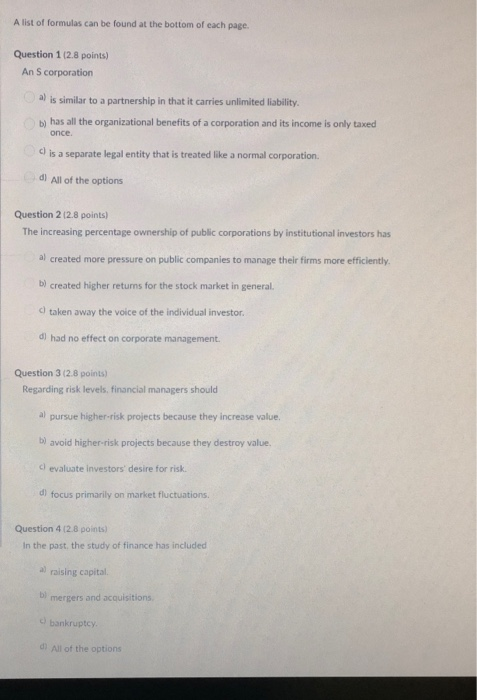

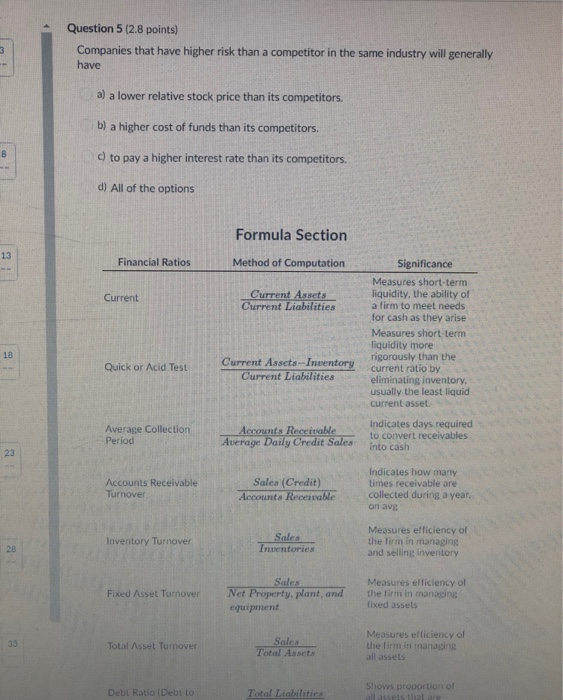

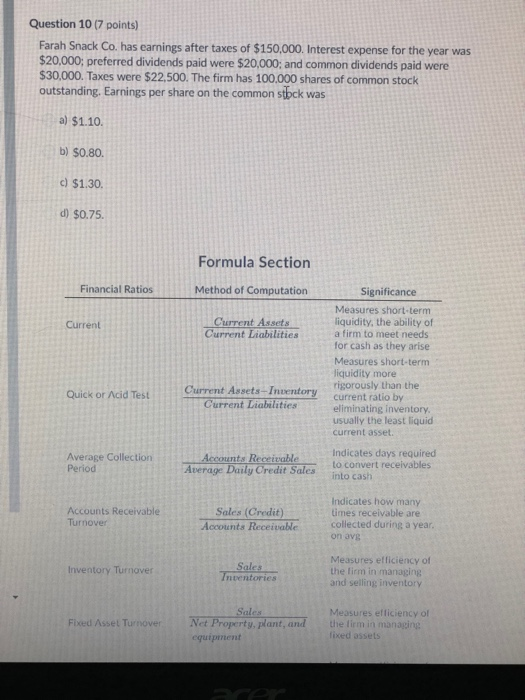

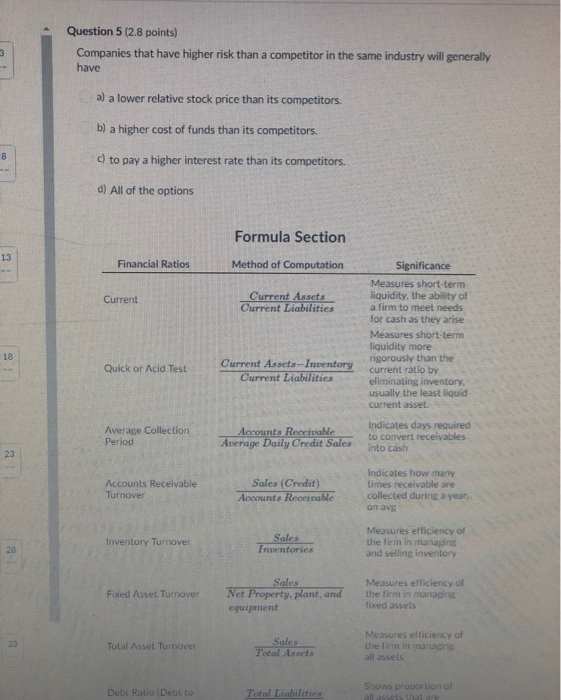

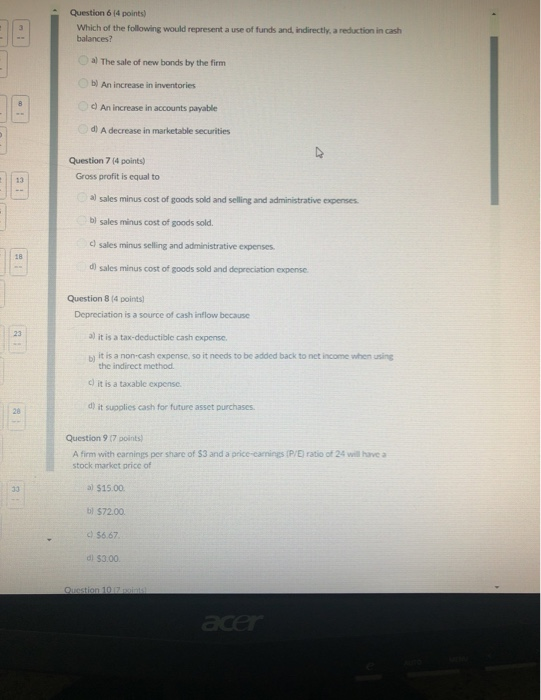

A list of formulas can be found at the bottom of each page. Question 1 (2.8 points) An Scorporation al is similar to a partnership in that it carries unlimited liability. b) has all the organizational benefits of a corporation and its income is only taxed once. C) is a separate legal entity that is treated like a normal corporation di All of the options Question 2 (2.8 points) The increasing percentage ownership of public corporations by institutional investors has al created more pressure on public companies to manage their firms more efficiently. b) created higher returns for the stock market in general. taken away the voice of the individual investor. di had no effect on corporate management. Question 3 (2.8 points) Regarding risk levels, financial managers should al pursue higher risk projects because they increase value. b) avoid higher-risk projects because they destroy value. evaluate Investors' desire for risk. d) focus primarily on market fluctuations. Question 4 (2.8 points) In the past, the study of finance has included a) raising capital bmergers and acquisitions bankruptcy d. All of the options Question 5 (2.8 points) Companies that have higher risk than a competitor in the same industry will generally have W a) a lower relative stock price than its competitors. b) a higher cost of funds than its competitors. c) to pay a higher interest rate than its competitors. d) All of the options Formula Section TE Financial Ratios Method of Computation Current Current Assets Current Liabilities Significance Measures short-term liquidity, the ability of a firm to meet needs for cash as they arise Measures short-term liquidity more rigorously than the current ratio by eliminating inventory. usually the least liquid current asset. Quick or Acid Test Current Assets--Inventory Current Liabilities Average Collection Period Accounts Receivable Average Daily Credit Sales Indicates days required to convert receivables into cash Accounts Receivable Turnover Sales (Credit) Accounts Receivable Indicates how many Limes receivable are collected during a year, on av Inventory Turnover Sales Inventories Measures efficiency of the firm in managing and selling inventory Fixed Asset Turnover Sales Net Property, plant, and equipment Measures efficiency of the firm in managing fixed assets Total Asset Turnover Sales Total Assets Measures efficiency of the firm in managing all assets Debt Ratio (Debt to Total Liabilities Shows proportion of Bassets that are Question 10 (7 points) Farah Snack Co. has earnings after taxes of $150,000. Interest expense for the year was $20,000; preferred dividends paid were $20,000; and common dividends paid were $30,000. Taxes were $22.500. The firm has 100.000 shares of common stock outstanding. Earnings per share on the common stock was a) $1.10. b) 50.80 c) $1.30 d) $0.75 Formula Section Financial Ratios Method of Computation Current Assets Current Liabilities Significance Measures short-term liquidity, the ability of a firm to meet needs for cash as they arise Measures short-term liquidity more rigorously than the current ratio by eliminating inventory. usually the least liquid Current asset Quick or Acid Test Current Assets-Inventory Current Liabilities Average Collection Period Accounts Receivable Average Daily Credit Sales Indicates days required to convert receivables into cash Accounts Receivable Turnove Sales (Credit) Accounts Receivable Indicates how many times receivable are collected during a year, on avg Inventory Turnover Sales tories Measures efficiency of the firm in managing and selling inventory Measures efficiency of Fixed Asset Turnover Sales Net Property, plant, and equipment Question 5 (2.8 points) Companies that have higher risk than a competitor in the same industry will generally have a) a lower relative stock price than its competitors. b) a higher cost of funds than its competitors. c) to pay a higher interest rate than its competitors. d) All of the options Formula Section 2 Financial Ratios Method of Computation Current Current Assets Current Liabilities Significance Measures short-term liquidity, the ability of a firm to meet needs for cash as they arise Measures short-term liquidity more rigorously than the current ratio by eliminating inventory. usually the least liquid current asset Quick or Acid Test Current Assets--Inventory Current Liabilities Average Collection Period Accounts Receivable Average Daily Credit Sales Indicates days required to convert receivables into cash Accounts Receivable Turnover Sales (Credit) Accounts Receivable Indicates how many times receivable are collected during a year on av Inventory Turnover Sales Inventories Measures efficiency of the firm in managing and selling inventory Fixed Asset Turnover Sales Net Property, plant, and equipment Measures efficiency of the firm in managing fixed assets Total Assel Turnover Sales Total Assets Measures efficiency of the firm in manage all assets Shows proportion of Debt Ratio (Debito Total Liabilities Question 6 [4 points) Which of the following would represent a use of funds and indirectly a reduction in cash balances? al The sale of new bonds by the firm An increase in inventories An increase in accounts payable di A decrease in marketable securities Question 7 (4 points) Gross profit is equal to al sales minus cost of goods sold and selling and administrative expenses. bl sales minus cost of goods sold. c) sales minus selling and administrative expenses. d) sales minus cost of goods sold and depreciation expense Question 8 14 points) Depreciation is a source of cash inflow because a) it is a tax deductible cash expense it is a non-cash expense so it needs to be added back to net income when using the indirect method c) it is a taxable expense. d) it supplies cash for future asset purchases. Question 9 17 points) A firm with earnings per share of $3 and a price-camnings IP/E) ratio of 24 will have a stock market price of al $15.00 b) 572.00 $6.67 d$3.00 Orastion 107