Answered step by step

Verified Expert Solution

Question

1 Approved Answer

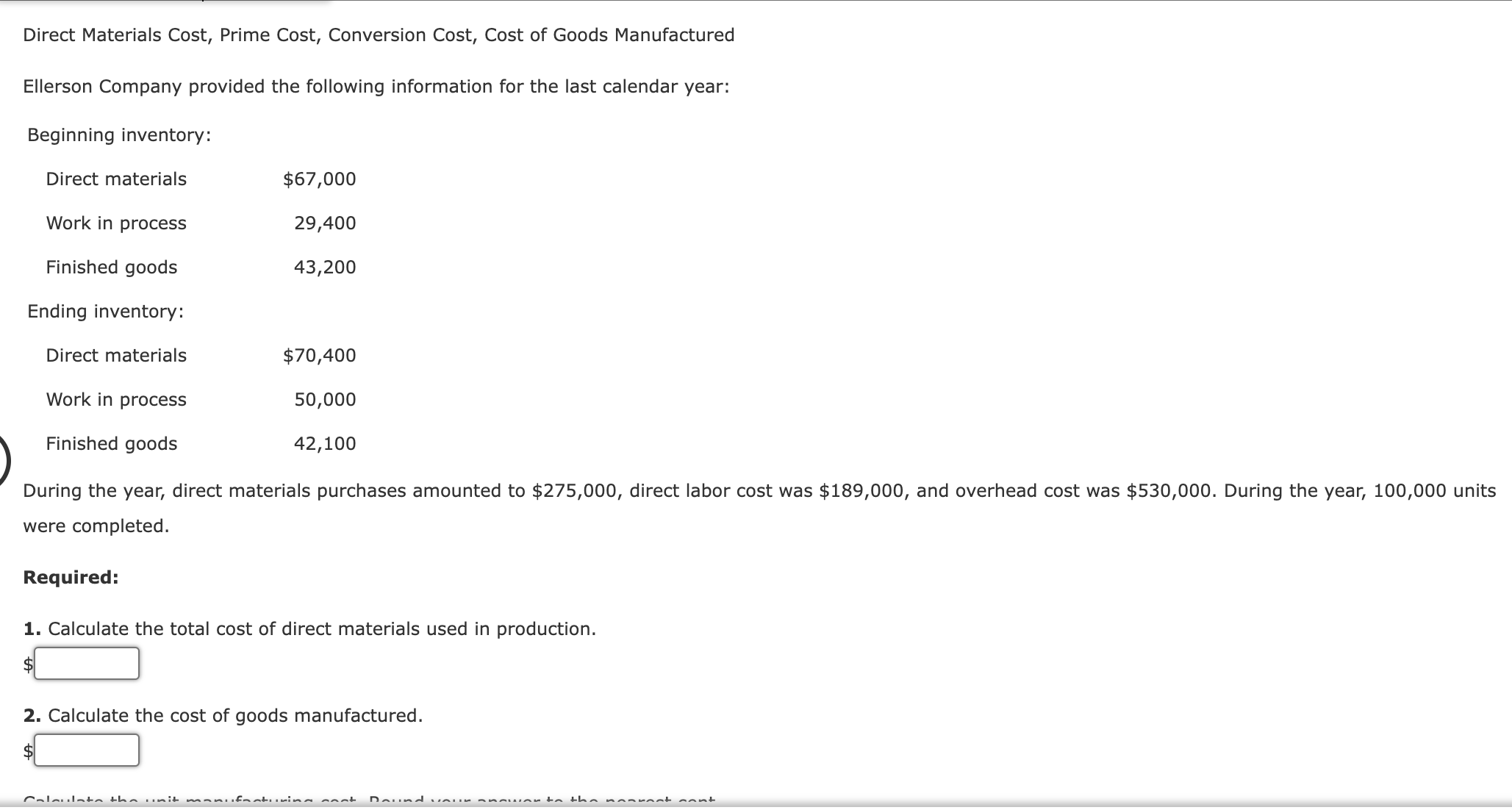

Direct Materials Cost, Prime Cost, Conversion Cost, Cost of Goods Manufactured Ellerson Company provided the following information for the last calendar year: Beginning inventory:

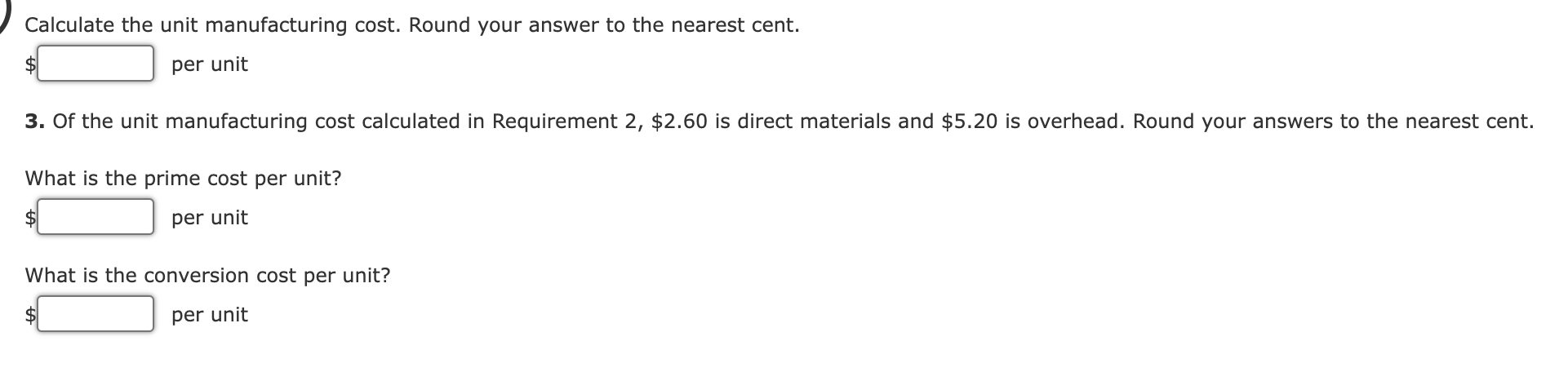

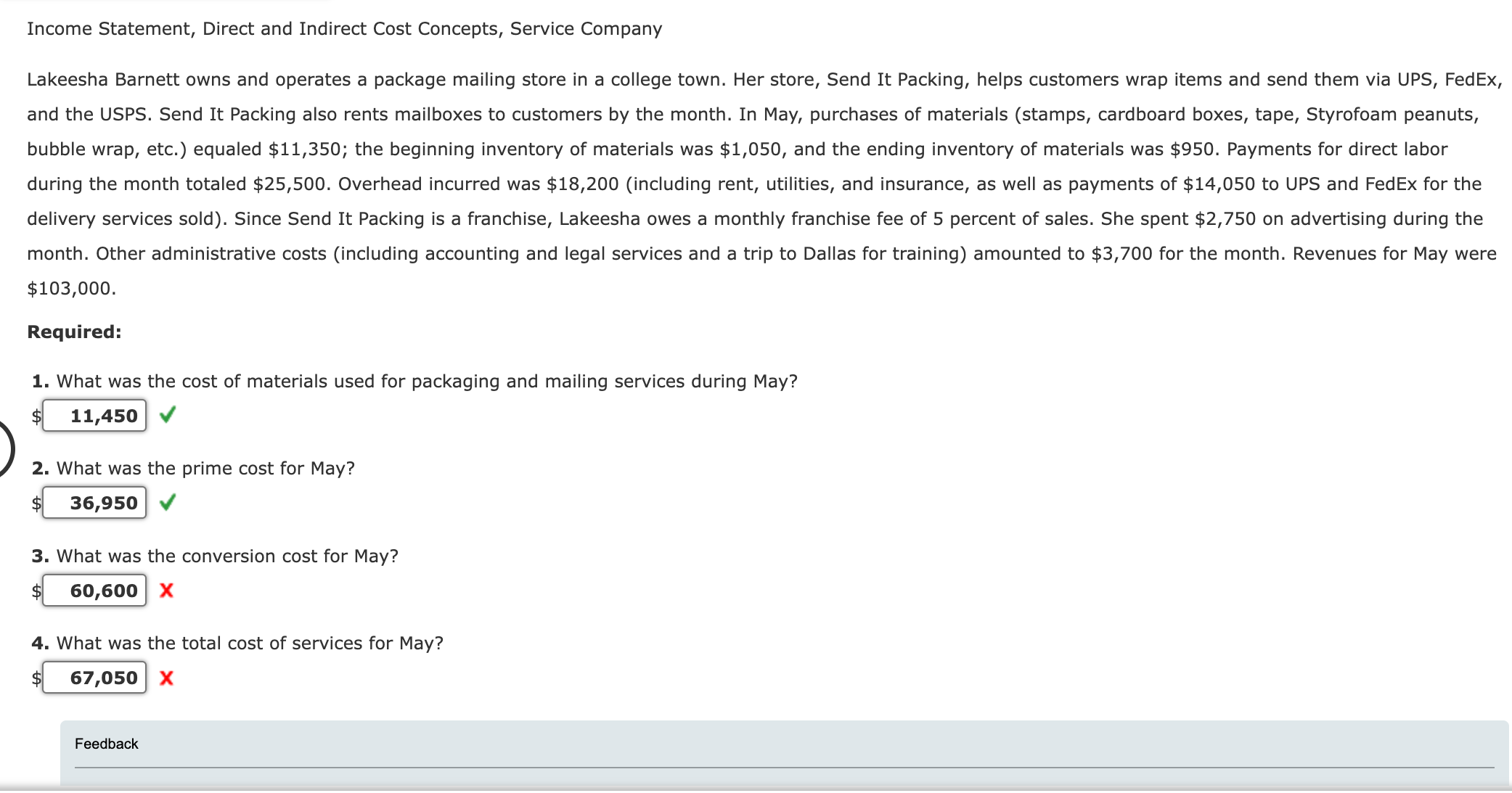

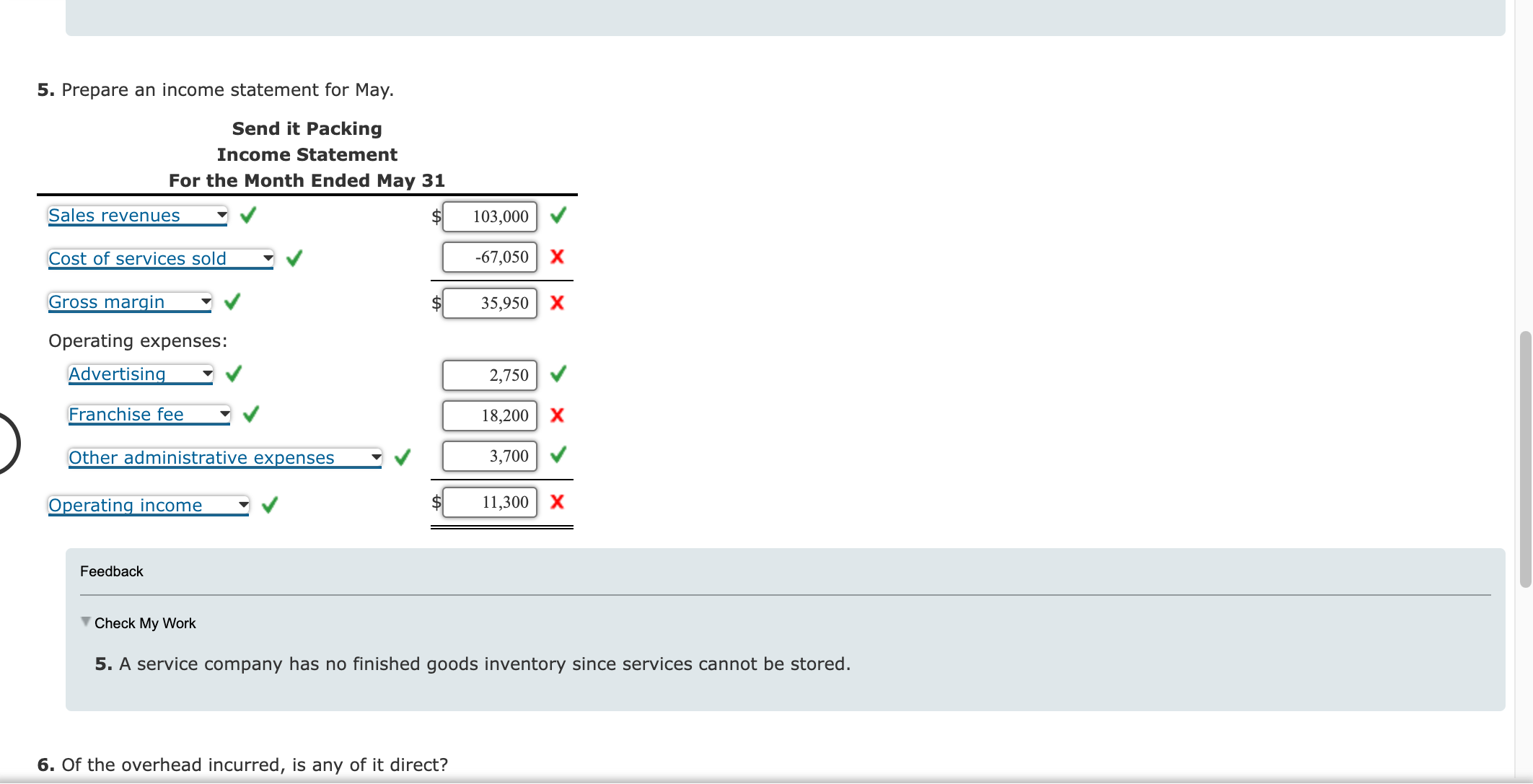

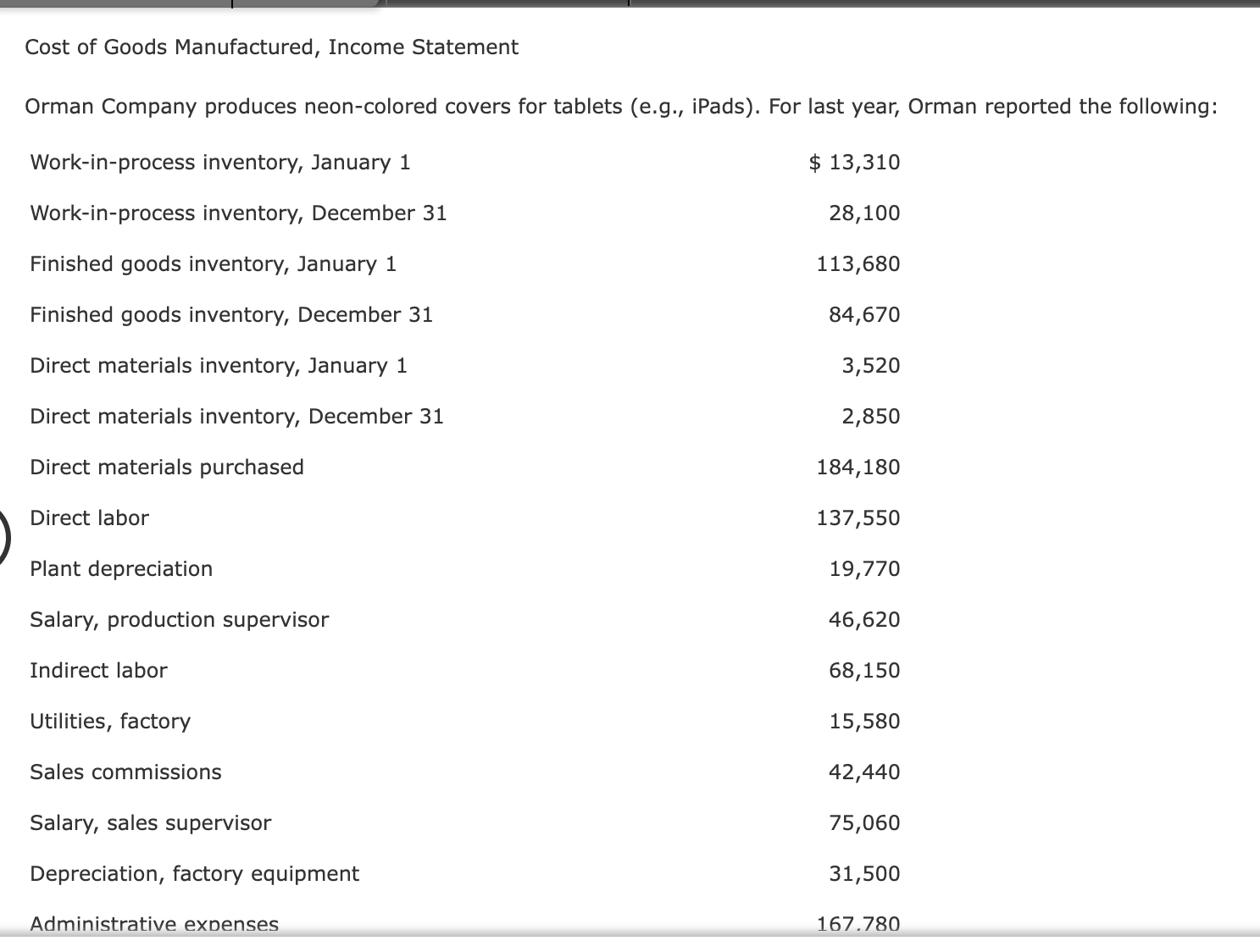

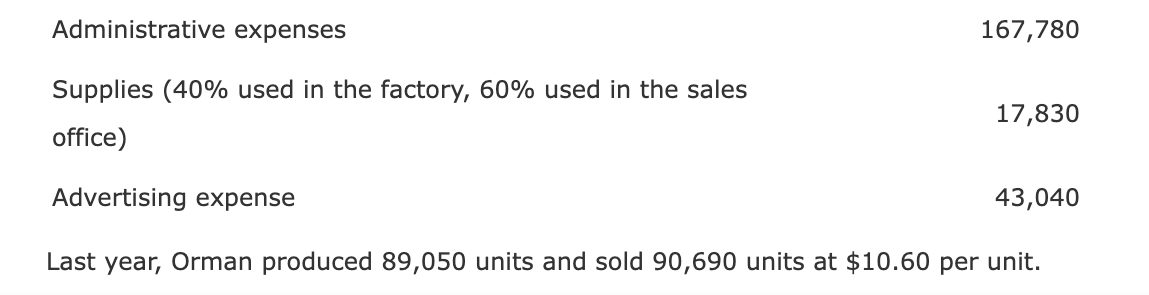

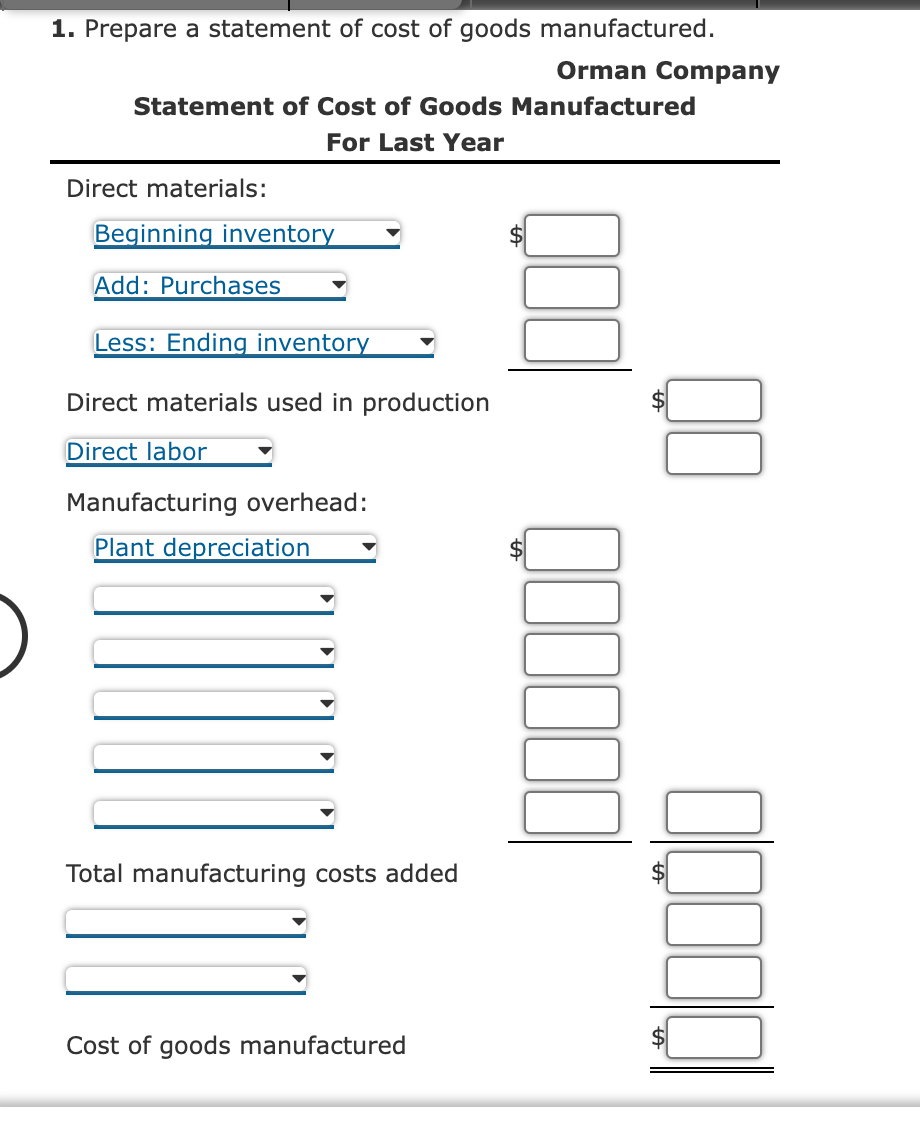

Direct Materials Cost, Prime Cost, Conversion Cost, Cost of Goods Manufactured Ellerson Company provided the following information for the last calendar year: Beginning inventory: Direct materials $67,000 Work in process 29,400 Finished goods 43,200 Ending inventory: Direct materials $70,400 Work in process 50,000 Finished goods 42,100 During the year, direct materials purchases amounted to $275,000, direct labor cost was $189,000, and overhead cost was $530,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. $ 2. Calculate the cost of goods manufactured. $ Calculate the unit manufacturing cont Dound your cont Calculate the unit manufacturing cost. Round your answer to the nearest cent. per unit 3. Of the unit manufacturing cost calculated in Requirement 2, $2.60 is direct materials and $5.20 is overhead. Round your answers to the nearest cent. What is the prime cost per unit? per unit What is the conversion cost per unit? per unit Income Statement, Direct and Indirect Cost Concepts, Service Company Lakeesha Barnett owns and operates a package mailing store in a college town. Her store, Send It Packing, helps customers wrap items and send them via UPS, FedEx, and the USPS. Send It Packing also rents mailboxes to customers by the month. In May, purchases of materials (stamps, cardboard boxes, tape, Styrofoam peanuts, bubble wrap, etc.) equaled $11,350; the beginning inventory of materials was $1,050, and the ending inventory of materials was $950. Payments for direct labor during the month totaled $25,500. Overhead incurred was $18,200 (including rent, utilities, and insurance, as well as payments of $14,050 to UPS and FedEx for the delivery services sold). Since Send It Packing is a franchise, Lakeesha owes a monthly franchise fee of 5 percent of sales. She spent $2,750 on advertising during the month. Other administrative costs (including accounting and legal services and a trip to Dallas for training) amounted to $3,700 for the month. Revenues for May were $103,000. Required: 1. What was the cost of materials used for packaging and mailing services during May? 11,450 2. What was the prime cost for May? $ 36,950 3. What was the conversion cost for May? $ 60,600 X 4. What was the total cost of services for May? 67,050 X Feedback 5. Prepare an income statement for May. Send it Packing Income Statement For the Month Ended May 31 Sales revenues Cost of services sold Gross margin 103,000 -67,050 X 35,950 X Operating expenses: Advertising Franchise fee Other administrative expenses Operating income 2,750 18,200 X 3,700 11,300 X Feedback Check My Work 5. A service company has no finished goods inventory since services cannot be stored. 6. Of the overhead incurred, is any of it direct? Cost of Goods Manufactured, Income Statement Orman Company produces neon-colored covers for tablets (e.g., iPads). For last year, Orman reported the following: Work-in-process inventory, January 1 Work-in-process inventory, December 31 Finished goods inventory, January 1 $ 13,310 28,100 113,680 Finished goods inventory, December 31 84,670 Direct materials inventory, January 1 3,520 Direct materials inventory, December 31 2,850 Direct materials purchased 184,180 Direct labor 137,550 Plant depreciation 19,770 Salary, production supervisor Indirect labor Utilities, factory 46,620 68,150 15,580 Sales commissions 42,440 Salary, sales supervisor 75,060 Depreciation, factory equipment 31,500 Administrative expenses 167.780 Administrative expenses 167,780 Supplies (40% used in the factory, 60% used in the sales 17,830 office) Advertising expense 43,040 Last year, Orman produced 89,050 units and sold 90,690 units at $10.60 per unit. 1. Prepare a statement of cost of goods manufactured. Orman Company Statement of Cost of Goods Manufactured For Last Year Direct materials: Beginning inventory Add: Purchases Less: Ending inventory Direct materials used in production Direct labor Manufacturing overhead: Plant depreciation Total manufacturing costs added Cost of goods manufactured Q A 2. Prepare an absorption-costing income statement. Orman Company Income Statement: Absorption Costing For Last Year Cost of goods sold: Less operating expenses: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started