Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A local hosptil is investing in a new plasma arc furnace for the incineration of medical wastes. The initial investment is $300,000 and annual revenues

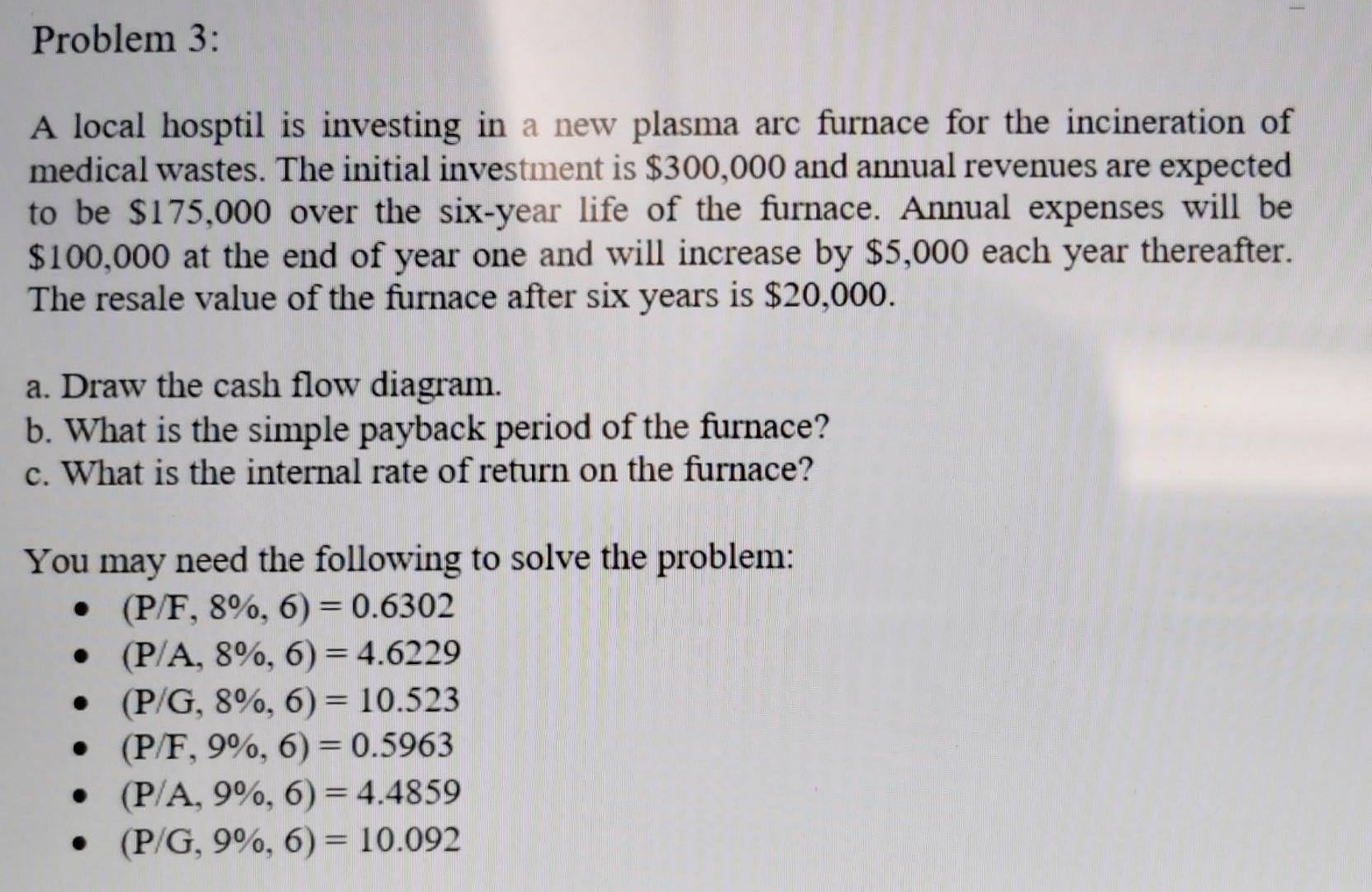

A local hosptil is investing in a new plasma arc furnace for the incineration of medical wastes. The initial investment is $300,000 and annual revenues are expected to be $175,000 over the six-year life of the furnace. Annual expenses will be $100,000 at the end of year one and will increase by $5,000 each year thereafter. The resale value of the furnace after six years is $20,000. a. Draw the cash flow diagram. b. What is the simple payback period of the furnace? c. What is the internal rate of return on the furnace? You may need the following to solve the problem: - (P/F,8%,6)=0.6302 - (P/A,8%,6)=4.6229 - (P/G,8%,6)=10.523 - (P/F,9%,6)=0.5963 - (P/A,9%,6)=4.4859 - (P/G,9%,6)=10.092 A local hosptil is investing in a new plasma arc furnace for the incineration of medical wastes. The initial investment is $300,000 and annual revenues are expected to be $175,000 over the six-year life of the furnace. Annual expenses will be $100,000 at the end of year one and will increase by $5,000 each year thereafter. The resale value of the furnace after six years is $20,000. a. Draw the cash flow diagram. b. What is the simple payback period of the furnace? c. What is the internal rate of return on the furnace? You may need the following to solve the problem: - (P/F,8%,6)=0.6302 - (P/A,8%,6)=4.6229 - (P/G,8%,6)=10.523 - (P/F,9%,6)=0.5963 - (P/A,9%,6)=4.4859 - (P/G,9%,6)=10.092

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started