Question

A Local 20,000 square foot retail building is 100% occupied by a single tenant. The lease started last week and continues for 10 years. The

A Local 20,000 square foot retail building is 100% occupied by a single tenant. The lease started last week and continues for 10 years. The rent is $7.00 per square foot per year. The landlord pays all the expenses associated with the building. The expenses total $2.00 per square foot per year, and we have determined that they are market-oriented. From a market survey, it is our opinion that 5% is a reasonable vacancy allowance and 2% is a reasonable allowance for collection loss. The market expects a 9% return on investment (overall rate) for investments like this.

What is the assumed vacancy and collection loss as a percentage?

What is the value of the property at the end of year 5?

What is the present value of the property?

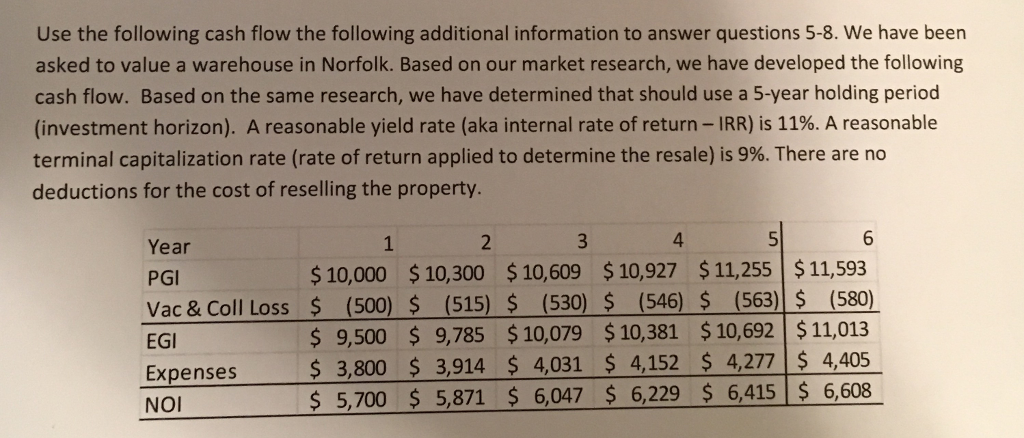

Use the following cash flow the following additional information to answer questions 5-8. We have been asked to value a warehouse in Norfolk. Based on our market research, we have developed the following cash flow. Based on the same research, we have determined that should use a 5-year holding period (investment horizon). A reasonable yield rate (aka internal rate of return IRR) is 11%. A reasonable terminal capitalization rate (rate of return applied to determine the resale) is 9%. There are no deductions for the cost of reselling the property. Year 10,000 10,300 s 10,609 10,927 11,255 11,593 PGI Vac & Coll Loss (500) (515) (530) (546) (563) S (580) 9,500 9,785 10,079 10,381 10,692 11,013 EG s 3,800 s 3,914 4,031 4,152 4,277 4,405 Expenses 5700 s 5,871 6,047 6,229 6,415 6,608 NOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started