Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Ltd, a listed company, is reviewing investment proposals that have been submitted by divisional managers. The investment funds of the company are limited,

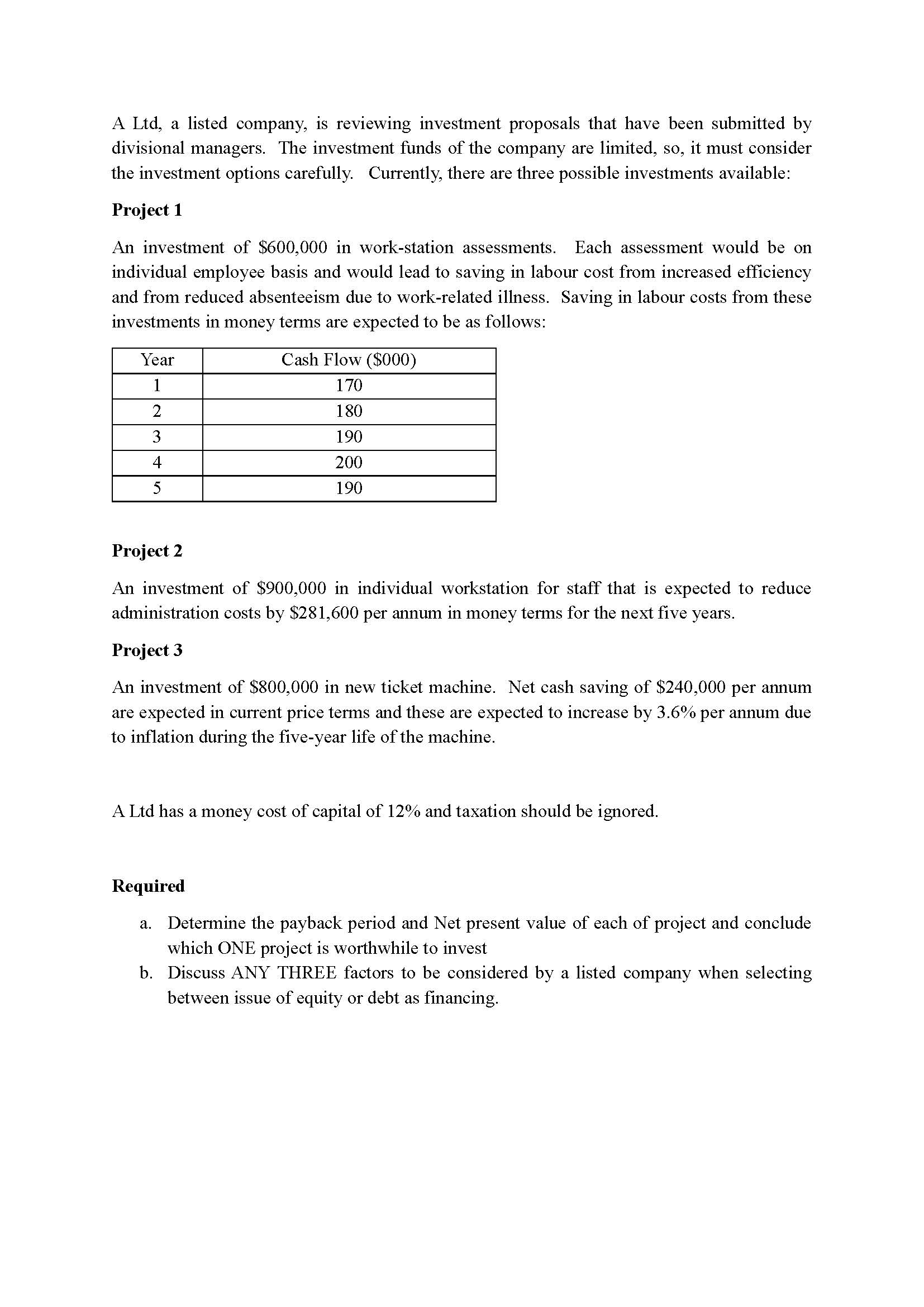

A Ltd, a listed company, is reviewing investment proposals that have been submitted by divisional managers. The investment funds of the company are limited, so, it must consider the investment options carefully. Currently, there are three possible investments available: Project 1 An investment of $600,000 in work-station assessments. Each assessment would be on individual employee basis and would lead to saving in labour cost from increased efficiency and from reduced absenteeism due to work-related illness. Saving in labour costs from these investments in money terms are expected to be as follows: Year 1 Cash Flow ($000) 170 2 180 3 190 4 200 5 190 Project 2 An investment of $900,000 in individual workstation for staff that is expected to reduce administration costs by $281,600 per annum in money terms for the next five years. Project 3 An investment of $800,000 in new ticket machine. Net cash saving of $240,000 per annum are expected in current price terms and these are expected to increase by 3.6% per annum due to inflation during the five-year life of the machine. A Ltd has a money cost of capital of 12% and taxation should be ignored. Required a. Determine the payback period and Net present value of each of project and conclude which ONE project is worthwhile to invest b. Discuss ANY THREE factors to be considered by a listed company when selecting between issue of equity or debt as financing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started