Answered step by step

Verified Expert Solution

Question

1 Approved Answer

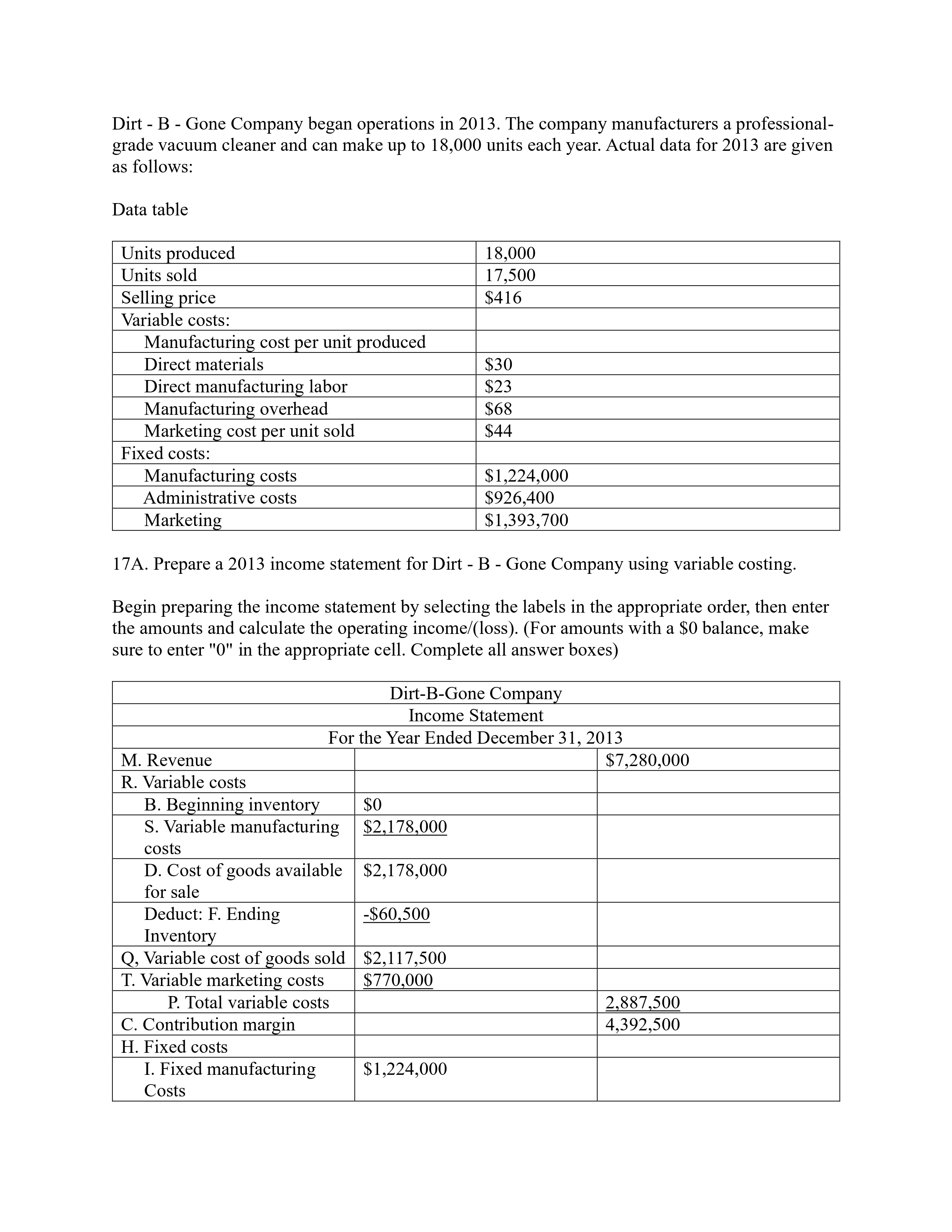

Dirt B-Gone Company began operations in 2013. The company manufacturers a professional- grade vacuum cleaner and can make up to 18,000 units each year.

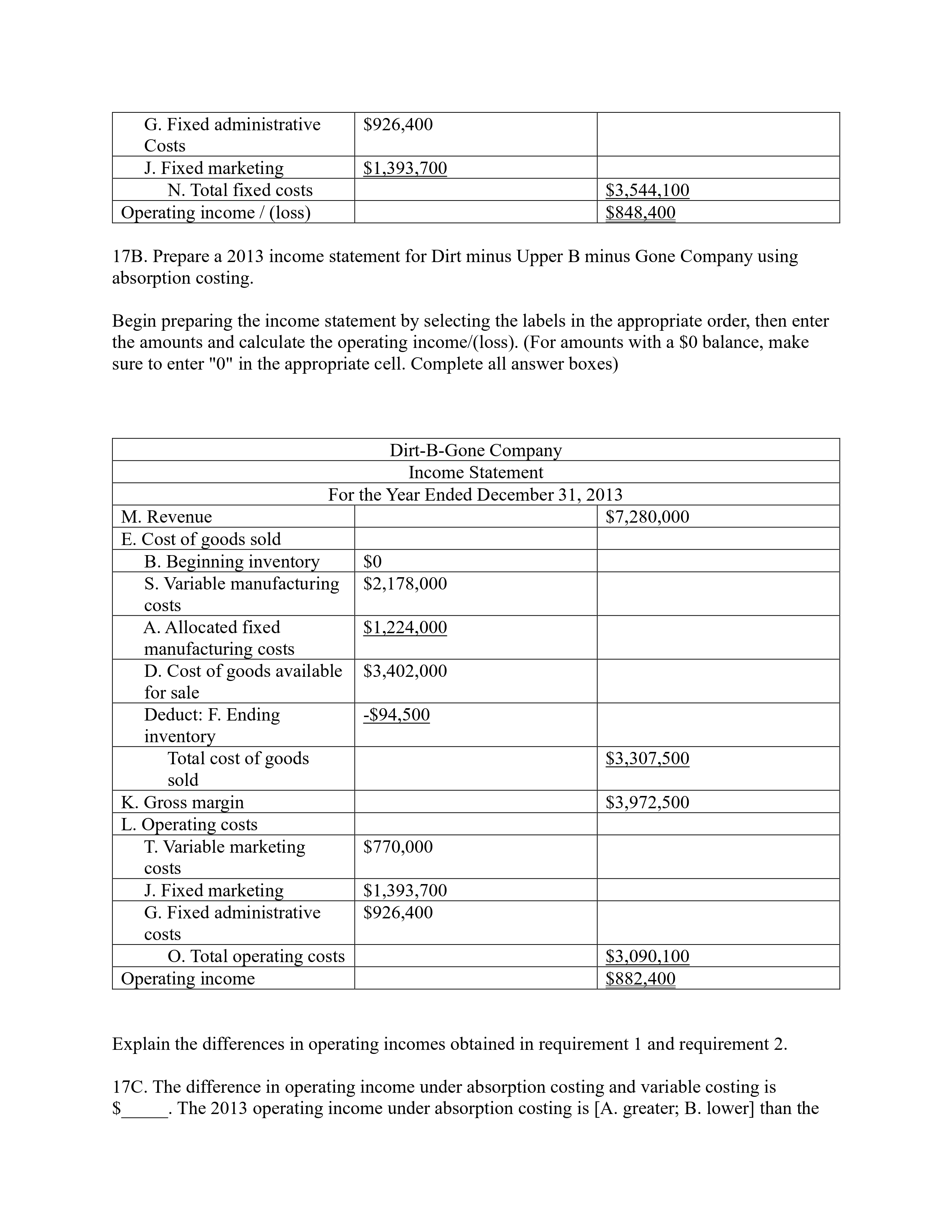

Dirt B-Gone Company began operations in 2013. The company manufacturers a professional- grade vacuum cleaner and can make up to 18,000 units each year. Actual data for 2013 are given as follows: Data table Units produced 18,000 17,500 $416 Units sold Selling price Variable costs: Manufacturing cost per unit produced Direct materials $30 Direct manufacturing labor $23 Manufacturing overhead $68 Marketing cost per unit sold $44 Fixed costs: Manufacturing costs $1,224,000 Administrative costs $926,400 $1,393,700 Marketing 17A. Prepare a 2013 income statement for Dirt - B - Gone Company using variable costing. Begin preparing the income statement by selecting the labels in the appropriate order, then enter the amounts and calculate the operating income/(loss). (For amounts with a $0 balance, make sure to enter "0" in the appropriate cell. Complete all answer boxes) Dirt-B-Gone Company Income Statement For the Year Ended December 31, 2013 M. Revenue R. Variable costs $7,280,000 B. Beginning inventory $0 $2,178,000 S. Variable manufacturing costs D. Cost of goods available $2,178,000 for sale Deduct: F. Ending Inventory Q, Variable cost of goods sold T. Variable marketing costs P. Total variable costs C. Contribution margin H. Fixed costs I. Fixed manufacturing Costs -$60,500 $2,117,500 $770,000 2,887,500 4,392,500 $1,224,000 G. Fixed administrative Costs $926,400 J. Fixed marketing $1,393,700 N. Total fixed costs Operating income/(loss) $3,544,100 $848,400 17B. Prepare a 2013 income statement for Dirt minus Upper B minus Gone Company using absorption costing. Begin preparing the income statement by selecting the labels in the appropriate order, then enter the amounts and calculate the operating income/(loss). (For amounts with a $0 balance, make sure to enter "0" in the appropriate cell. Complete all answer boxes) M. Revenue Dirt-B-Gone Company Income Statement For the Year Ended December 31, 2013 , E. Cost of goods sold B. Beginning inventory S. Variable manufacturing $0 $2,178,000 costs A. Allocated fixed $1,224,000 manufacturing costs D. Cost of goods available $3,402,000 $7,280,000 for sale Deduct: F. Ending -$94,500 inventory Total cost of goods $3,307,500 sold K. Gross margin $3,972,500 L. Operating costs T. Variable marketing $770,000 costs J. Fixed marketing $1,393,700 $926,400 G. Fixed administrative costs O. Total operating costs Operating income $3,090,100 $882,400 Explain the differences in operating incomes obtained in requirement 1 and requirement 2. 17C. The difference in operating income under absorption costing and variable costing is The 2013 operating income under absorption costing is [A. greater; B. lower] than the $ operating income under variable costing because [A. In 2013 inventories increased by 500 units; B. Marketing and administrative costs are not included in absorption costings' ending inventory. C. Operating costs are calculated with costs sold and variable costing is based off of units produced. D. Total manufacturing costs are not included in absorption costings' inventories.] Therefore, this makes [A. absorption; B. variable] costing have a lower cost of goods sold. [$34,000] [A. greater] [A. In 2013 inventories increased by 500 units] [A. absorption] The difference in operating income under absorption costing and variable costing is [$34,000]. The 2013 operating income under absorption costing is [A. greater] than the operating income under variable costing because [A. In 2013 inventories increased by 500 units] Therefore, this makes [A. absorption] costing have a lower cost of goods sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started