Answered step by step

Verified Expert Solution

Question

1 Approved Answer

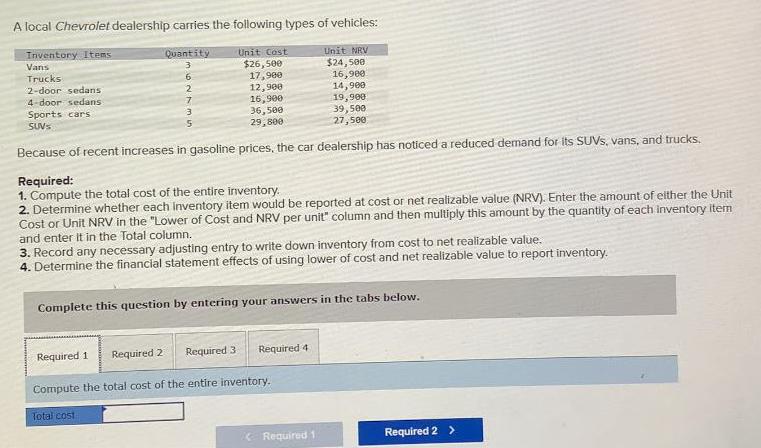

A local Chevrolet dealership carries the following types of vehicles: Inventory Items Vans Trucks 2-door sedans 4-door sedans Sports cars SUVS Quantity 6 7

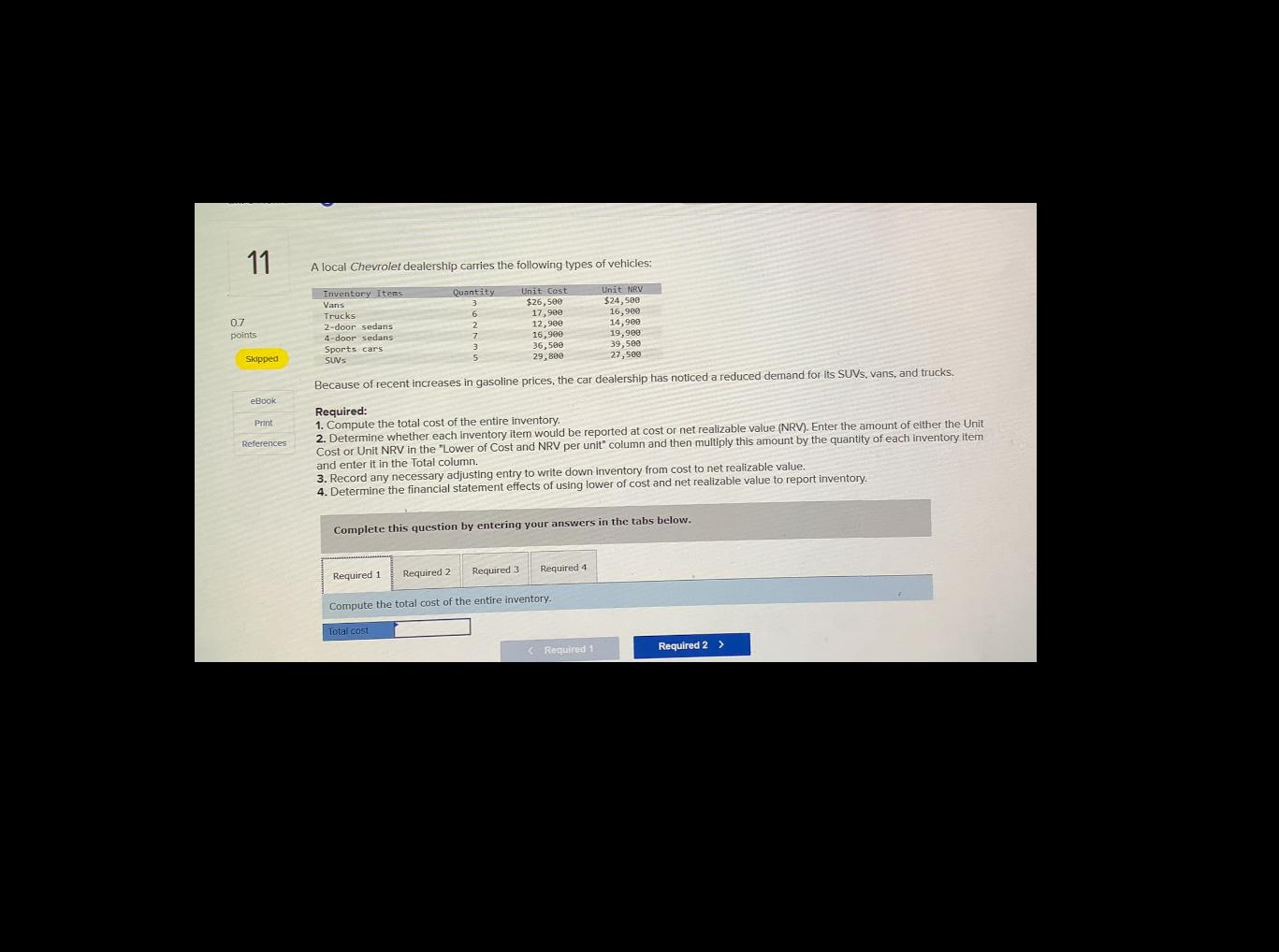

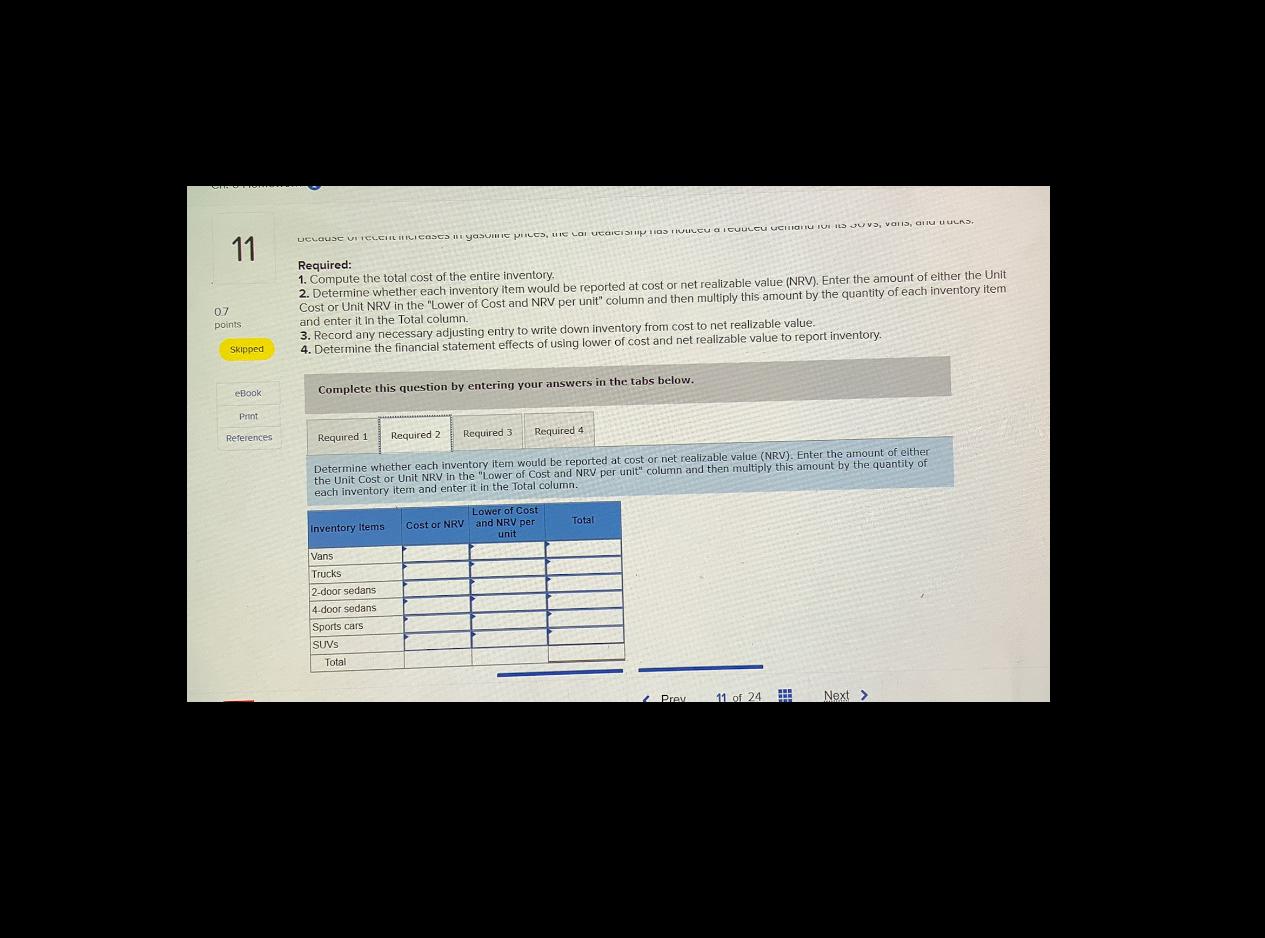

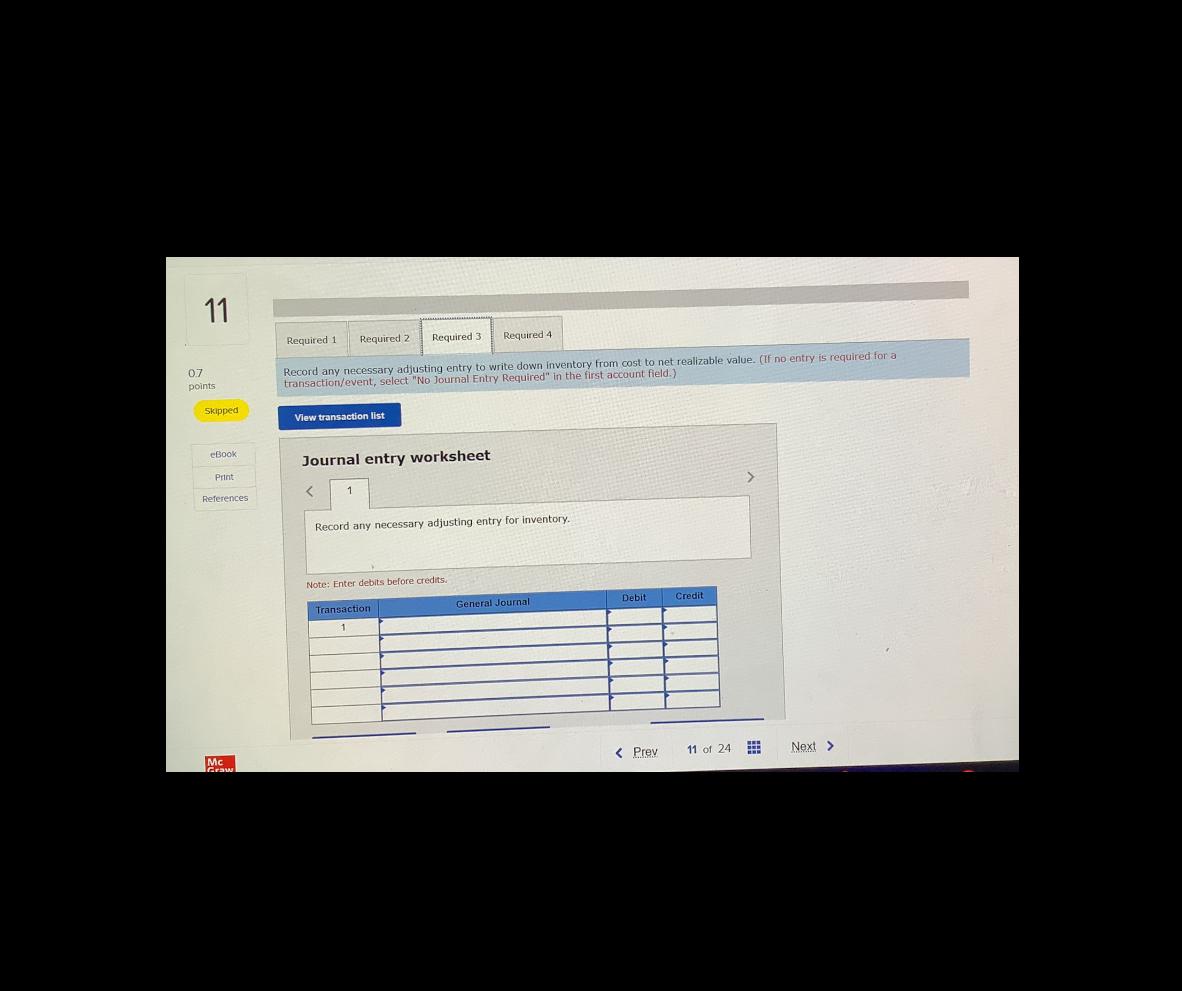

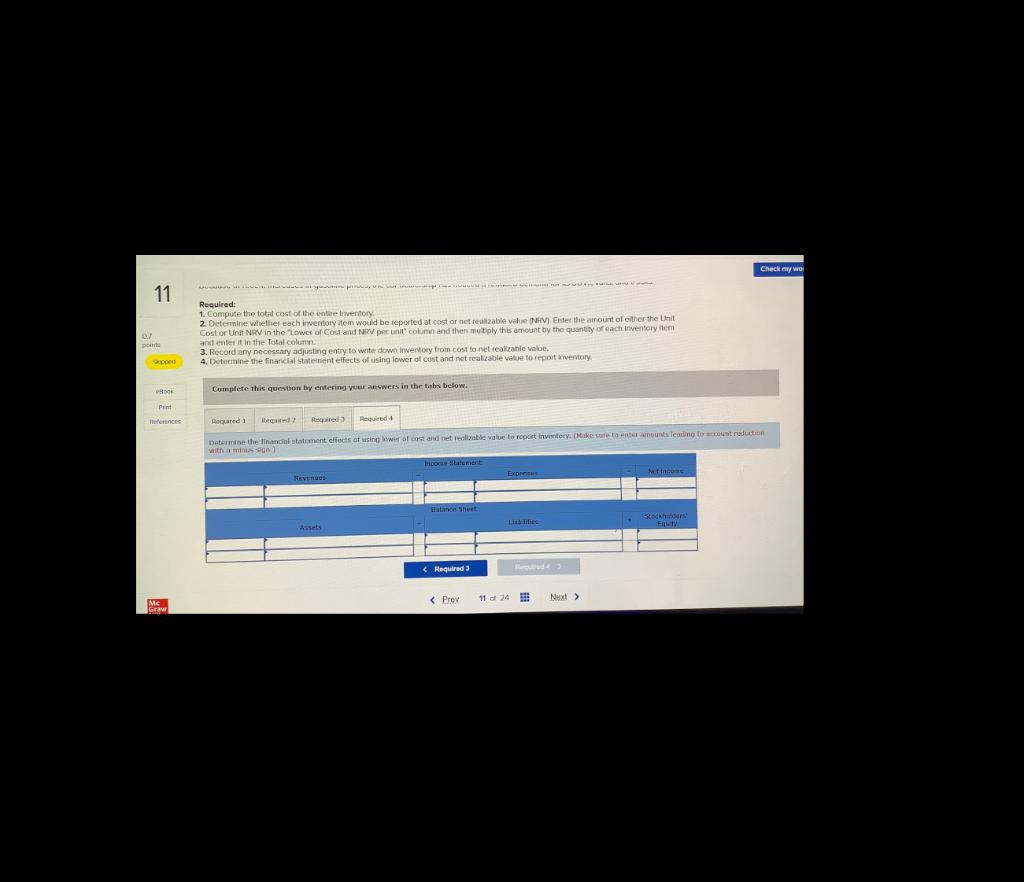

A local Chevrolet dealership carries the following types of vehicles: Inventory Items Vans Trucks 2-door sedans 4-door sedans Sports cars SUVS Quantity 6 7 Total cost 5 Unit Cost $26,500 17,900 12,900 19,900 39,500 27,500 Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and trucks. 16,900 36,500 29,800 Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each Inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. Required 3 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Complete this question by entering your answers in the tabs below. Unit NRV $24,500 16,900 14,900 Required 4 Required 1 Required 2 Compute the total cost of the entire inventory. 11 07 points Skipped eBook Print References A local Chevrolet dealership carries the following types of vehicles: Quantity 3 Unit Cost $26,500 17,900 6 2 12,900 7 16,900 3 36,500 29,800 Inventory Items. Unit NRV Vans $24,500 Trucks 16,900 2-door sedans 14,900 19,900 4-door sedans Sports cars SUVs 39,500 27,500 Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and trucks. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the total cost of the entire inventory. Total cost < Required 1 Required 2 > 11 0.7 points. Skipped eBook Print References DCLOUSE VI TCLCHLICosts i yasuline prots, wie lai utaitistas fleu a iculeu ucilanu i volis, au uns. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Complete this question by entering your answers in the tabs below. Required 1 Inventory Items Required 4 Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. Vans Trucks 2-door sedans 4-door sedans Sports cars SUVS Required 2 Total Required 3 Lower of Cost Cost or NRV and NRV per unit Total Prev 11 of 24 www www EMAN Next > 11 07 points Skipped eBook Print References Mc Graw Required 1 Required 2 Required 3 Required 4 Record any necessary adjusting entry to write down inventory from cost to net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.). View transaction list Journal entry worksheet < 1 Record any necessary adjusting entry for inventory. Note: Enter debits before credits. Transaction 1 General Journali Debit < Prev Credit 11 of 24 www www www Next > 11 07 noud pont sepped eBook Print References Mc Graw 42255 ya pin Required: 1. Compute the total cost of the entire Inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV) Enter the amount of either the Unit Cost or Unit NRV in the Lower of Cost and NIV per unit column and then multiply this amount by the quantity of each Inventory tem and enter it in the Total column. 3. Record any necessary adjusting entry to write down Inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Complete this question by entering your answers in the tabs below. Revenues Required 4 Assets Required 1 bequited ? Required 3 Determine the financial statement effects of using lower of cost and net realizable value to report inventory. (Make sure to enter amounts leading to account reduction with a minus sign.) Income Statement Balance Sheet Nettaco Check my wo Stockhinders Equity

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Inventory Item Cost or NRV Lower Total i i X Qua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started