Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (18 marks) A trader at a local investment bank is reviewing the current global macro environment. She has taken note of rising

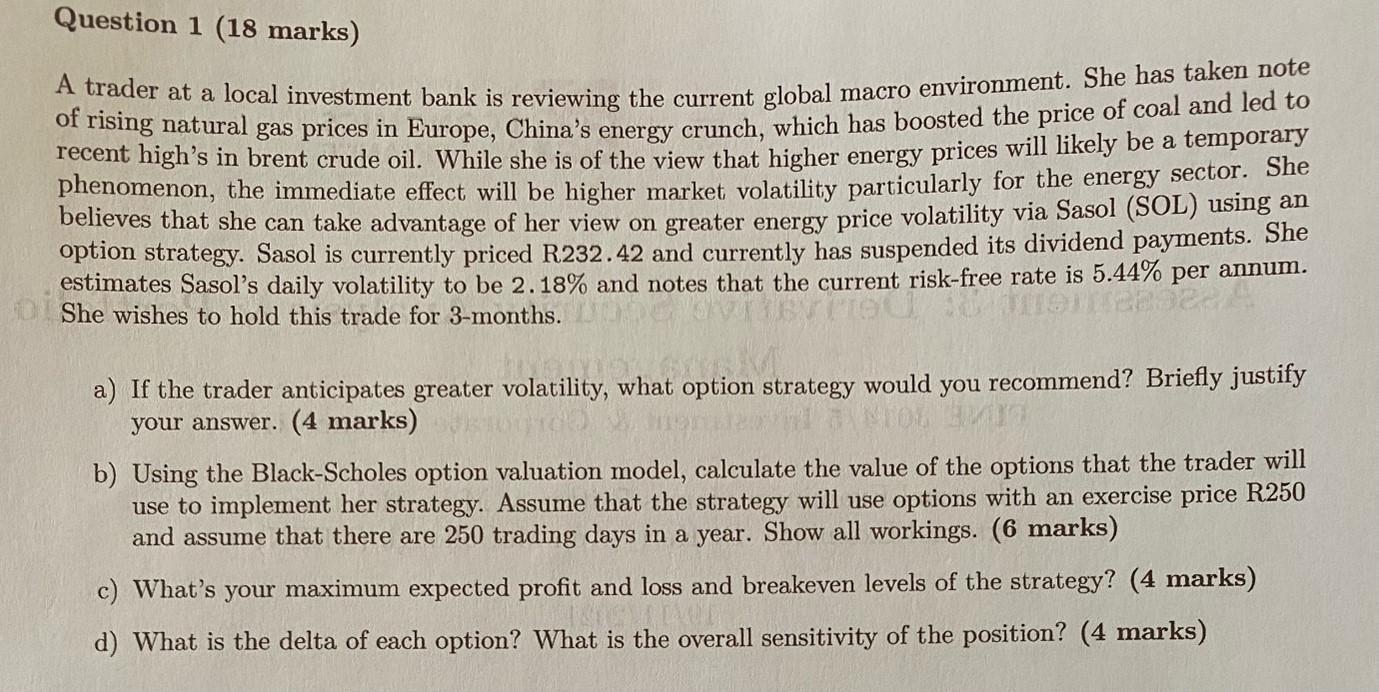

Question 1 (18 marks) A trader at a local investment bank is reviewing the current global macro environment. She has taken note of rising natural gas prices in Europe, China's energy crunch, which has boosted the price of coal and led to recent high's in brent crude oil. While she is of the view that higher energy prices will likely be a temporary phenomenon, the immediate effect will be higher market volatility particularly for the energy sector. She believes that she can take advantage of her view on greater energy price volatility via Sasol (SOL) using an option strategy. Sasol is currently priced R232.42 and currently has suspended its dividend payments. She estimates Sasol's daily volatility to be 2.18% and notes that the current risk-free rate is 5.44% per annum. She wishes to hold this trade for 3-months. a) If the trader anticipates greater volatility, what option strategy would you recommend? Briefly justify your answer. (4 marks) b) Using the Black-Scholes option valuation model, calculate the value of the options that the trader will use to implement her strategy. Assume that the strategy will use options with an exercise price R250 and assume that there are 250 trading days in a year. Show all workings. (6 marks) c) What's your maximum expected profit and loss and breakeven levels of the strategy? (4 marks) d) What is the delta of each option? What is the overall sensitivity of the position? (4 marks)

Step by Step Solution

★★★★★

3.26 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a If the trader anticipates greater volatility I would recommend a straddle option strategy This str...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started