a total of $227.5 million. Trading of the bonds commenced on the ASX on 25 June 2012 The following information is obtained from The Australian Financial Review of Tuesday, 20 July 2013 on page 30 (the data is for 19 July 2013 - call it "today"); Interest Rate Securities Corporate Bonds Company ASX Last Face Coupon Next Maturity YTM Name Code Sale Value (%) pa Cpn Date (%) Date Heritage HBSHB 105.00 100.00 7.259 20/09/13 20/06/17 5.9 Bank Sources: ASX and Ord Minnett Ltd In comparison, fixed coupon bonds issued by the Commonwealth government Treasury bond, also called CGS) that mature on 15/02/17 with a coupon rate of 6.00% have the yield to maturity of 2.738% p.a. (The Australian Financial Review of Tuesday, 20 July 2013 on page 31, under Treasury - Wholesale market). 1. What is happening here? What is the "big picture"? What was Heritage Bank doing in this case? What seems to be its aim? Bond features