Question

A long-term US investor holds 100 shares of the SPY, an S&P500 index ETF, but is worried about a pull-back in the overall stock market

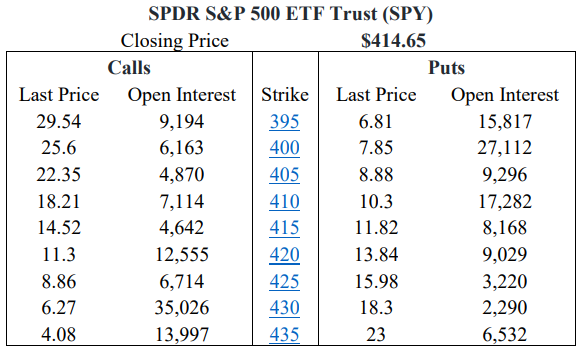

- A long-term US investor holds 100 shares of the SPY, an S&P500 index ETF, but is worried about a pull-back in the overall stock market during the summer. The following is the option chain quote for SPY for the August maturity. Use the nearest strike prices.

a. Construct a hedge to protect the position against a market decrease of more than 5%. Explain the strategy, how it is constructed, and the total cost to the investor.

b. The investor wants to offset the cost of the hedge in part (a) by giving up some upside if the market increases by 5% or more. Explain the combined strategy, how it is constructed, and the total cost to the investor.

2. Suppose that put options on a stock with strike prices $30 and $35 cost $4 and $7, respectively. How can the options be used to create (a) a bull spread and (b) a bear spread? Construct a table that shows the profit and payoff for both spreads.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started