Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A local hedge fund is looking into a potential arbitrage opportunity with the Industrial (Indi) 25 Futures. On the 1st of October 2022, the

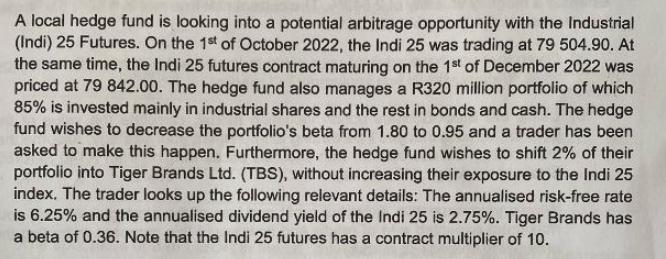

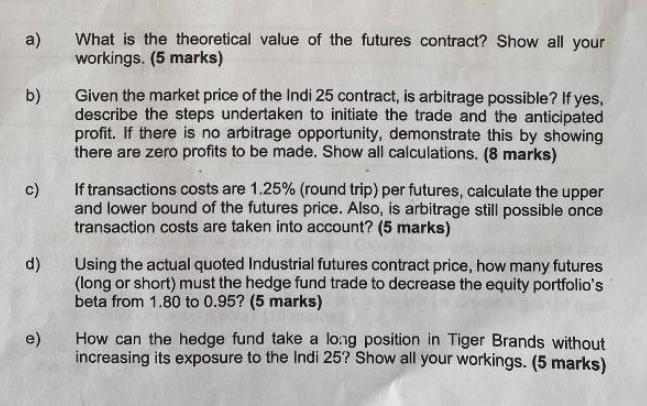

A local hedge fund is looking into a potential arbitrage opportunity with the Industrial (Indi) 25 Futures. On the 1st of October 2022, the Indi 25 was trading at 79 504.90. At the same time, the Indi 25 futures contract maturing on the 1st of December 2022 was priced at 79 842.00. The hedge fund also manages a R320 million portfolio of which 85% is invested mainly in industrial shares and the rest in bonds and cash. The hedge fund wishes to decrease the portfolio's beta from 1.80 to 0.95 and a trader has been asked to make this happen. Furthermore, the hedge fund wishes to shift 2% of their portfolio into Tiger Brands Ltd. (TBS), without increasing their exposure to the Indi 25 index. The trader looks up the following relevant details: The annualised risk-free rate is 6.25% and the annualised dividend yield of the Indi 25 is 2.75%. Tiger Brands has a beta of 0.36. Note that the Indi 25 futures has a contract multiplier of 10. a) b) d) What is the theoretical value of the futures contract? Show all your workings. (5 marks) c) If transactions costs are 1.25% (round trip) per futures, calculate the upper and lower bound of the futures price. Also, is arbitrage still possible once transaction costs are taken into account? (5 marks) e) Given the market price of the Indi 25 contract, is arbitrage possible? If yes, describe the steps undertaken to initiate the trade and the anticipated profit. If there is no arbitrage opportunity, demonstrate this by showing there are zero profits to be made. Show all calculations. (8 marks) Using the actual quoted Industrial futures contract price, how many futures (long or short) must the hedge fund trade to decrease the equity portfolio's beta from 1.80 to 0.95? (5 marks) How can the hedge fund take a long position in Tiger Brands without increasing its exposure to the Indi 25? Show all your workings. (5 marks)

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

With the given information we find a The theoretical value of a futures contract is given by Future price S 1 r T Where S is the spot price r is the r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started