Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a lot of answers for this specific question ive found online are incorrect, please work carefully :) Ace Development Company is trying to structure a

a lot of answers for this specific question ive found online are incorrect, please work carefully :)

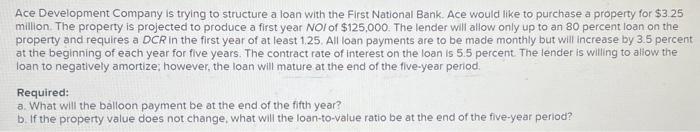

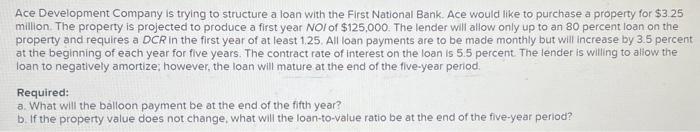

Ace Development Company is trying to structure a loan with the First National Bank. Ace would like to purchase a property for $3.25 million. The property is projected to produce a first year NOI of $125,000. The lender will allow only up to an 80 percent loan on the property and requires a DCR in the first year of at least 1.25. All loan payments are to be made monthly but will increase by 3.5 percent at the beginning of each year for five years. The contract rate of interest on the loan is 5.5 percent. The lender is willing to aliow the loan to negatively amortize; however, the loan will mature at the end of the flive-year period. Required: a. What will the bailloon payment be at the end of the fifth year? b. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period? Required: a. What will the balloon payment be at the end of th b. If the property value does not change, what will tl Complete this question by entering your answ What will the balloon payment be at the end of the fif answer to 2 decimal places.) Required: a. What will the balloon payment be at the end of the fifth year? b. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period? Complete this question by entering your answers in the tabs below. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Ace Development Company is trying to structure a loan with the First National Bank. Ace would like to purchase a property for $3.25 million. The property is projected to produce a first year NOI of $125,000. The lender will allow only up to an 80 percent loan on the property and requires a DCR in the first year of at least 1.25. All loan payments are to be made monthly but will increase by 3.5 percent at the beginning of each year for five years. The contract rate of interest on the loan is 5.5 percent. The lender is willing to aliow the loan to negatively amortize; however, the loan will mature at the end of the flive-year period. Required: a. What will the bailloon payment be at the end of the fifth year? b. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period? Required: a. What will the balloon payment be at the end of th b. If the property value does not change, what will tl Complete this question by entering your answ What will the balloon payment be at the end of the fif answer to 2 decimal places.) Required: a. What will the balloon payment be at the end of the fifth year? b. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period? Complete this question by entering your answers in the tabs below. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started