Answered step by step

Verified Expert Solution

Question

1 Approved Answer

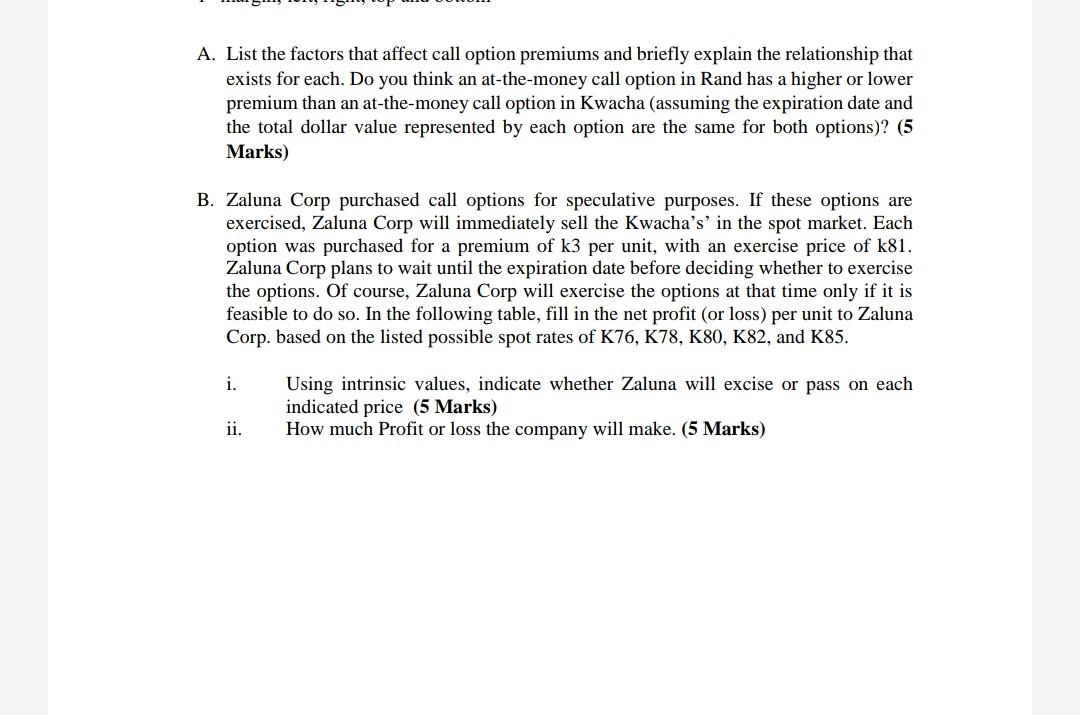

A. List the factors that affect call option premiums and briefly explain the relationship that exists for each. Do you think an at-the-money call option

A. List the factors that affect call option premiums and briefly explain the relationship that exists for each. Do you think an at-the-money call option in Rand has a higher or lower premium than an at-the-money call option in Kwacha (assuming the expiration date and the total dollar value represented by each option are the same for both options)? (5 Marks) B. Zaluna Corp purchased call options for speculative purposes. If these options are exercised, Zaluna Corp will immediately sell the Kwacha's' in the spot market. Each option was purchased for a premium of k3 per unit, with an exercise price of k81. Zaluna Corp plans to wait until the expiration date before deciding whether to exercise the options. Of course, Zaluna Corp will exercise the options at that time only if it is feasible to do so. In the following table, fill in the net profit (or loss) per unit to Zaluna Corp. based on the listed possible spot rates of K76,K78,K80,K82, and K85. i. Using intrinsic values, indicate whether Zaluna will excise or pass on each indicated price (5 Marks) ii. How much Profit or loss the company will make

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started